Hello all.

After contemplating for a while whether I should make a post like this or not, I figured keeping my thoughts and allowing the community to give some feedback on what I’m doing in post form is a lot more productive than simply asking in #trading-floor discord chat. So a little about my history. I started trading in 2021 during the GME craze. Did some stupid shit, blew up my account. Bought in again during the AMC craze. Did some stupid shit, blew up my account, thought I’d be done for good until I saw Conqueror’s post on Reddit in September on WSB about IRNT and found my way to Valhalla. Made out well on that play and did mostly okay before SPY calls pre-Thanksgiving weekend took my portfolio. Since then I’ve been mostly dormant here until ESSC. Did some stupid shit and ended up losing a lot of my account on ESSC 2nd run. So when Conquerer announced he was starting his $1k challenge, I mostly shadow-traded along with him. The difference was that I started with about $1.6k(what was leftover after the second run). Long story short, had mainly wins by following a lot of Conq’s trades on that account and then also played some earnings and lost some of my gains. Got squirreley the weekend before the first Russian activity and went into all cash because I wasn’t confident in the Russian thesis. By doing so, I incurred a Good Faith Violation restriction on my account until at least June 1st(so I am only able to trade with settled cash). Got a small win on PYPL last week and I figured while my portfolio was locked up in halted stocks that this would be a good point to start my trading journal.

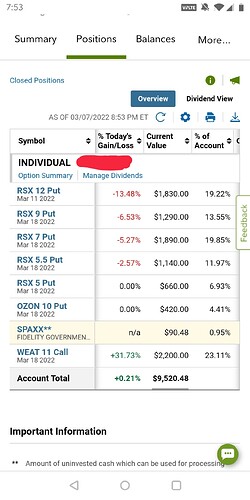

So let’s start with today’s summary:

So, similarly to Conq’s challenge account, I am holding quite a few RSX and OZON puts. The rest of the account is on WEAT calls. Today I didn’t really enter or exit any positions so my account is essentially flat with a gain of about 0.21%.

What are my long term goals? To try to reach the $1MM or greater mark within a year and have enough capital generated that I can invest in Dividends and ETFs which pay passive income that I can live off of.

Important lessons of what I have learned so far?

- Conviction in a play. If I don’t have a solid thesis into why I am in a play, I shouldn’t be playing the ticker.

- No FOMO. By not having conviction and entering oil stocks and rapidly exiting because I wasn’t confident, I incurred a GFV, which means that while Conq is making plays on his account, I will be making plays with a 1-day delay(or more depending on when I am allowed to sell my puts to generate liquidity)

- Stay Liquid. Having no buying power really hurts me because of there’s an opportunity, I’m not able to buy in at ideal support and resistance levels.

More tomorrow. I hope to have some criticism because like many of you, I am still learning.

5 Likes

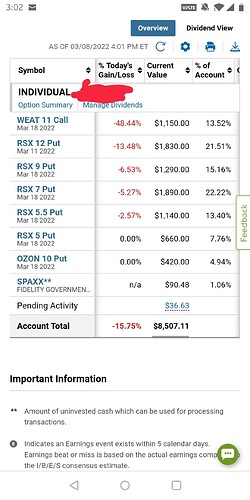

Update for 3/8/22

What a rough one. Not much trading activity on my end. All I did was buy one SCO call for $0.57 for the quick pop on bearish news to oil and sold for $0.95. Otherwise, I just ended up holding the full position in WEAT and watched it bleed. I still believe in the thesis that the war is good for WEAT and we got more good news about Putin sanctioning his own Russian goods from entering the outside economies, so I’ll be holding the positions still. All of the Russian positions are still on hold and MOEX is supposedly going to be open tomorrow, so fingers crossed for an unhalt.

See you all tomorrow.

1 Like

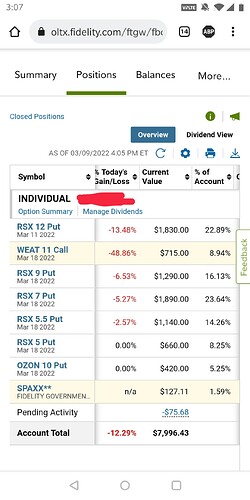

A short update for 3/9/22

Not much today. I bought 1 more WEAT call to average down, but most of the action in my portfolio was from WEAT bleeding throughout the day. I do honestly believe any major escalation from the conflict will send WEAT soaring(and oddly enough, it seems like the weekend has been when these conflicts happen). Oddly enough, for some reason, my RSX options had an adjustment to their price today which is where I hope to get my future liquidity from. What could it all mean? Find out on the next episode of God’s Blessing on this Fantastic Trading Journal!

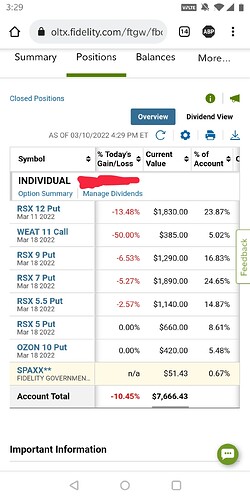

Update for 3/10

Not really much, just decided to watch WEAT bleed out. My reasoning behind not selling when everyone else did today is that I am still willing to bet that we have a final spike. Hoping that something will happen. Will cut on Monday for sure if there’s no catalyst this coming weekend.

Update for 3/22/22

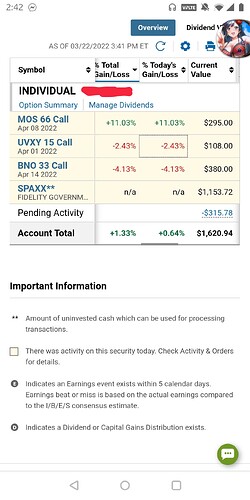

After eating the nuke from RSX, I decided to add $1000 back into the account to try again. There isn’t much else to say about this, so let’s look at what happened today:

I bought a SPY $445c with 3/25 expiry date yesterday for $2.93 and sold this morning at open after the overnight gap up for $4.10. Seeing that the SPY support of $446 held and following Yong’s call-out, I then picked up a SPY $450c with 3/25 expiry date for $2.84 and had a stop loss of $3.35 set while I went afk to do other things. Came back a few hours later to see that I was stopped out.

I then re-entered the Russia trade of $MOS because I saw the nice dip and felt that this still had some room to run due to food shortages and stuff related to the fertilizer play. Afterwards, I also picked up some BNO and a UVXY with my remaining funds to hold onto tomorrow. SPY maybe back to it’s bull run depending on if Powell’s comments dent it tomorrow or not. I personally think the bull run continues, so might play SPY calls again if the opportunity arises.

Update for 3/23/22. Let’s take a look:

Let’s take a look at the good and the bad of today.

The good:

Sold MOS call for $4.25 after the gap up. ($2.65 cost basis)

Sold BNO calls for $2.50 each after the overnight gap. ($1.98 cost basis)

Bought an AMC 4/1/22 $20c following Conq’s challenge account for $1.80 and sold for $2.50

The bad:

Bought a SPY 3/28/22 $450c at $446 support expecting the bull run to continue since the JPowell comments didn’t seem to have had much impact and thought there wasn’t anymore FUD in the market. Forgot about Fed zombie Bullard talking in the afternoon, so now I might be holding a bag. Going to hold this call overnight hoping for a gap up or any kind of positive reversal.

Sold my UVXY $15c with 4/1/22 expiry for $1.09(cost basis $1.10). When my SPY call was going down, I don’t know what I was doing but decided to sell this position, when I should have been holding it as a hedge to the call.

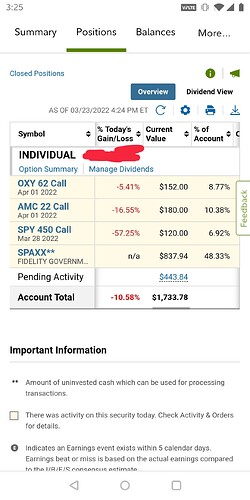

As to what I am holding overnight, it is as you see. I have confidence that OXY will gap up overnight again as a part of the Russia war play. The AMC call is to be held on any kind of AH spike to follow the meme trend. And the SPY call I’m just bagholding in hopes of a reversal. May cut for a direct loss on Friday if I don’t see anything coming.

Update for 3/24/22

Not good. Sold the SPY call I had for a loss of about 20% because I didn’t want theta eating away at it anymore. Sold AMC call for a loss as well. OXY seems to be bleeding. I put quite a bit of the portfolio into MOS because I am pretty sure of the play, today was a buy the dip on MOS.

Update for 3/25/22

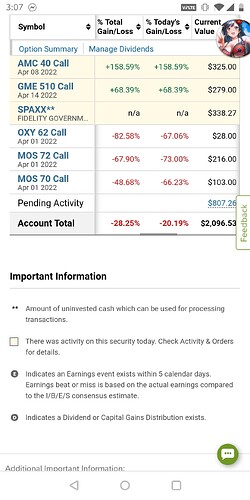

First let’s look at the overall status

MOS rebounded like I predicted. I sold one of my 70c for 50% gains and am holding the other one. Also holding 72c. My theory is that we should see a gap up on weekend Ukraine news(this seemed to happen the last week, so I’m betting on it happening again. This is also the same reason I am still holding the OXY call(this also seemed to rebound a bit before losing strength mid-day.

Now for the meme stock plays, I re-entered AMC and took a single GME call. I don’t have the capital to play a 4/8 expiry, so I figured if the big move happens, it will be next week and I should still be able to capture a lot of the upside. The loss on AMC looks big, but my cost basis is actually $1.60. Because I sold AMC for a loss yesterday, it added the loss to the position as a wash sale. As for position sizing to prove I’m holding very minimal amounts of each, here:

I think I’ve made proper calls on everything. We appear to still be in a bull market, so hopefully everything looks good still on Monday. Happy Weekend!

Update for 3/28/22

So my theory of an over weekend gap up on MOS didn’t work out and now I’m down huge on these calls. Not good. Probably should have exited last Friday, but hindsight, right?

AMC and GME, holy shit. Not much more, I did have a 4/1 call on GME, but at the discretion of everyone on trading floor, I exited this at $8.20.

I will hold the MOS calls until tomorrow hoping for a rebound, and regardless of if it happens, will look to cut the MOS tomorrow.