Hello everybody I’ve got a dd on the spdr gold trust gld, gold prices have been on a tear recently and I think the price is setting up for a pretty rapid upwards move this week.

Fundamentals

Gold has been at a rapid increase these last weeks for a few reasons.

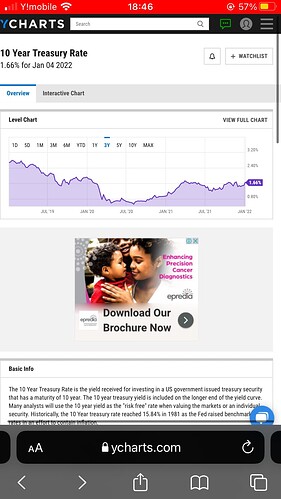

1.) bond yields have been dropping. Since December 20th 10 year bond yields have dropped from 131.62 to 130.34, this is important because investors consider both these safe haven assets so as yields decrease it makes gold seem more attractive.

2.) us central bank balance sheet reports a high or 8.79 trillion dollars which adds to debt worries all uncertainty around the economy helps gold prices.

3.) the US dollar had been dropping since December 20th it’s dropped 96.61 to 95.69 this is bullish for gold because it’s considered a safety net over the US dollar.

4.) Omicron variation still is making investors cautious the more uncertainty in the market the better for gold prices.

5.) inflation is rising makes some investors more nervous about the economy and seek haven in gold (even though historically gold isn’t a proven hedge against inflation what’s more important is the psychology of the fact rather the economics)

If we see these trends stay steady into next week we could see gold future prices soar over the 1833 resistance level in November we saw after a break of 1833 it fly to 1867 within two days.

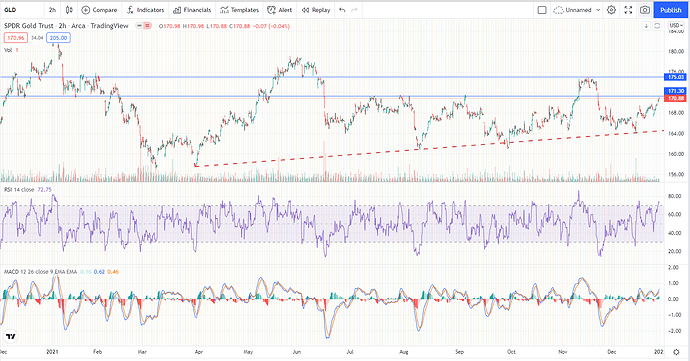

Technicals on the gld trust.

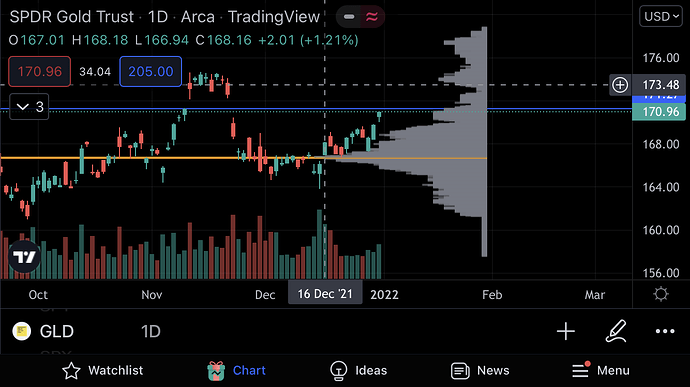

Looking at this chart you can see what happened the last time gold was at these levels.

After bouncing off the 171.32 area the next day you can see it ran up on the pre market hours from 170.38 to the 174.5 area.

Looking at the chart below you can see the volume at the price levels on the right with the volume profile, after the 171.27 level volume thins out until the 173.48 area this could create a quote on quote smoothing sailing area for the price.

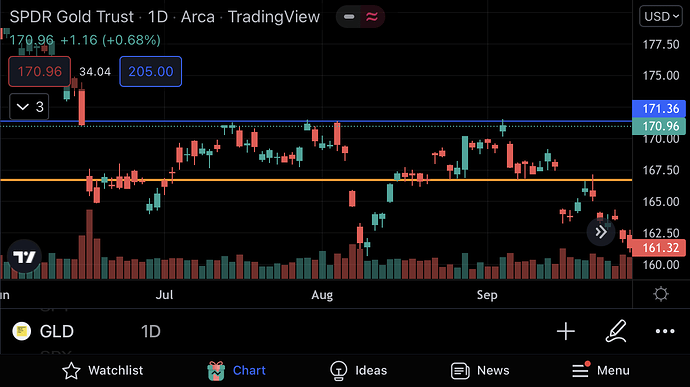

Looking historically you can see a lot of bounces off of this 171.36 line causing down trends in both august and September adding to my theory of seeing critical resistance around the 171.27-171.36 area

The price is currently at1 70.02 right now my hypothesis is that if we see a break of the 171.27-171.36 area we could see a big move up in the gld trust in the coming days, I will be watching this chart as well as monitoring futures to see if we have a continuation of the trend (bond yields lowering, dollar value lowering, and gold prices rising) going into next week and if it holds we could see a good opportunity to catch a run up in the gld trust.

This is my first dd so I would love to here opinions and critiques around the play and the dd itself