Week 3 updates and thoughts

I’ll start keeping a blog as I continue with my gold play posting thoughts, position changes, and prixe movements mostly for myself but in case anyone else is interested or following the play. I am expecting to continue trading this through fomc at least.

Sunday evening.

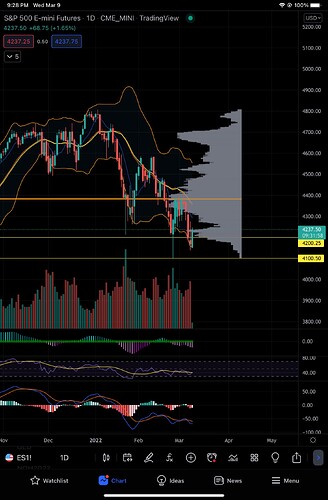

Gold opened up and ran Sunday evening following oil up and inverting s&p going down, the news stating inflation fears as the cause and I agree oil, wheat and corn all ran at open.

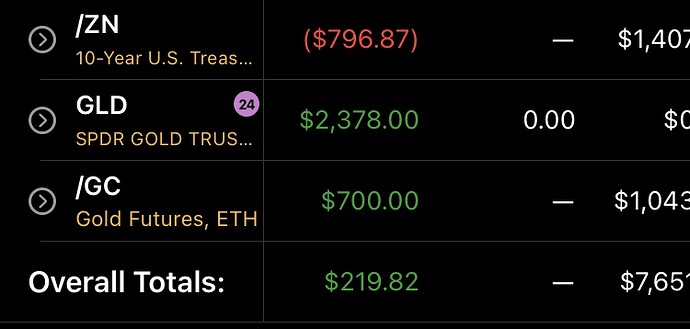

Took 500 dollar profits by rolling to a further strike again and bought another t bond put. After adding 500 in gold profits I also added another 200 loss in t bond puts that being the trade off in a hedge it decreases your downside but also decreases your upside as well. I am strategically buying gold fd calls but buying t bond puts with 45 days until expiration as I am still confident t bonds will come down after fomc, not sweating the red especially since my green fat out weighs it and am holding a confident thesis.

My 3 gld calls where bought about 2.40 lower then the current price so if we see a similar opening price I will be up quite nicely on those but still a long way until open and as I write this gold appears to be coming down.

Update 1 gold appears to be ranging between 1990 area and 1997 area and bonds appear to be in a down trend if gold breaks below 1990 area I will sell my t bond put I bought earlier and buy a strike closer to expiration, to keep up with the gold call loss better, I am expecting a down trend is due at some point soon.

Update 2. Took 62 dollar profit on 5 day t bond puts and bought one expiring in 11 days likely content with my position for now gold seems to be coming back up and I still have my calls at open.

Update 3. Watched a negative 35% trade go green me in the past would’ve panick sold at 20% loss then fomoed back in at the top glad but instead of loosing hundreds of dollars I even made 67$ on t bond puts feels good to finally be improving.

Update 4 decided to take another 46$ profit on bonds as they look like they are going to track gold again here going to look for a higher entry.

Update 5 decided to take 140$ profit on gcj calls I’ll renter if it dips here if not I’ll just let my calls collect profit until open.[quote=“KneifKneif, post:1, topic:13257, full:true”]

Week 3 updates and thoughts

I’ll start keeping a blog as I continue with my gold play posting thoughts, position changes, and prixe movements mostly for myself but in case anyone else is interested or following the play. I am expecting to continue trading this through fomc at least.

Sunday evening.

Gold opened up and ran Sunday evening following oil up and inverting s&p going down, the news stating inflation fears as the cause and I agree oil, wheat and corn all ran at open.

Took 500 dollar profits by rolling to a further strike again and bought another t bond put. After adding 500 in gold profits I also added another 200 loss in t bond puts that being the trade off in a hedge it decreases your downside but also decreases your upside as well. I am strategically buying gold fd calls but buying t bond puts with 45 days until expiration as I am still confident t bonds will come down after fomc, not sweating the red especially since my green fat out weighs it and am holding a confident thesis.

My 3 gld calls where bought about 2.40 lower then the current price so if we see a similar opening price I will be up quite nicely on those but still a long way until open and as I write this gold appears to be coming down.

Update 1 gold appears to be ranging between 1990 area and 1997 area and bonds appear to be in a down trend if gold breaks below 1990 area I will sell my t bond put I bought earlier and buy a strike closer to expiration, to keep up with the gold call loss better, I am expecting a down trend is due at some point soon.

Update 2. Took 62 dollar profit on 5 day t bond puts and bought one expiring in 11 days likely content with my position for now gold seems to be coming back up and I still have my calls at open.

Update 3. Watched a negative 35% trade go green me in the past would’ve panick sold at 20% loss then fomoed back in at the top glad but instead of loosing hundreds of dollars I even made 67$ on t bond puts feels good to finally be improving.

Update 4 decided to take another 46$ profit on bonds as they look like they are going to track gold again here going to look for a higher entry.

Update 5 decided to take 140$ profit on gcj calls I’ll renter if it dips here if not I’ll just let my calls collect profit until open.

Monday market close updates

Started this morning with a small loss basically what happened was I “bought the dip” then average downed on “the dip” and I kept dipping and panic soled one of my calls near the bottom but luckily the t bond put I had to hedge saved some of the loss. Unfortunately the call i panic sold ended up back near break even eod so definitely a lesson to learn there.

The day started with a dip so I decided to go to bed as I wasn’t looking to average down because I don’t want to throw to much money into this still keeping responsible position sizes even though I’m up a lot.

Zooming out we saw Green Day for gold red day for both t bonds and junk bonds could this be a confirmation to my theory? We’ll see how it trends as well as cpi on Thursday should give us a clue.

Lots of position changes for today

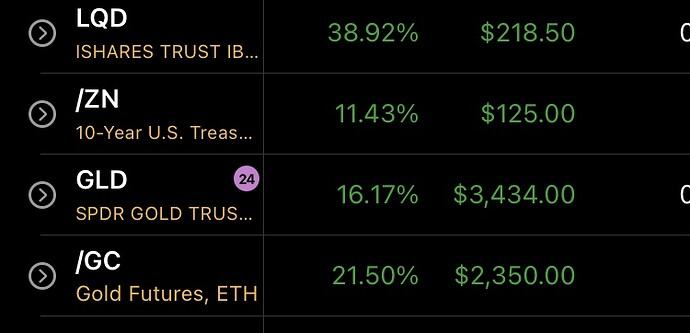

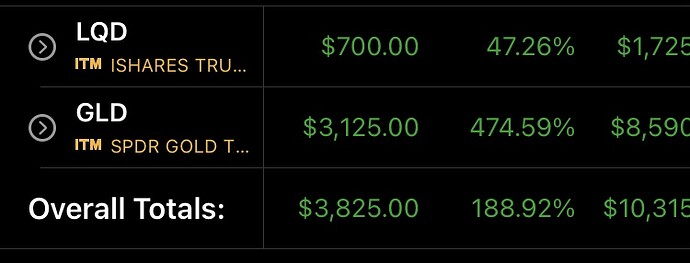

First thing is my April gld calls were up 100% an hour before close making this my 3rd 100% return on gld so I decided to take some profit by selling and buying a strike closer to expiration march 31sts I used the profits to secure some money in index funds.

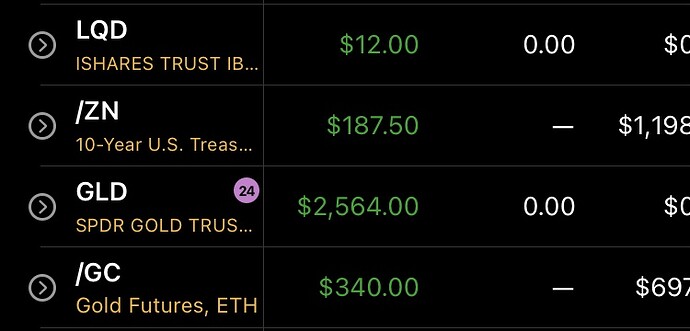

Also added 7 April 14th 120 puts for lqd here as well.

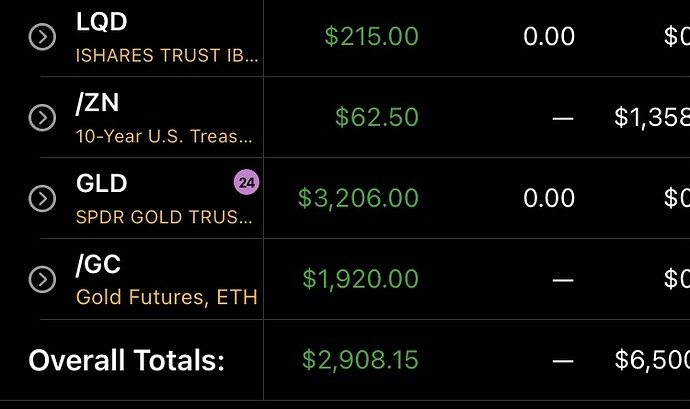

Also the red t bond puts I was holding down 20 and 30% are now green which was a pleasant surprise.

My current positions are

Lqd 7 120 puts April 14th

Znm2 puts expiring On April 14th a 125 and 126 put

Znm2 put expiring in 11 days 127.25 strike

3 march 31st gld calls

1 gcj2 gold fd 2070 strike.