Me do trading journal.

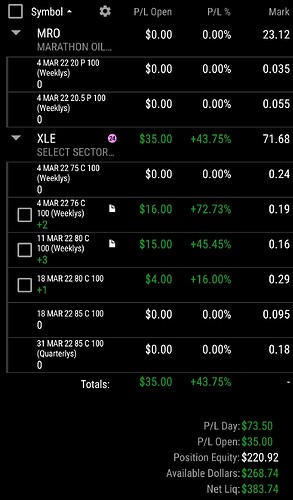

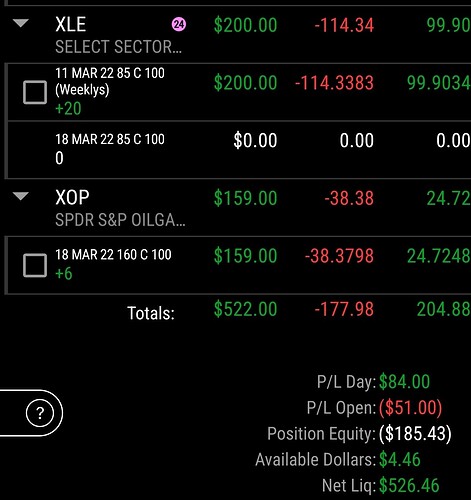

Current Positions and Account Balance

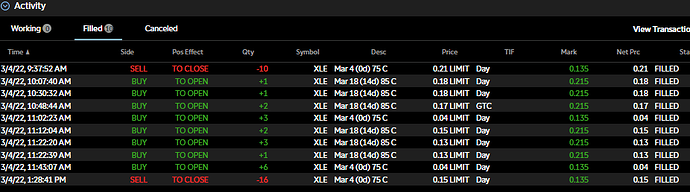

I have been trading XLE green for 5(?) days from a starting balanve of around $170. I opened all the positions pictured above today.

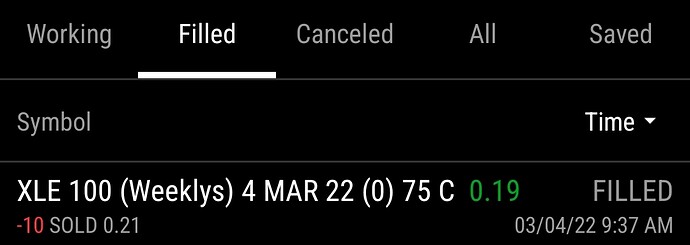

XLE

I have lomit order set to unload 3 of the $11 contracts at $25 each that i expect to fill in early trading tomorrow. My 3 remaining contracts will be held at an adjusted cost basis for an aggregate of $5.

I maintain bullish on XLE but anticipate a possible negative catalyst (the White House accouncing its intent to control runaway oil prices being the most relevant)

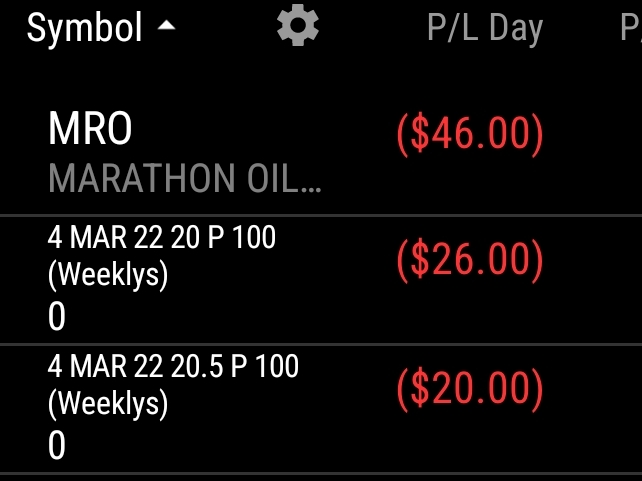

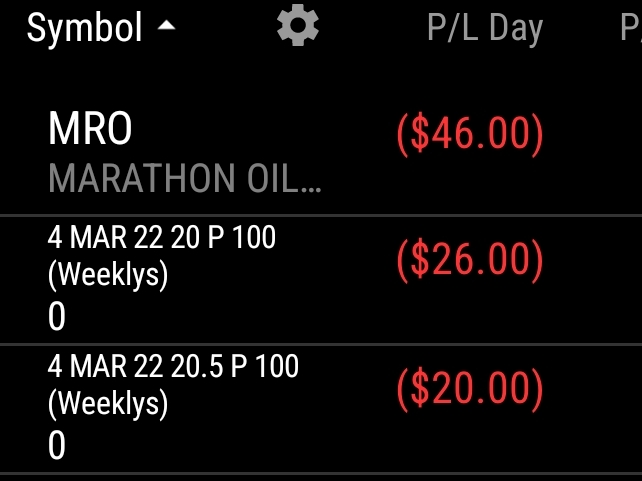

MRO

This was a mistake and ate into a lot of my profits today. I opened these positions at various points yesterday based on bearish TA. I held overnight and got blown out by a gap up (I should have expected this). I cut my losses today during the morning low period. I could have salvaged more if i held until a later point in the day but I was and am happy to be out of the play.

Will likely be edited for grammar, style and spelling.

1 Like

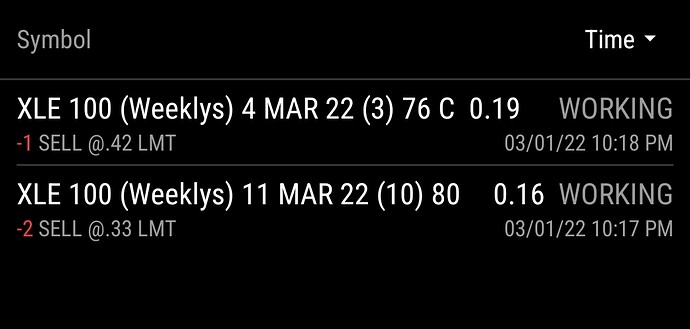

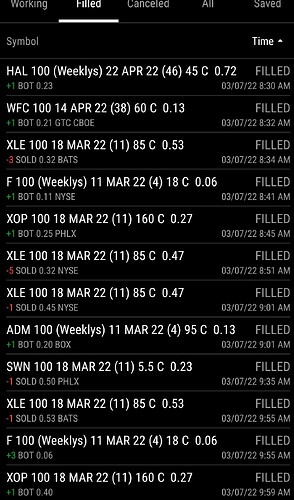

I’m adjusting my XLE sell limits for open based on good Biden SOTU sentiment. See below

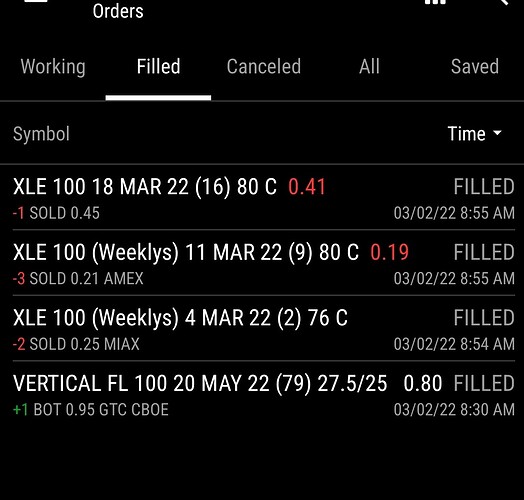

Didnt get the fills i posted last night. We did see a gap up in XLE so i was forced to sell.

Also opened a $FL spread that is way too big of a position size for my portfolio. I filled instantly at open so I probably didnt get a good entry.

Opened some $XLE put FDs for scalp

I cut $XLE puts at 3:55 for loss. Cost basis 18.xx sold at 16. Kick in the teeth when it started dropping on the next candle. OTM FDs though, so if I had held I would more than likely be blown out (of a sizeable portion of my portfolio.

Still holding $FL from open. I want to try and exit this spread at cost and reposition at a later date.

1 Like

Was looking ugly yesterday evening but putin said fuck your iv crush.

Avg cost 18.6 sold some for 21 riding some out (still think 75 is possible today)

Probably going cash into monday barring any major events today

I should have been dunced. I would call it getting bailed out, but XLE followed my TA and got me where I needed to keep away from the Wendy’s dumpster.

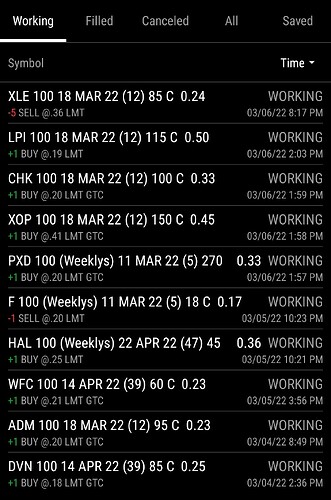

I’m holding XLE 85c monthlies right now. Might look to enter a few more positions on other tickers during PH.

Friday AH Update

Looking forward to next week and crude to 125.

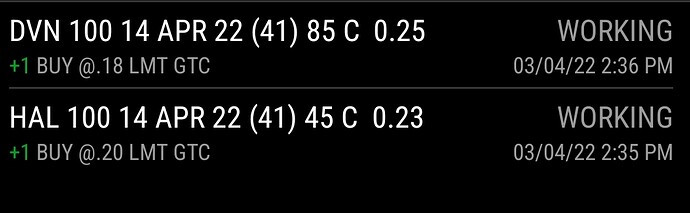

I have $HAL and $DVN orders that i would love to see fill on Monday at open. Something something hydrocarbons. I dont know much about fracking. I have been told that when oil/gas are up fracking becomes a lot more viable. These are the two I know about. If I come across any good DD I will adjust position target but this shit just flying up YTD so what is Groupie do?

Picked up $XLE 85c on intraday low. I would like to take some profit there on Monday. Also scalped more 75c FDs. Thats what really saved my ass today. Shits almost went to 0 bids before bouncing back.

Weekend goal is fracking.

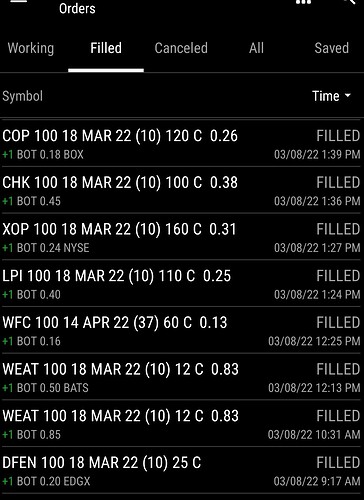

Orders set for Monday. I won’t be very active and i would be surprised if many of these buys filled.

Tickers all based on forum plays.

$XLE looks like it may open around 78. Another 3 point gap up. Really satisfied with this play. 10 contracts at cost basis . Selling 5 at $36 to cover cost and 5 ready to ride to Valhalla.

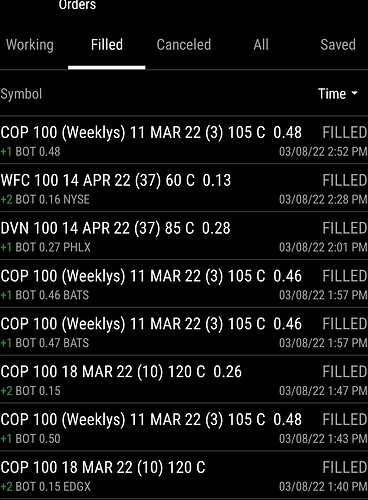

Quick post for daily balance and trades. Lots of fills this am. Some better than others. $HAL was a snipe. 100% dialing this entry in.

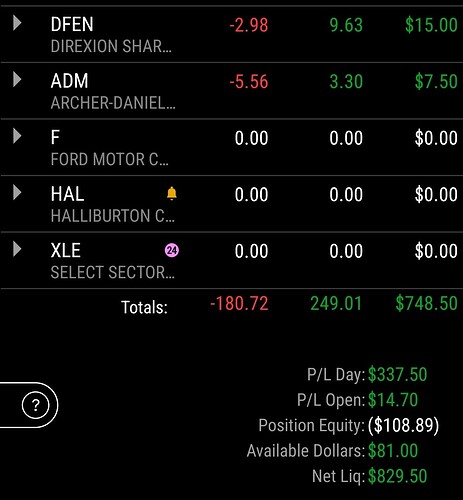

Sold things. Sold early idgaf its a 40% day and 7th green day in a row.

$HAL did work. Hoping for similar return on $COP i picked up today. Might put in an order or 2 to avg down if it drops intraday. Got gardening and shit to do

Added $DFEN. Triple Leveraged Bear Aero+Military Sector ETF. Literally 0 DD but its low and theres shit going on in the world.

End of Day not too shabby. Few more fills, mostly $COP and I picked up $WEAT on a low.

Been a while since I touched this. Blew this account up on COP FDs. Currently holding 5xHAL 3/25 44c. I sould have sold the intraday peak and repositioned but I didn’t. Probably wont tomorrow either

So those contracts expired worthless.

Account died.

Funded $25 here, going shares only, and $25 in a new webull cash account for options.

Currently in CLVR, IMPP RNRG shares. Waiting on deposit to settle in webull.

I aim to get back to regularly posting.

Other side-mission is to set up a set-aside bank account so I never again have to pay premium for not prepaying taxes.

Also got El Troque mostly running and legal. Still need new tires. Front are down to 3 and back down to 2 (yikes). Still need to get some work done on the body and instrument panel, fix windshield and shitty aftermarket window tint, plus I’ve got a 2nd Takata airbag that I need to get swapped out.

Also got some crypto holdings~ 0.44 ATOM and 3.22 APE. I don’t really understand this shit so I’m probably going to pretend it doesn’t exist.

All crypto now in APE

Sold RNRG for mid gain. It doesn’t have fuck all for volume.

Filled some IMPP buy @1.5. Still sitting at about 50% cash

Options account watching $TAN $XEL $HAL $CVX for calls $TMC for puts. Still 100% cash

Averaged down on more CLVR at 2.35/now average cost 2.4.

took profits on CLVR.

sold IMPP because I didn’t like looking at its immobile ass.

shares account all cash.

bought 2x GME 250 FDs on the options account. Going to sell for slight loss soon before theta makes these worthless.

Converted crypto to ATOM. Staking

Took L on GME FDs

Been buying back in on CLVR. right now average 2.9. Probably sell the news in 10 minutes