Hello, I’ve been seeing some interesting in gold from some people after it’s rally due to Russia war concern and would like to provide a guide to gold and a possible way to hedge if your interested in playing gold for the remainder of this conflict tension.

PART 1 UNDERSTANDING GOLD TRADING

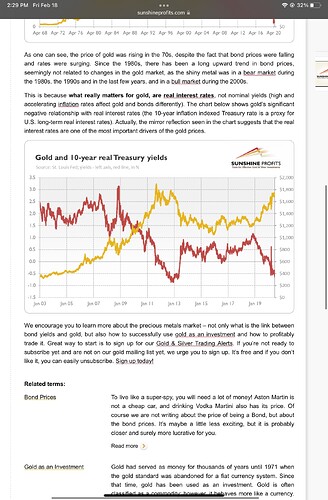

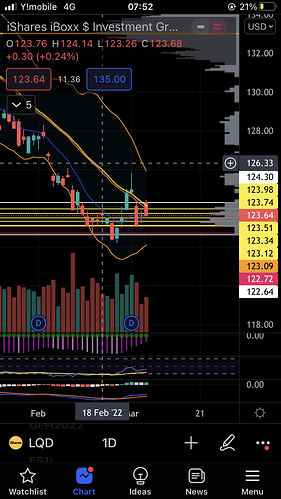

The first thing to understand about gold before you trade is it has a high correlation to the bond market. Gold and bonds are both considered “safe havens” when people are scared of stocks they come here. Treasury bonds collect a yield on them where as gold doesn’t collect anything (it’s just a rock) so in any environment where treasury yields rise gold prices will tend to fall as the doomsday prep crowd rushes to treasury yields instead. (See chart below #1)

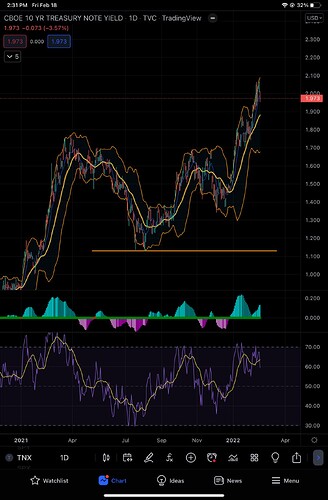

Treasury yields move inverse to the price of the bond high priced bonds have low yields and low priced bonds have high yields. Article below if you want to understand better or don’t believe me. (See chart below #2)

Another important thing is gold prices move inversely to the us dollar as well. This is why gold does well during inflation because the more usd that comes into existence the less the value of each individual dollar. (Other currencies as well but inflation seems to an issue in other countries as well)

PART 2 UNDERSTANDING JUNK BONDS

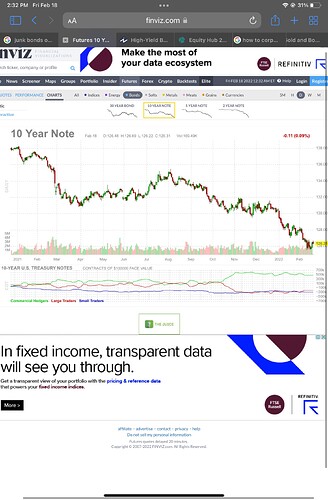

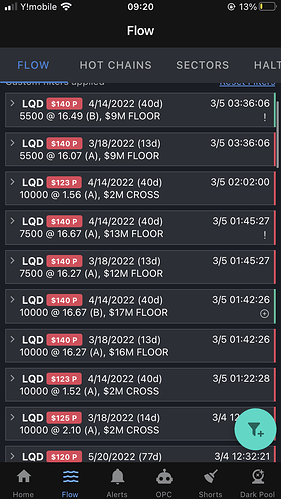

The next piece of my trade is junk bonds. A junk bond is a bond that isn’t a treasury bond but behaves the same way. Junk bonds follow the price of regular bonds similar to gold because as treasury bond prices fall their yield increases making treasury bonds more attractive and making junk bonds obsolete. (See chart below #3) there are many junk bonds to choose from but I personally like lqd as my choice for junk bonds.

So combining the knowledge above we see that gold prices and bond prices will rise and fall together. Remember yields inverse prices and gold inverses yields.

PART 3 THE PLAY

So what opportunity’s does this knowledge create for us in the current market. First we see increasing interest rates as a reality in march, and second we see escalating tensions in Ukraine over Russia invading.

Interest rate increases are bearish for both bond prices and gold prices. (Again remember as bond prices decrease yields increase and yields increasing is bearish for gold)

The combination of increasing tension in Russia and interest rate hikes creates a rare opportunity where gold prices are rising due to conflict but bond prices are falling due to threat of rate hikes In Mach. I’m other words gold is rising when it should be falling in relation to bond prices.

Tl;dr (I recommend not skipping if you aren’t knowledgeable but whatever)

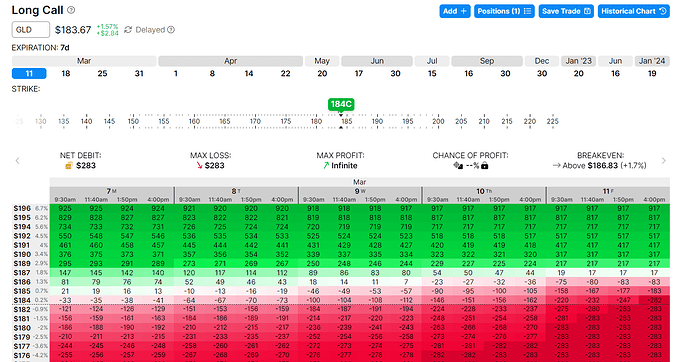

If your interested in taking a long position in gold but are worried about rate hike hawkishness brining gold down or Russia backing down derailing your position you can hedge by taking a short position in junk bonds, this will create more scenarios then just success or failure.

Scenario 1 ideal scenario russia and Ukraine conflict escalates and the fed comes out more hawkish in this scenario you profit both ways for reasons stated above. (I consider this to be the most likely which is why I’m taking it)

Scenario 2 slightly less ideal russia Ukraine conflict escalates but fed comes out more dovish, I’m this way you profit off gold increases due to dovish fed and Ukraine tension but take a loss on the junk bond short position. Remember what I said earlier about why gold thrives during inflation, if fed somehow comes out dovish then gold will still get a boost from massive inflation fears as fed continuing to do nothing will see inflation get out of control.

Scenario 3 less ideal russia Ukraine conflict finds a peaceful resolution but fed comes out hawkish. In the scenario you loose on gold but are compensated on a gain from the junk bond short position.

Scenario 4 worst case is Russia Ukraine conflict finds a peaceful resolution and fed comes out dovish in which case you would loose out on both ends of the trade. I believe this to be the least likely as inflation is getting out of control and Russia has shown no signs of stopping. Remember what I said earlier about why gold thrives during inflation, if fed somehow comes out dovish then gold will still get a boost from massive inflation fears as fed continuing to do nothing will see inflation get out of control.

The key thing to remember is as long as people think one of these things the longer the position has to gain in value so the day the decision comes out you will still have plenty of time to exit positions.

Risks

The first thing is the threat of theta from holding to option contracts. I recommend taking further out calls and or itm calls to minimize theta exposure. Also selling the inverse on either side can see theta working for you not against you but remember the risk of assignment. Also shares for the long leg will have no theta exposure.

When considering inverses it’s not really one for one.

I could be wrong/loose money on this trade. As with all trades the possibility of being wrong and loosing money is there.

PART 4 CHARTS

1.) treasury yields vs gold price

- Yields vs bond prices (tnx tracks yields not prices)

- Treasury bonds vs junk bonds (lqd)

PART 5 CONCLUSION

Based on my research I consider this to be a strong play and with proper position sizing consider it to fit my personal risk tolerance. The play will play out around a 1 month time frame as march fomc will see the rate hikes and russia is slow to invade still. This play is a bit longer minded there are opportunities to scalp/day trade junk bonds and gold/gold miners but the play as written has a 1-2 month time frame.

Edit 1.) the hedge is more so catered to the threat of increase rate hikes bringing down gold then russia canceling the war.

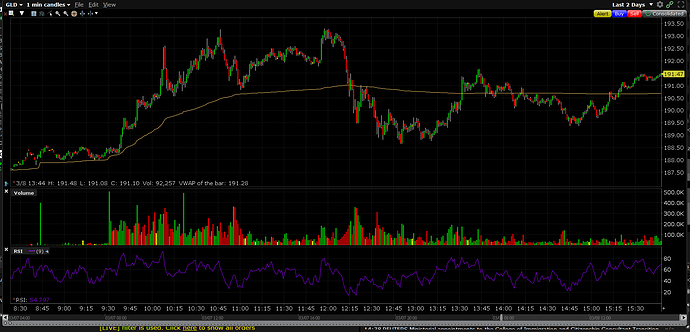

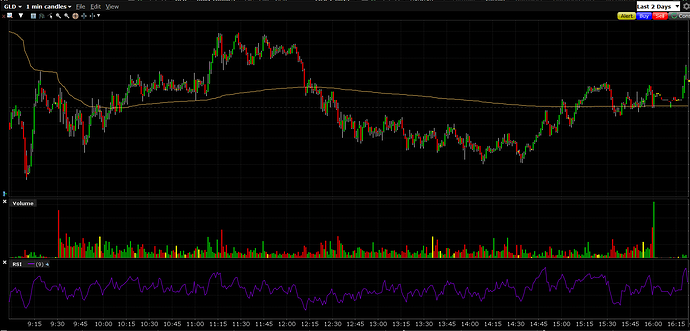

Edit 2.) I do see gold is down on peace talks I’m not going to rush into the gld calls, will wait to see how the day trends. I am also ready to switch gold thesis to bearish on a dime as it’s near an all time high only fueled by a single event.