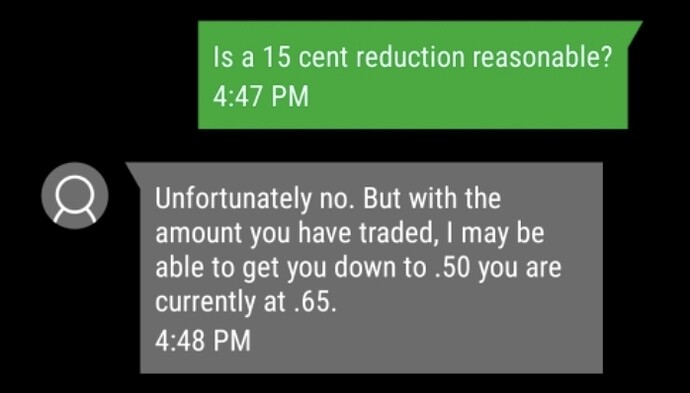

The typical per contract fees for options trading is around 65c / contract at non robinhood/webull brokers.

These are negotiable though! They will discount this based on your account size and/or trade volume.

You can get down to like 30 - 35 cents / contract w/ a large enough account or if you trade enough.

Even if you have a small account, some of you guys are doing like 100 trades a month. For that kind of volume a lot of brokers will give you a discount on your fees.

What you do is you call up your broker’s customer service, and ask to speak to someone to negotiate your options commissions. They will evaluate your account’s assets and activity, and possibly give you a rate better than the 65c. There’s no risk to doing this either, worst case is they tell you they can’t do any better and you stay at the 65c, but I bet many of you will be offered a lower rate if you call and ask. If you have multiple accounts that you want to consolidate, they may even give you a lower rate if you offer to transfer more assets in / trade more in exchange for the lower rate (I’m not sure if they’ll revoke the rate though if they give it to you because you tell them you’re gonna transfer in 1MM in assets and you never do it)

There is one certainty though, if you don’t ask for lower fees they won’t go out of their way to give them to you, you need to ask.