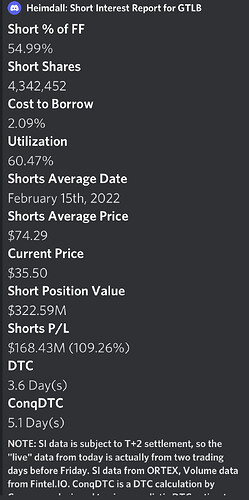

Not sure what to look for exactly. Decent SI% but only 3% of shares are shorted. Doesn’t look like much potential?

GitLab is DevOps software, intended for the tracking and development of technologies. They have earnings coming up on March 14 after hours (so this is probably too late to play), and the shorts are currently profitable in this position. Average daily volume is low enough to cause some heartache for these shorts if GTLB happens to blow earnings out of the water, but the average short price right now is more than 2x the current stock price - $74.29 average short price. We don’t usually see +100% earnings so this is one of those ones where the shorts have likely won. Let them win.

They have a decent list of customers including Goldman Sachs, Nvidia, and Siemens so I assume they’re doing okay. But deployment management is a pretty saturated market so unless they announce a huge deal that they just signed, or conversely a big customer they just lost, I couldn’t imagine earnings carrying much of an impact here.

Just my two cents - I personally won’t be playing this one. There’s simply not enough time to avoid IV crush between now and earnings. This would have been a good one to grab puts at the start of last week.

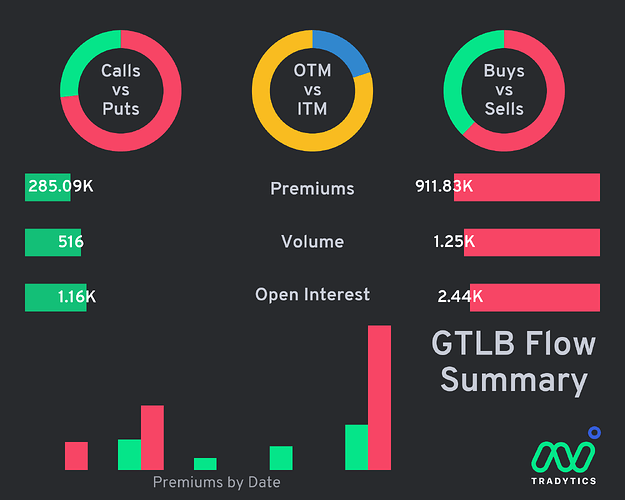

On the other hand we have this, which may make for a double play POST EARNINGS. Mid-term, I am bearish on the cash negative tech company valued at $5B with $150M revenue:

I’m expecting a drop post-earnings followed by a bounce off the bottom of the channel before continuing on the downtrend. I will not play earnings since there is no need for me to take that kind of risk with high IV. I see several people on social media simply touting this as a short squeeze candidate without factoring in the earnings, this may only be possible if earnings are a blowout and the price increases AH. In this case, I will only play the downside at the peak. Otherwise, I will play both the upside (up to near middle of channel) and the downside if I see a shift in momentum.

Looks like GTLB beat earnings and was up 16.6% (now 7%) Was expecting a drop, but a pop is alright too. Now I’m looking to see where on the channel it is for entry on puts. I doubt it can hold these gains and shorts aren’t underwater enough.

Thanks TMilly for sending earnings screenshot:

thanks for this thread! always grateful for all the knowledge passed down on the forums. seeing some really bullish price targets this morning after earnings. Lowest $65 (BoA), mid $86 (GS) and high $105 (Truist - who the hell are these guys? lol).

couple PTs were cut/lowered down to $50 range (Keybanc). keeping an eye on this today. thanks all for the thread!

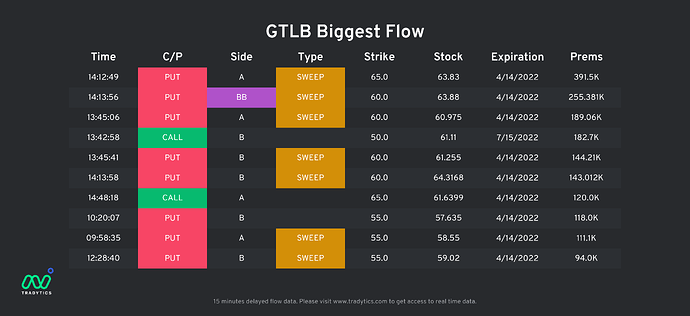

Writing this to inform GTLB has now hit the top of my channel. Could not play the upside of this as I was tied up making profits from China. I’m in with one put. Also there is this for today:

GTLB had another earnings beat and ran hard today. Now seems the SI is lower as far as percent of the float. However the CTB and utilization is minimal. The shorts are now in the hole here as I’m sure many took profits and repositioned after the last couple month drop. So if this continues up trend may see a few pops up from short covering.