Hey all, I’m going to go over a pretty simple play that i’ve been running on FOMC days. It’s not often that free lunch is found in the market, but with the volatility and uncertainty that a bear market brings, for now this seems to be one of those rarities.

Three FOMC’s ago, I was watching the SPX options chain and noticed that IV was increasing so rapidly AND consistently on OTM SPX calls and puts, that theta was completely null. At open, IV was at about 50%, and increased all the way to 90-95% before rapidly dimishing going into the rate decision. That kind of IV increase on SPX contracts in 4 hours is insane.

The next FOMC I decided to play it very small, I bought one put and one call each for .10

By 1:00, the call was worth .25 and the put was worth .20

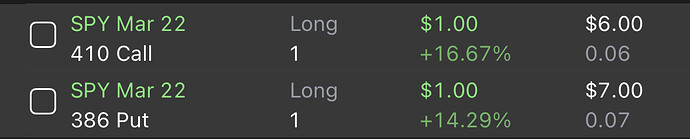

I ran this play again last time in January, buying different strikes ranging from 1.00, .50, .25, .10, and the results were the same. All of them increased, the 1.00 going to 1.50-1.70 for 50% profit, and the .10 going to .20-.25 for 100% profit.

I wanted to make sure this wasn’t a one off before sharing it. Considering everything that’s going on with the banks and the uncertainty of this rate hike, I’m expecting the same results.

The play:

As described, immediately at open buy far OTM 0DTE SPX straddles. I personally just have the option chain loaded at open and ready to go. As I described above, i’ll be targeting puts and calls valued at 1.00, .50, .25, and .10

So for example:

4200C and 3800P for 1.00 each

4250C / 3750P for .50 each

4300 / 3700P for .25 each

These values are completely hypothetical, as you won’t know which strikes are going to be 1.00, .50, etc at open.

Then after quickly loading your contracts, do nothing for 3 1/2 - 4 hours and let IV work it’s magic. I have gotten antsy and sold some contracts 2 hours in as they were up 25-30%, but they really did peak at around 4 hours in. It’s important to sell about an hour before the FOMC report drops. IV seemed to peak around 1pm, and then drop off a bit leading into the report.

The real gem of this play is that you can make a bunch of money on FOMC day without actually having to play the real volatility of the report drop. Also, the reason I am buying far OTM contracts is firstly IV is going to increase much more on them, and secondly by having a low delta value, it doesn’t matter what the SPX intraday price action is.

The reason I choose equal calls and puts is that there is no way to know which way volatility will skew. Both will go up, but usually one side is favored.

Also the great thing about this play is the cost to entry is extremely low!

Hope this play prints for the 4th time, I am highly confident in it. As said above with the uncertainty in the markets right now, this is probably one of the most important FOMC days yet.

Let me know if you have any questions!