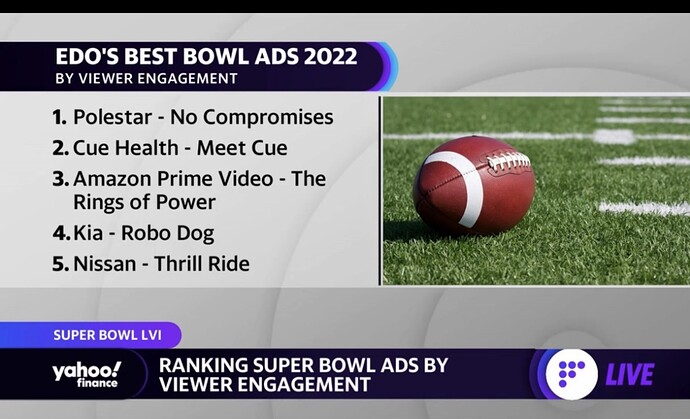

Polestar had the best preforming ad engagement wise in the whole super bowl. Might be a runner this week? Merger is expected soon

Been adding April 10c this week.

With the pops this week, how is your cost entry looking? I am waiting next week to hopefully re-enter the play.

I went ahead and grabbed 10/15 vertical spreads here for april. The 15s take the extrinsic out of the trade

The third revision was filed today. SEC has to respond in ~10 days. Calls are cheap again. I’ll be reloading a position for April. This will be a smaller position than before due to the current world environment and consequently this may not run because of that. I’m looking at the 10Cs, mostly, and the 12.5Cs. The March calls would be extremely risky and only a play that the revision is accepted this week and merger is next week.

https://www.sec.gov/Archives/edgar/data/0001884082/000119312522066540/d239003df4a.htm

Watching Volvo show today:

Spring Auto Conference by BNP Paribas Exane

Volvo confirms, they don’t and didn’t have manufacturers from Russia.

They’re not directly affected by RU-UE war and is not worried about meeting demands.

They are importing batteries from external source, on top of their in-house supply.

China and specifically Geely is mentioned today as one of the sources/partners.

More Sweden partners also mentioned.

Volvo tries their best to supply raw materials, but also looks to external sources for possible better prices.

Polestar despac:

Polestar will want to secure more funding.

Volvo will support Polestar with funding/funding process.

Volvo doesn’t mind smaller position but is confident to make most of their investment and profit from both retail and commercial (?).

*I didn’t know Polestar has commercial clients lined up.

Maybe it’s a bit of confusion with Volvo trucks.

On Google:

Volvo chose Google as partner because they believe in being a part of an ecosystem, and don’t currently think it’s sustainable for them to start their own.

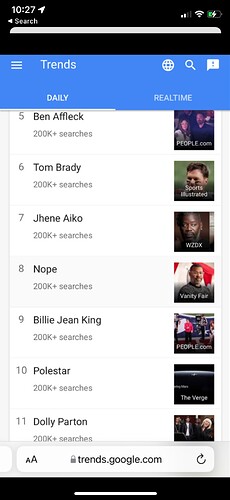

FYI, GGPI cut some of its guidance slightly

Saw it under:

https://twitter.com/N2EVBull/status/1501223267453091849/photo/1

GGPI/Polestar is stirring.

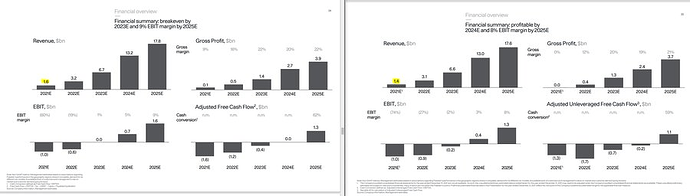

A long standing limit buy of 5/20 7.5P filled today for $0.10 and then dropped to $0.06. Apparently I was one of the very few numpties who took this trade.

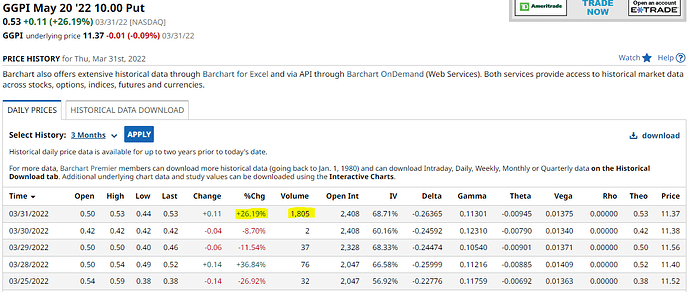

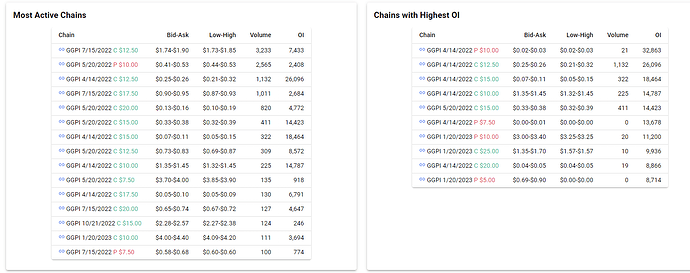

Meanwhile, the 5/20 10P went up in price and saw major volume (we will know OI tommorrow morning):

One reading of this is that market expects the vote and merger will be before the 5/20 opex, but does not expect prices to go below NAV much, if at all. The 10Ps are therefore probably hedges.

I feel like the IV bloat before merger should preserve the $0.10 floor, and worse case, I should be able to exit for 1/2 price, so not worried about that position. Best case, it actually falls below NAV and there is decent price appreciation.

Fwiw, option pricing now suggests merger will not happen before April opex.

Anyone have access to options flow data? Any whale-size movements?

(For complete disclosure: I also hold commons because I think this is a nice company that will go far.)

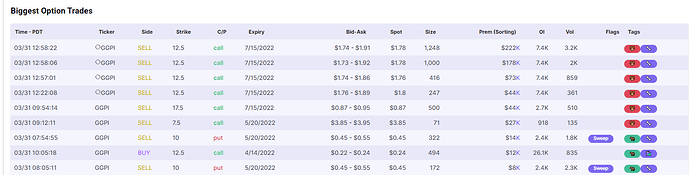

Here’s today’s stats:

2 to 3 minutes before close today were the Top 3 biggest options trades. Note that I have confirmed that sometimes UW gets the bid/ask wrong, so take the Sell/Buy marker with a grain of salt. Can’t be sure if they’re actually bearish or bullish.

GGPI up in pre market on news of Hertz buying up to 65,000 EVs over 5 year span.

https://www.marketwatch.com/story/hertz-to-purchase-up-to-65000-evs-from-swedens-polestar-over-5-years-as-it-works-to-speed-up-electrification-2022-04-04?siteid=rss

Ahh it’s too bad I didn’t take a look at this thread this morning, calls on HTZ would have been a clear play…+10% today. Too late now, that was definitely only off this news

Anyone following this closely?

I’m following it loosely and I think the date people want it to merge by is 5/27 because after that technically both parties can terminate the merger if they want to. Mostly I’ve ignored this but we’re getting a bit close to 5/27.

Just putting my thoughts on this. It seems like this may be a solid company with low hype around it, Leonardo di Caprio as an investor aside.

People bought in likely expecting it to fly to $15. With market keeping everything down I bet probably it goes to at most 12.75-13.5 on merger confirmation.

Maybe this is one of those SPACS where it only erupts after merger? Like it will need to ride some major Tesla hype and maybe some big investor goes in, on a lucky day where market is up. Not sure if the chinese connection keeps this from being a safe EV play, maybe investors are worried about the Geely connection

Anyway those are just my thoughts no TA just ramblings.

edit: also oops I remember reading we shouldn’t talk too much about price targets, so sorry if that was a mistake, please ignore price target that is ultimately dependent moreso on market anyway here IMO keeping everything down

Not at all @Rubick - thank you for putting this back on our radar!

The current price is indeed a very nice potential entry point. And I agree with you - pre-merger chatter should see GGPI back at the $12-$13 level again!

Got a bunch of GGPI commons @ 10.70, limit sell set for 11.99. The pre-merger floor is difficult not to take advantage of. ![]()

I’m still loaded here with lots of 7.5c, but not at a very favorable basis (around 3.90). Been waiting a long time for a merger vote announcement, although given the size of this merger, and the fact that it’s a revenue-generating international company, it probably should have been expected.

Exactamundo! I always enter under 10.5.

Alerts help a lot.

This baby took quite a beating and is down to 10.25! I wonder if CPI numbers are bad may be even lower. I think hype is low with all the amendments (they’re on their 6th)

Someone in the sub-reddit “ggpi” was saying they looked at the difference between 5th and 6th amendments and they were clerical and small in nature. I did not double-check their work. This would seem to indicate maybe it’s the last one finally.

I still think it’s going to pop 10-30%. I am not in it right now. Trying to get some money off of SPY before this thing does its boom, I might end up missing it.

I hope you’re right.

This bounced pretty hard off 10.20 today, which is not surprising as actual NAV might be just below that level with interest added to the trust. It bounced off a similar level back in February. So long as this stays above 10.15 I expect that it will stay out of the territory where arb funds start loading up (which would slow or prevent any pump on merger vote date finally being announced).

Sentiment has never been worse here. But shares and ITM calls (close to intrinsic) are very low risk below 10.30, especially when this has a history of swinging from the 10s to the 12s three different times in the last six months.

I have been averaging down, now around a 3.50 average on my 7.5c.

They submitted a sixth amendment to the F-4.

No request for extensions on votes etc. so Q2 2022 for merger to happen is still quite likely.