tl;dr FXE allows us to play Euro/USD, which will likely react strongly if ECB significantly alters rate hike expectations in the face of record inflation in the EU.

ECB rate hikes of 0.5%-1.5% incoming

Two weeks ago, the ECB President shared her view on where interest rates will be:

The European Central Bank is likely to raise its deposit rate out of negative territory by the end of September and could lift it further if it sees inflation stabilizing at 2%, ECB President Christine Lagarde said on Monday.

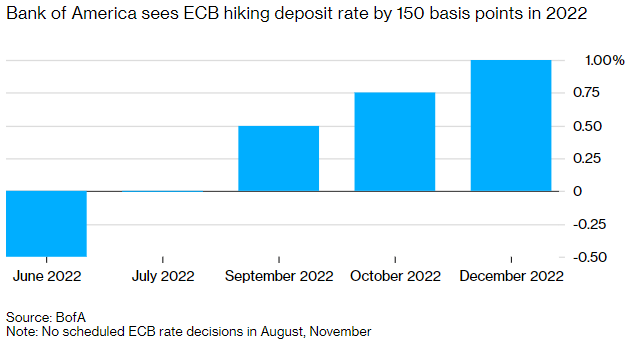

Bank of America decided to stick its neck out and make this call last week:

The European Central Bank will raise interest rates by a half-point in both July and September, Bank of America predicts, followed by two quarter-point hikes in October and December.

But EA inflation is clocking at 8.1%

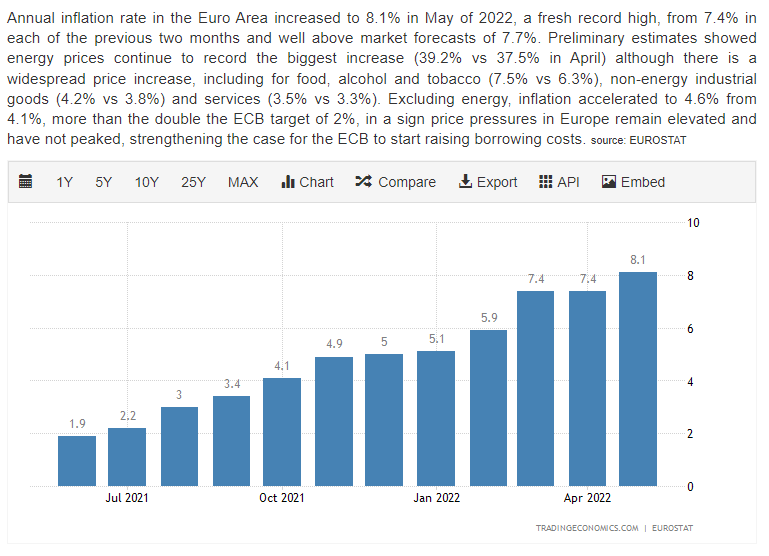

While BofA might be seen as quite the risk taker as a result, inflation the real economy is fast running away from both of these two - it hit a record 8.1% in May 2022:

ECB meeting tomorrow

While the obvious solution here may seem to be a hike in interest rates to bring inflation under control, the ECB is a little hamstrung for the following reasons:

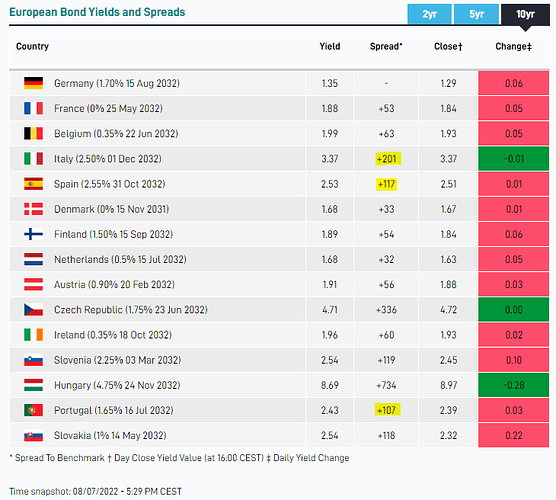

- The EU is a monetary union but not a fiscal one - this means the effect will be felt very differently in different countries, making it harder to achieve political consensus on the need for a hike. The UK has it simpler in this regard.

- Growth is already anemic in the EU, and hiking rates would accelerate the onset of recession, and make it more chronic.

- Compared to the US, more of the inflation in the EU is supply-side, both because their policies were not as accommodative and they are much more exposed to the effects of the Russia-Ukraine war

Nevertheless, there is an ECB meeting tomorrow (kinda like the FOMC) where they should provide updated guidance.

Euro may respond - FXE provides exposure

There are many ways in which changes in ECB rate expectations will effect the EA economy. Here, we focus on the Euro, which can be played through the ETF FXE:

All else being equal, heighted expectations of rate hikes should strengthen the Euro against the USD, which is what FXE provides exposure to.

It has options, though liquidity is not the best.

Caveats

Everything is never equal, of course. Two major confounding factors come into play.

First, there is the treasury auction happening tomorrow, which will indicate demand for T-bills with the Fed and QE. If the pricing on that is juicy, it can negate any benefits from any additional ECB rate hike. Good news is we will know tomorrow so won’t have to wait.

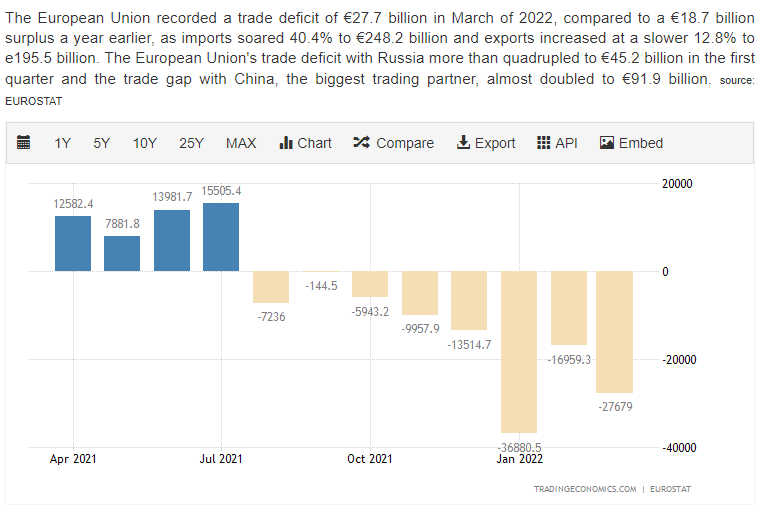

Second, the other major factor in determining exchange rates is balance of trade (BoT). Simplistically, countries (or economic unions) that import more than they export, and therefore have a negative balance, have weaker currencies. That would be the case for the EU:

This situation is unlikely to change in the near term.

Course of action

For now, we wait. Hopefully not for long. Let’s see what the ECB says, and how the T-bill auctions go. Currencies move slow, so we will have time to play FXE.

Wanted to get this on our radar so we can crowdsource ideas and keep an eye on this. ![]()

If anyone has any other ideas on how to play the ECB potential rate hike in the face of accelerating inflation (or lack thereof), please suggest that too. Would be nice to have direct exposure to that without having to account for the additional dimension of currency interactions too. Especially when the currency pair is the USD, which has its own set of complex dynamics.