*Disclaimer - I am not a financial advisor and this is not financial advice. Do your own diligence and make decisions best for you. This is my first DD so someone who actually knows what they’re doing please tell me why I am wrong on all of this.

Summary

Good Rx has great operating performance, a lock on the market that accounts for 80% of their revenue, growing Rev and EBITDA as a “rule of 70”, and has been punished in recent earnings due to poor EPS due to non-recurring stock-based compensation payouts likely ending in Q4. I think there is plenty of room for this stock to grow.

About Good Rx:

- Mission focused company aiming to help customers save money on medications.

- How do they make money? They take advantage of the broken prescription system where pharmacies over-charge customers to ensure that they receive the maximum reimbursement from Pharmacy Benefit Managers (PBMs). Good Rx works with Pharmacies, PBMs, and drug manufacturers to offer customers “savings”, the difference between the list price and the price paid by the customer and thus received by pharmacies. Good Rx takes a portion of the savings from PBMs as revenue and receives a referral payout from pharmacies.

- They have four revenue streams with prescription savings totaling 80% of all revenues in Q3. The company is diversifying its revenue and reducing this number each quarter through new upstream offerings via acquisitions.

- Prescription savings mentioned above is 80% of total revenue

- Subscription users on the Good Rx platform

- Ad sales on the Good Rx platform

- Good Rx Care telehealth, formerly Hey Health

The stock is currently recovering from a big drop in Nov and Feb

- In Nov 20 Amazon announced the launch of Amazon Pharmacy. Many investors view this as a direct competitor to Good Rx’s core business. However, Good Rx contends they are a marketplace, not a pharmacy and therefore Amazon is not a competitor.

- Despite a strong Q4 and 2020, the companies EBIT dropped dramatically from x in 2019 to y in 2020. This was due to two non-recurring expenses: 1) $297M in stock based compensation to the founders and 2) $41M in charitable donations. The market definitely got spooked by the low earnings and brutal EPS miss. In addition, the company curbed guidance due to the slowdown in prescriptions through covid (backlog of diagnosis/treatment) and a weak flu season. Some would say that’s a good thing, but for a company that makes money on medication sales, not so much.

Growth:

- People LOVE Good Rx. They have a 90 NPS with both customers and providers. By comparison, Netflix, Amazon, and Apple have NPS scores in the 60s. What’s not to love? Customers get deep discounts on drugs FOR FREE, while pharmacies acquire more customers and PBMs profit. It’s good for the whole chain. 50% of pharmacies recommend Good Rx to their customers keeping customer acquisition costs low.

- Partnerships with DoorDash and USAA. Many pharmacies don’t offer delivery and as customers move to seek pharmacy-filled, direct-delivery options having logistics partners will help capture that segment.

- There is a huge backlog of undiagnosed and untreated individuals as people struggle to access doctors and/or lost insurance through covid. As normalcy returns, there will be a surge of people seeking treatment and thus medication in the next year.

- Growth of the core business was hampered by a low flu season last year. With lockdowns over and likely not returning, increased flu rates in 2021-22 flue season will benefit the business.

- Good Rx continues to expand its revenue streams and recently entered the telehealth business. I’m not too bullish on this as we know how price competitive the telehealth business is. I do think this is a great offering and pairs perfectly with Good Rx’s core business but expanding in this space will definitely have its costs on reduced margin.

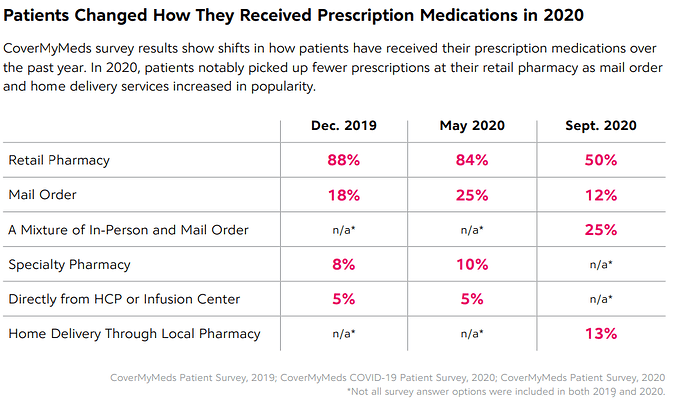

- There is slow adoption of pure mail-order pharmacies. It seems providers and customers are favoring pharmacy filled or a hybrid solution for delivered medication. See chart below.

Financials

- Quick Ratio: ~14

- Positive Operating Cashflow for last 4 quarters

- Q3 195M 39% YoY Rev growth (inline with guidance) at 32% margin, $62M adjusted EBITDA

- 31% YoY growth in monthly active users to 6.4M and sustained growth over the last 12 months

- Barely beat Q3 EPS targets even with $40M in stock based compensation

- Q4 guidance is 38-45% rev growth to $222M

- Con: trading at 25x sales currently

Pros

- The only thing getting in the way of price growth is the stock based compensation, which is crushing EPS. They’ve paid the majority out only $20M remaining out of $530M. The stock went on a run after Q2 earnings where they issued $24M in payouts. In Q3 they issued $40M.

Risks

- Near term covid impact continues to depress prescription transaction hindering significant earnings beats

- Good Rx planned $530Mstock based compensation payouts to its Co-CEOs. $510M has already been paid with $40M in Q3, so $20M remains to be paid likely in Q4. The market reacted very negatively to the nearly $300M payout in 20Q4 so that response may continue through the next quarter.

- Amazon Pharmacy and other mail-based pharmacies may capture significant market share reducing Good Rx’s total addressable market. However, Amazon is primarily focused on generic drugs so there will still be plenty of room for Good Rx to play.

- The company could aggressively expand into lower margin businesses like telehealth which would hurt EPS

- Health care and prescription policy reform could reduce or eliminate the crazy pharmacy markup that Good RX makes its money on. Pigs will fly before this happens.

Investor Activity

- Moderate buy with a $45 price target. Hedge fund and insider activity both increasing

Technicals

- The stock is currently at $40, up 100% from its ATL in May and down 17% from its recent high of $48 and IPO price

- Currently hitting a double bottom at ~$39.76 support on the 1D

My position:

None currently, looking at shares, 12/17 42.5C, and 1/21 50C