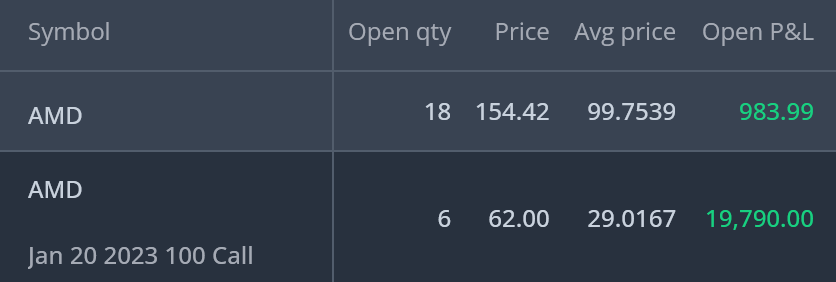

Nothing much here other than updates on my positions.

I also liquidated my 160c’s for breakeven before this gap up today which I feel sour about but it is what it is.

I plan to use those for shorter term / riskier plays. Also waiting to do Norbert’s Gambit on margin account (can’'t today, CDN exchanges closed).

2 Likes

19K isn’t a bad green number at all my friend. good work!

1 Like

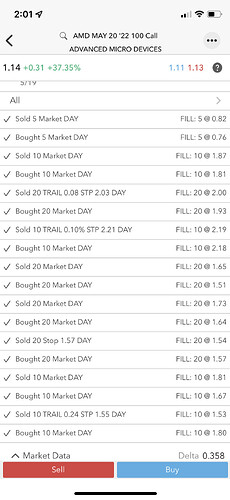

Sold and rolled up 100c strikes to 130c, grabbing 3 more contracts. Sold stocks and grabbed an OTM 185c for fun. I want to compare OTM leap to ITM leap. Tmr CES will be very interesting. I could’ve sat that one out but decided to just be in the market.

Update on since last month.

Sold out of all my positions after a big dump at a small profit.

Gambled big and lost a lot on a few earnings and SPY bets. Wouldn’t do that again for awhile.

Re-entered leaps and VTI shares couple days ago.

Today and yesterday have printed big for AMD, not so much for AAPL.

Switched from Questrade to IBKR. So much better.

small update.

Russia invaded Ukraine and my port took a big fat dump and I was staring down -15k at the lowest.

Today, it sits at +1.7k and I feel much better about making smaller plays based of news and projections.

I’m getting more patient with my entries, and it is starting to pay off.

Exited Mar18 AMD 110c at 4.3% gain (at the lowest, it was -50%, bagholding this one was tough)

Sold 5 VTI shares taking $69 loss to make smaller plays.

Holding onto AAPL jan2024 155c and AMD jan2023 115c LEAPs and VTI shares. These are my retirement babies.

Entered SENS with 100 shares at 1.8, sold 1 CC at 2 strike for 0.15. I’m going to try and see if I can be profitable with CC.

Still holding 2 SU 32c. I believe dividend is coming up in march and will sell before.

War related plays. I plan to hold these thru weekend and sell on Open if war continues causing these to spike.

RTX: bought 2 98c. I think this has better potential than LMT as dividend is lower for higher price gains.

UNG: bought a 14c.

WEAT: bought 4 8c.

Value play

TSM: Entered 2 110c. Noticed that ASML had gone up while TSM hadn’t due to perceived fears from China and/or difficulties with 3nm. I think the fear is premature and TSM will pull through.

Pos:

Retirement:

AAPL 5 155c Jan19’24

AMD 14 115c Jan20’23

VTI 100 shares

VTI -1 230c Mar18

SENS 200 shares

SENS -2 2c Mar18

Margin:

AMD 1 115c Mar18

BNO 3 30c Mar18

CCJ 3 26c Jun17

EQNR 1 30c Apr14

NVDA 1 share

RSX 20 3p Mar18

RSX 7 5p Mar18

RSX 5 7p Mar18

USO 2 75c Mar18

VET 1 17.5c Jun17

Gains:

Sold all of RSX 9p’s at 117%  and rolled half into RSX 5p’s.

and rolled half into RSX 5p’s.

Consistent multi tens of % bangers on commodity plays such as USO, BNO, WEAT

DCA’d TSM when it dropped to 105, sold when it gapped up to 111 at small profit.

Losses:

LMT 485c - bought when LMT reached high at 458 range. Stupid mistake buying when LMT ran. Cut losses only at -200 however. Position sizing and waiting until gap up helped limit losses.

F calls after it ran. again another stupid mistake. mitigated losses only because I timed exit well.

Todo: Planning to trim exposure to AMD and move into a consumer staple boomer stonk.

My margin account is in hibernation mode waiting for RSX short position to trade away. IBKR has stupid 2500 cad limit thing. I’ll start this over once RSX is cleared.

Since then I have made couple of trades, learned more lessons.

Tech. It is very bad to bet medium term on tech when macro conditions aren’t favourable. At best you get a swing play, at worst, constant downtrend. Fortunately my calls were quite long dated and I was able to exit AAPL, AMD, NVDA at breakeven prices after many DCA’s. Unluckily, my short dated attempts resulted in taking a approx 2 grand losses.

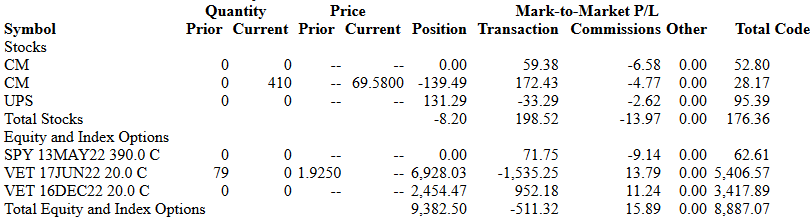

Energy commodity stocks has been very volatile but Energy producers have been on a tear lately. So far after initial investment of 10k in VET june calls, they were up 30% last week. Today it broke 79% high. I believe in the thesis and think I picked the right dip. I took some profits today to buy and build an AMD desktop. I have nagging suspicion that money that I don’t spend would have high probability of being lost to MMs.

started off the day with bad spy scalp putting me at -500.

as of now, up +185 just off spy scalps. probably calling it a day UNLESS?

I lost 700 on day of FOMC. huge mistake not watching jpow and deciding to time the 2nd top when he said ‘we’re not looking at 75bp’ which set the course for the rest of the day. Day after, I’m down another 800 approx wrongly timing QQQ calls and puts. Patience always 99.95% of the time wins. Retard power took over me and I was determined to lose even more money and dumped 4k into SPY 410p at the wrong time of course. Luckily SPY decided to shit its brains out and I came out +1000 out of that trade. A few more scalps on QQQ put me at +411 for the day, still down if I count yesterday. I am holding TSLA 1050c May20 x3 for a reversal next few days. Holding HD 330c Jul cuz <300 HD has always been a buy in my eyes. Also playing GFS 60c May20 x4 for the ER Run-up. Today would’ve been easiest day to scalp if I waited for deadcatbounce to enter puts. I need to be more prepared in the morning and engage less revenge trading.

scalped 30x408c 1dte 1.32->1.48

sold rest of my VET dec 20c leaps 20x 3.6->4.4

I missed the retard spy rally at the end but o well can’t be too unhappy.

started day off disastrous with too many bad scalps, ending at -1300, decided to take the plunge after spy broke with two large red candles, taking below:

may31 380p x9 4.09

Cut 4 at 7.32

Cut 5 at 5.75 for combined 2.11k profit.

Net today is +774.

1 Like

10x 490c jun17 COST 5.70->6.80 for 1.09k profit

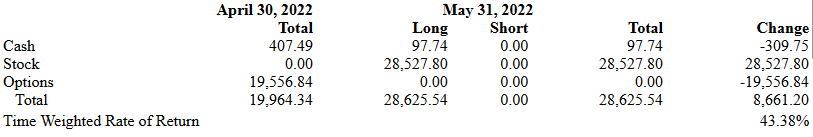

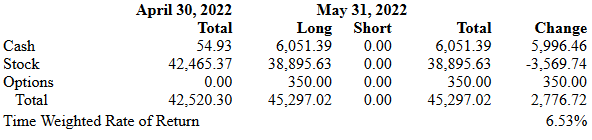

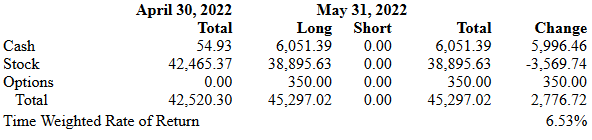

Monthly update for May.

Margin (on hold til RSX)

TFSA:

Majority of gains came from swinging VET.

RRSP:

I mostly scalped in this account using starting amount of around 6k. Not as successful as I thought, but I’m learning.

activity last 2 days:

bought BTE.to 3200 shares at 7.87 (close 8.35) going to hold until 10-12.

sold CM 380->50 shares for ~500 profit

bought TVE.to 350 shares at 6.22 (close 6.25)

scalped XLE for small profit ~20

holding 1 OXY 70c sept bought at 8.06 (close 8.60)

I think there is still more upside to canadian oil small caps as long as WTI holds at $120. $BTE.to has no divvy and plans to reintroduce divvy at 2023 Q2. It seems like a good thing that oil producers aren’t increasing capex and instead focusing on returning value to investors, to not repeat US shale gas of 2015.

opened 40x BTE 9c Mar17’23 leaps

sold more CM shares

closed OXY, didn’t like the look. put the money towards BTE leaps.

opened 8x VET 25c Jun17, playing the Freeport LNG explosion news. EU gas will get more expensive.

added more bte shares now at 3450 at 7.95

degen docu 60p before close

at one point today daily gain sat at 2.2k until spy decided to shit its bwains out. bte is only big green in sea of red even in energy. ending the day at just +51. all the losses in vti googl vet calls offsetted by bte shares and leaps. hoping to cut vet sometime, might have to take a loss.

sold 1.5k of CM to start off a daytrading challenge.

took 2 sept 16c for $MEG.to near eod as I feel that selloff isn’t justified with questionable demand destruction