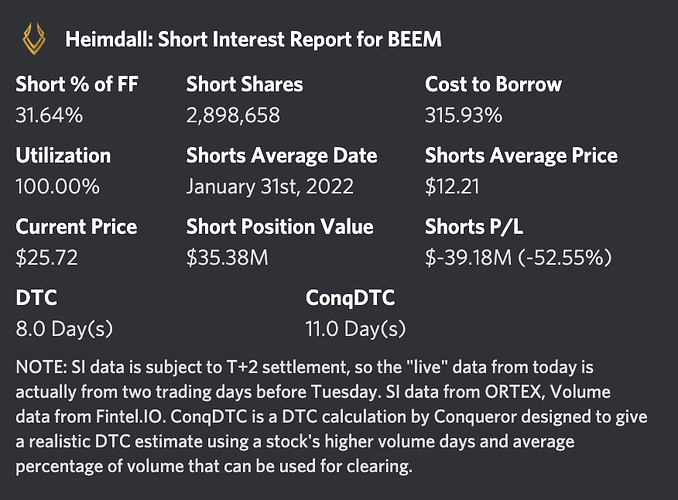

BEEM has been a very profitable play today, so I wanted to look back at what might have made it a viable play to better understand the call-out.

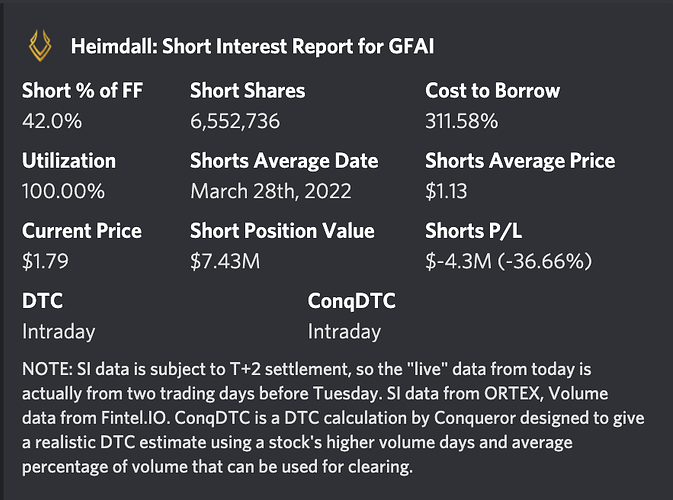

A finviz scanner led me to GFAI, where I’m seeing similar numbers to BEEM:

The key difference there is DTC. And GFAI is not optionable.

I’d like to better understand how DTC is used in determining viability of these types of setups.

If BEEM is covered over the course of 8 / 11 days, and if GFAI is covered intraday, would the price action they each experience differ?

Does the longer DTC just provide a longer timeframe to exit our positions, or is it more than that?

If GFAI shorts covered entirely in one trading session, would a significant move up in price be expected from all that buying pressure?

Thank you!