GAP inc. – Pass me the brown hoodie please

Earnings on Nov 23 After Market Close

So GAP inc, you might think three big letters G-A-P, but this is a holding company which has the following billion dollar brands under it’s name

- Old Navy – Their biggest brand (61% of sales as of Q2)

- GAP

- Banana Republic

- Athleta – The brand that is driving some real growth

Now GAP went through troubled times over the last decade, which led them to developing a new turn around strategy called Power Plan 2023 which is best summarized below:

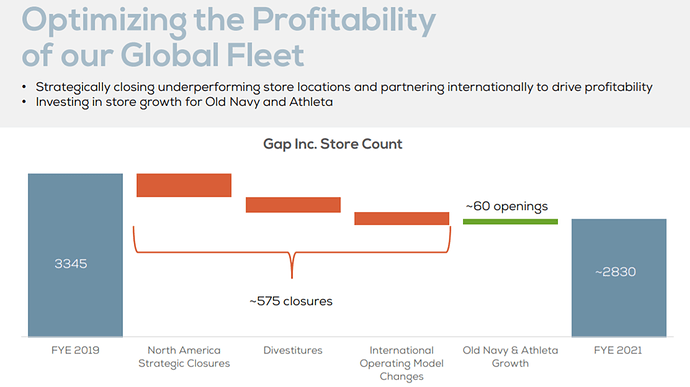

- Reduce the footprint of unprofitable Gap and Banana republic stores

- Their plan was to completely exit physically in Europe, but seems like they have pivoted recently and will remain presence in those markets via partnerships (e.g.Next in the UK)

- Focus on opening up selected but profitable stores for Old Navy and Athleta

- Increase online presence and sell more via their e-commerce platforms

- Focus on being an all inclusive lifestyle brand

So how is this actually coming along. From all the reading I have done, I am seeing nothing but good news. So before I get into the stock price and what not, lets catchup a bit more on the above points

The market actually loves the idea of them closing down profit eating physical stores and actually the stock price had jumped 3% on the day they announced this. What is their plan:

Now on the latest earning call, they did say that they plan to achieve 75% of their North America closures (350), by end of this year, so this will impact topline for sure, but better for their bottom line

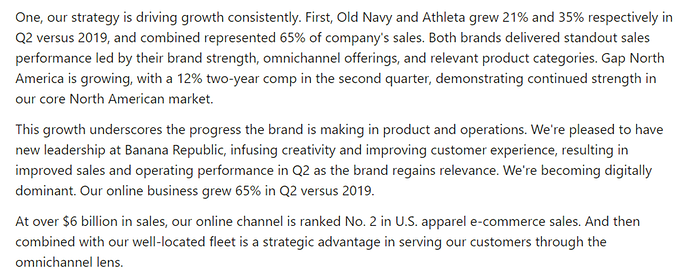

Despite these closures, they are still growing and Q2 really started to show that their strategy is starting to take shape.

So how is the strategy working, if their last ER call is anything to go by, the turnaround is in full swing. See picture below from the ER transcript:

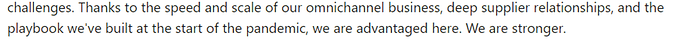

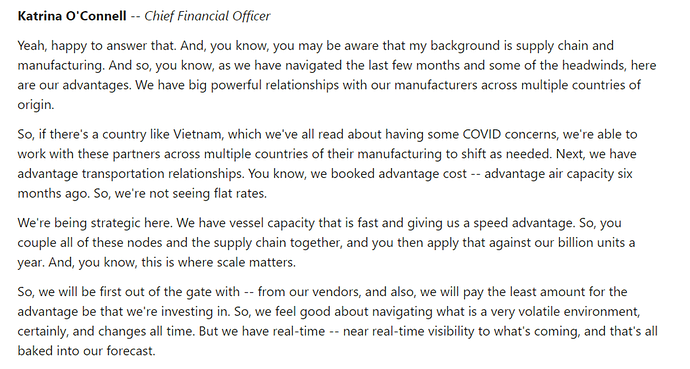

Okay, Asif, that is all fine, but what about supply chain, what about the future, what will happen, well their response:

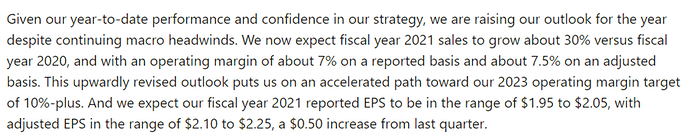

They have raised their guidance and I am pretty confident they will raise it again. Sure they might mention some pressures on profit, but I feel they will be impacted a lot less than some other retailers as they saw this supply chain issues coming a while back and were ready. In their own words the supply chain issue will be their advantage

And there is even more:

I have not yet read another retailer talk about supply chain positively. I feel this will allow them to raise their guidance, as other companies struggle with supply chain, these guys are ready!

So till now, we have a turnaround story of a company that is back to growth, increasing margins, raise their outlook and I fully expect to raise their outlook in this ER as well.

Okay, so then what about this pivot as being a lifestyle brand and what not.

- They partnered with Walmart to start selling furniture

- They are doing a full body inclusive campaign for Old Navy that is doing well

- Yeezy, its selling out like hotcakes

- The GAP Hoodie became a social media sensation this last quarter.

All of the above will start to reflect in their sales and guidance this year. Below some articles to ready about this pivot and resurgence:

Also, now they feel they have real competition to LULU. The article below summarizes best their confidence in Atheleta:

This is a huge market, LULU alone is valued at 64bn, so the opportunity is immense and by all accounts it seems they are doing well.

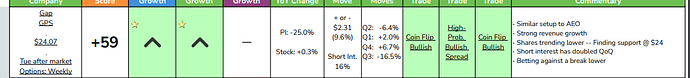

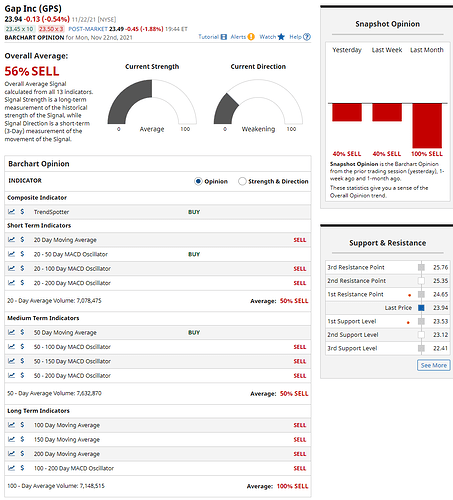

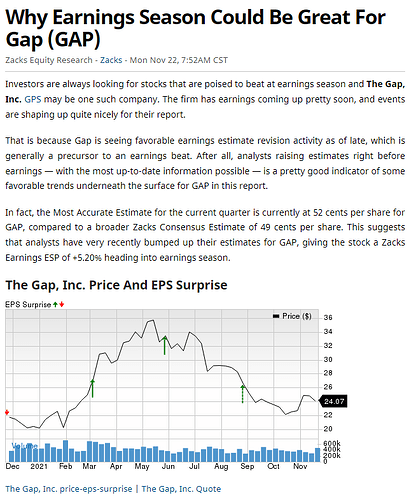

So the stock had a 52 week high of 37.63 and as of Friday close was at 24.07. With many retailers complaining about supply chain issues, GAP also went down, but I feel GAP will come out and surprise everyone, talk of Supply chain as an advantage and further raise their guidance. Why do I feel that way:

- Back to school tailwinds

- GAP Hoodie had a big moment in Q2

- Partnerships in Europe and also in the USA (Walmart)

- Yeezy, being a much bigger hit than anticipated

- Athlena, they just opened a second store in Canada

- Loyalty program already has 40m members and growing (Can be used across all brands)

- Less discounts, more full price plays on GAP (focus on profits)

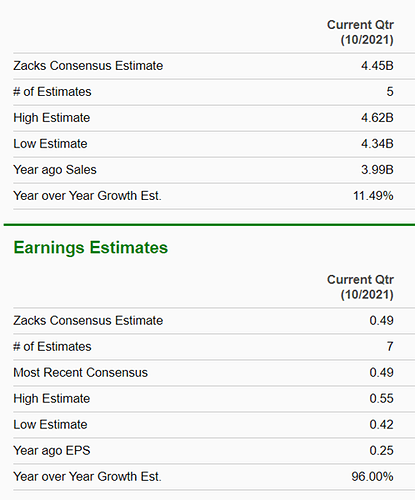

I fully expect them to come out and surprise. Below are the latest estimates according to Zacks:

Earnings whisper is already predicting $0.62 and unless costs really went out of control for them this quarter, I think they can match of beat previous quarter EPS of $0.67.

The stock has been beat down and a surprise is on the cards. I feel really good about this play, so will probably be getting a small position in weekly options, but my biggest play will be 25c for Dec 17

Investor Presentation:

Earnings Transcript (PLEASE READ!!)