[size=6]Unusual Options Activity[/size]

I have a cousin who works in the fashion industry and he’s a $GPS Gap bull. Last week he told me that he thinks they’re about to announce some new collection, kinda like how they announced the Kanye collection last year. I forgot about it, and decided to do a bit of digging tonight.

Edit: It was this: https://www.refinery29.com/en-us/2022/01/10825059/yeezy-gap-balenciaga-collaboration-2022

So I started poking around $GPS data, and noticed that $GPS has some fucking weird options flow.

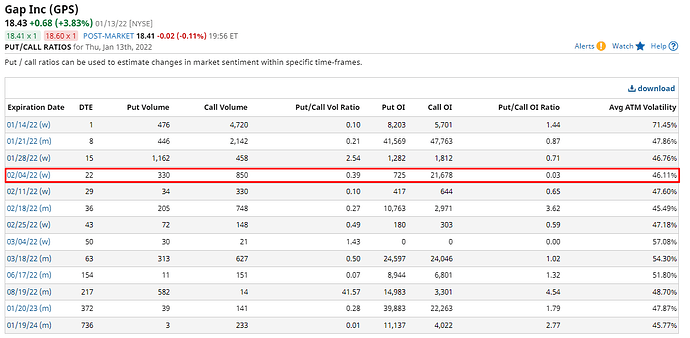

Based on what my cousin told me, I thought hmm let’s take a look at barchart. And I found that very strangely, February 4 has unusual put/call ratio compared to literally any other opex and Feb 4 isn’t even a monthly opex. Take a look:

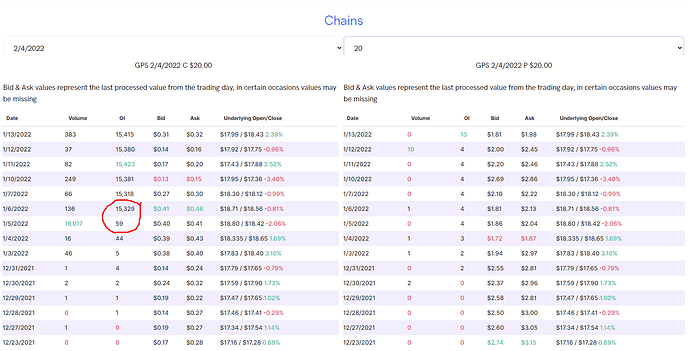

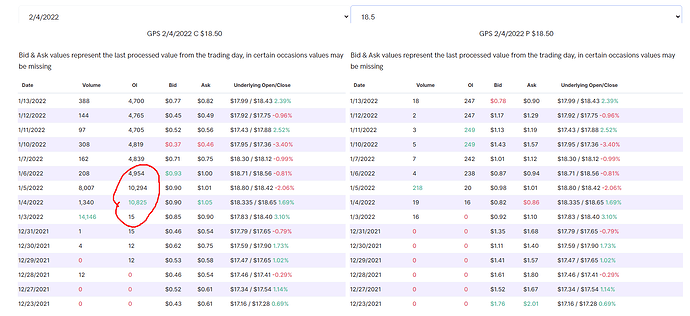

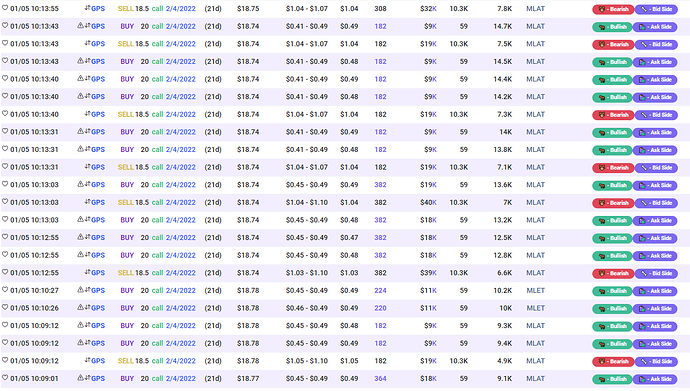

Then I went on Unusual Whales as always, and checked for when these were bought. It looks like on January 5, someone loaded the boat with Feb 4 20c and looks like they loaded Feb 18.5c on Jan 3. They’re down on their investment though as the stock tanked right after they bought. But basically it looks like one trader owns the entire 15000 OI on the 20c which is around $750K, and it looks like they might own the 18.5c too based on the UW flow.

Screenshot of the day the options were bought:

Screenshot of the ~15,000 OI jump made by the whale buying on January 5 for the 20c.

Screenshot of the massive 18.5c purchase on Jan 3 and then apparent rolling into 20c on Jan 5.

Snippet of the purchases on Jan 5 FYI:

Now, the other day Gap did put out some NFT news and the stock moved up as a result, but I’m not convinced that this is the price move that the whale was waiting for, or maybe they were just wrong… idk tho

[size=6]What am I doing with all this?[/size]

Gonna follow the whale and buy a lottery ticket in the February 4 20c and see what happens.