Do not do this, you are gambling on the direction of movement which is not the play. If you buy both puts and calls with similar delta the day of, direction is neutralized. Now we just hope IV overcomes theta and cash out before IV crush of post rate release

If I had done that it would be too late <:kekw:923797443471081503>

Very true

However I did just read everything you posted and you’re doing gods work my friend!<:pepepray:930324508018106448>

I’m a guy doing questionable work with very little data points at best. If you do this, please don’t be fooled by both calls and puts getting 90% gains. I have know way of knowing when those gains happen. Take 20-30% w total returns when u see them

I hope callouts are functioning in the morning. That will help everyone to stay on track <:pepepray:930324508018106448>

Again, if you play this, try buy equal delta strikes within the range/strike mentioned above. Do not get greedy, take 20-30% when given. My man gramps buffet was happy with 20% in a year, yet alone a day

Something I noticed last time we did this play: profit usually peaks if we get a nice move in either direction before fomc. This is because the side of the straddle getting closer to the money gains value faster than the other side loses value. Has to do with the gamma changing in opposite directions on the strikes. We don’t always get a good directional move pre event but if we see one today that’s probably going to be your prime profit taking territory. If you hold while the market snaps back to neutral (which it usually does) because you are trying to stay in all the way up to the event you might end up losing money. Just something I noted from last time we should keep mind <:pepepray:930324508018106448>

great observation. This is exactly what happened to me last time even though the play itself still did work. Just got caught up in work and figured I had time but the move just wasn’t as great (still a winner) and happened quicker.

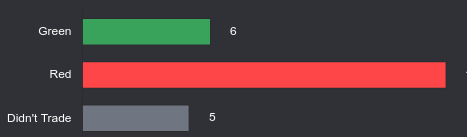

I guess based on todays performance we should pause on this play.

I made the same mistake as last time. Was up about 5% total at 11:00. Then the reverse happened. I was able to get out with 1% gain but it involved me holding a much larger position than I would like to through the meeting and praying for the algos to save my ass. It worked but I didn’t like it.

So I’ll do my debriefing now. I bought 1dte 461c and 447p between 9:45 and 10:15. Calls I got an average of 18c, puts avg .20c. Iv for calls when I started buying (9:45) was around 17.04 and the puts around 18.37. By 11:45 calls IV was at 17.93 and puts at 19.27. At 12:54 calls IV was 18.37. I had already sold my puts at this point and forgot to record IV first. So in theory this play should work. I was able to get up to 5% total return which I should have taken but didn’t. The reason I didn’t sell my puts at 30% gains was …. I guess I didn’t want to leave my calls unprotected from further decline. I doubt I was the only one in this situation so that may be the next piece of the puzzle. When to cut each leg. Again I still like this play better than playing the algo pump due to is better r/r but might try to tweek the strategy a bit before sept

Also if anyone had similar experience or better yet a very successful one, please share

From my experience, it’s not worth going long on a strangle or a straddle unless there’s a mismatch between the expected move and the premium cost. Something like an inverse iron condor or inverse butterfly allows you to benefit from IV expansion, but doesn’t put you in a long only position because they’re comprised of credit spreads.