This thread is for general discussion of commodities overall.

I’m currently watching the usual suspects for entries as they’re just inverse SPY at the moment. Unfortunately means my current BNO position is probably not timed perfectly, but I’ve got room to average it down.

WEAT is holding the best at the moment, but that’s to be expected since it doesn’t move much anyway.

Thought process here is if these are just moving inverse of SPY and we’re expecting a reversal here soon, its probably a good time to pick up some of these cheap.

I think fertilizer is a commodity so uh

https://vm.tiktok.com/ZTdPoJt1B/

Here’s the same dude who explaining the WEAT thing I posted in the WEAT DISCUSSION THREAD. Talking about the fertilizer problem.

It is, just made a thread for it ![]()

Aight bet

I would also put LAC in there, which is lithium Americas Corp. Has been following the same trajectory as MOS and other commodities

Palm oil is currently being banned by the Indonesian government (supplies 30% of global supply) as domestically the price has shot up and the Indonesian people aren’t too happy. Unfortunately, this ban will likely skyrocket the price, especially into some fragile economies like Sri Lanka, Egypt, and Tunisia.

As @sparrow mentioned, the nice corollary play would be to look into food companies such as $UNFI (haven’t looked too much into this but mostly North American) and I would suggest $ADM (Tedro has excellent DD on this).

Also, the more degenerate play would be to postulate that soaring food prices (e.g. Ukraine wheat) and high energy costs would disproportionately effect third-world economies and politically unstable countries. For example, Egyptian ETF put plays paid in a big way during the Arab Spring. They were also subsequently halted when the economy collapsed.

If this is bringing back recurring nightmares of RSX it should. RSX was a brilliant trade and well thought out. The halt blindsided many of us. As I’m posting this I realize how irresponsible it would be to trade in any shaky foreign ETFs right now because of the fact that we now know halts are real and somewhat arbitrary and definitely not to the investor’s benefit. Maybe it can be more of a launching pad to generate other trade ideas like the one Sparrow came up with?

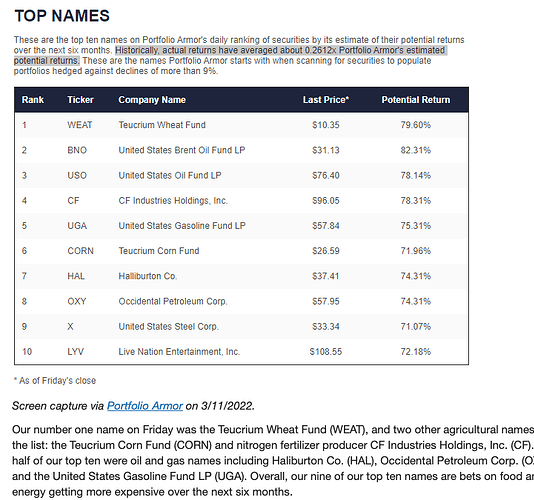

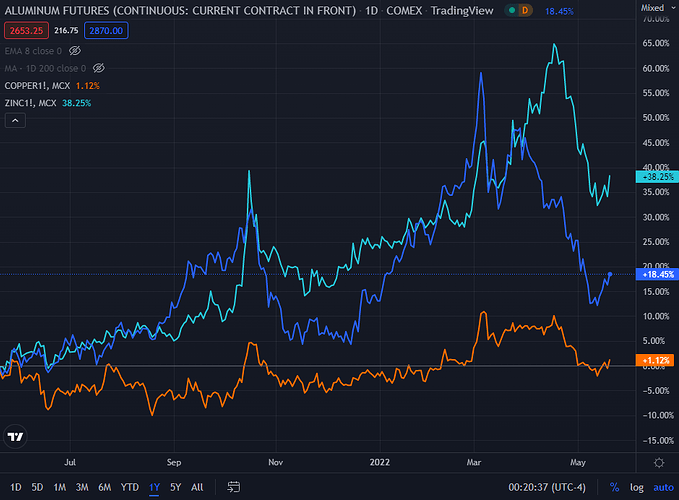

DBB is starting to look interesting again.

This base metals ETF is split three ways between aluminum, copper and zinc. They had all seen two rallies of excitement - one where the British version of CME, called LME, managed to let a copper happen which squeezed other things in sympathy, and the second is around the Russia invasion.

It now seems that things have mean reverted, but will also continue moving up:

With inflation all around and the supply chain issues due to the war, we can reasonably expect prices to keep squeezing upward. Will initiate a position in DBB shortly.

Some more material on copper is in this thread. The thinking here is also related to that behind getting DBC, which is discussed in this thread.

#dbb #zinc #copper #aluminum

Honestly not sure what to do with this information but I came across it so figured I would post it here.

So I was reading the above and came across the lines

The leading manufacturing industry trade body Make UK said the current crisis was leaving businesses “facing a stark choice: cut production or shut up shop altogether if help does not come soon”.

About 13% of the businesses it surveyed said they were now cutting their hours of operation or avoiding production during peak energy price periods, and 7% were stopping production for longer periods. Meanwhile, 12% have already made job cuts.

and head over to nytimes for the below quote.

https://www.nytimes.com/2022/09/02/business/gazprom-nordstream.html

The latest action by Gazprom will raise fears of a permanent shutdown of the pipeline, which had been the key conduit for gas to Germany, a country heavily dependent on Russian natural gas. Like other European Union nations, Germany has been rushing to fill storage facilities before winter as insurance against Russian cutoffs

Apparently even if they fill storages as a whole it would only supply Europe with 30% of its energy needs so they have been importing coal, liquified gas and installing solar panels while considering rationing energy.

“It’s every man for himself,” says Ms Dourian. “Everyone is taking their own steps to solve the energy shortage, and making their own deals”

The_Ni posted in the natural gas thread led me to comments about Nordic Greens canceling their tomato winter cultivation due to energy costs. Its to the point companies aren’t willing to pay the current prices and are facing higher ones leading into the winter.