Hi everybody! I’ve been seeing around trading floor chat that some folks are having trouble understanding the fundamentals of gamma and short squeezes; the HOW and WHY they happen. I’m hoping to clear up some of that confusion and do it in a very simple manner. I’m also hoping that this post can open a dialogue for others to correct and add input as necessary. Let’s get into it.

GAMMA

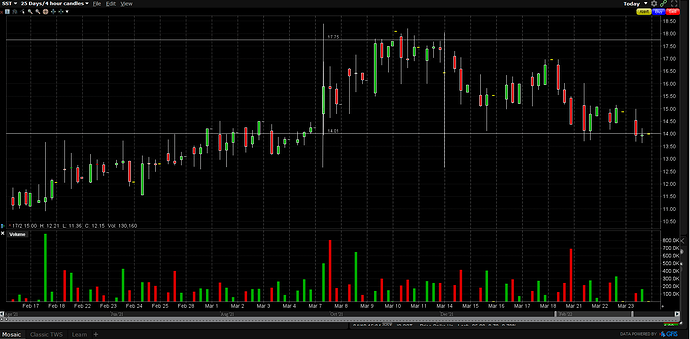

I’ll start with gamma because everyone has a close eye on ESSC at the moment, and it obviously has immense squeeze potential. There are a few terms I’ll need to define up front to make it easier to understand in the long run.

- Underlying - In regard to options trading, the underlying is the security that a derivative contract is structured around, most often a stock.

- Derivative - A contract that is valued based on the price of the underlying security. In regard to this write up, this refers solely to options contracts. Open interest refers to the volume of derivative (options, both calls and puts) contracts that are open on a given date.

- Delta - Delta is a ratio that compares the change in price of the underlying (see above) to the change in price of its derivative, in the case of the gamma squeeze, a call option. Delta will be a fraction in between 0 and 1 and increases the deeper in the money your call option is. (Remember this, it is key)

- Market Makers - A group of individuals, usually working with a brokerage firm, that create liquidity in the market by providing trading services. market makers make profit through the bid-ask spread, so they try to eliminate as much risk as possible while trading. They do this by hedging their trades.

- Hedging - Hedging is the main driving force of a gamma squeeze. In regard to this write up, hedging occurs when market makers buy shares of the underlying security they have previously sold call options for, decreasing their risk exposure. This is essentially insurance on their initial trade.

Now I’ll get into the mechanics of the gamma squeeze. The market maker sells some call options to retail traders like us. Once he does so, he is immediately exposed to risk, and remember, market makers hate being exposed to risk. In order to insure himself against the calls he sold, the market maker must buy shares of the underlying to hedge. This way he is protected should the price of the underlying increase, because he now owns shares that increase in value to counteract the lost value from the calls he has sold. The amount of shares he buys to hedge depends on the delta ratio of the call option he has sold. To put it simply, the higher the delta, the more hedging occurs (per contract: 0.15 delta = 15 shares, 0.50 delta = 50 shares, 1.00 delta = 100 shares). In most cases, this hedging doesn’t have much of an effect on the price of the underlying. Under special circumstances, however, (like in the case of ESSC’s insanely low free float) increased volatility in the underlying is enough to set off a chain reaction which becomes the gamma squeeze. With a surge of volatility and open interest from retail traders like us, the price of the underlying increases enough that cheap, out of the money options with very low delta and very high open interest become in the money. When this happens, the delta increases, market makers purchase more shares to hedge, and this in turn drives the underlying price up further. Then even higher strike options become in the money…

and you can see how it becomes a vicious cycle creating immense upward pressure on the stock. Ideally, the open interest in the option chain should be high across all strikes fairly equally, so that there is a nice smooth progression as each strike becomes in the money during the squeeze. This is called the “gamma ramp.” The rise in price is usually very fast, and it will very likely reverse just as quickly. This is why you must always take care to cover your cost basis on the way up, and try not to FOMO in late. I can speak from experience that it rarely works in your favor, and it can be catastrophic to your account. These plays come about fairly often, its better to just wait for the next opportunity!

When I first started researching squeezes, it was a little difficult for me to understand, and I wished I had a resource like this forum and discord to help. I hope this will help some people like that. I tried to keep it simple, short, and easy to understand. Over this weekend I will work on another write up for a short squeeze as well.

Enjoy your weekend folks, and let’s get hyphy for ESSC next week!

-glick