Found a Reddit post that seemed like a really interesting play and would like somebody else’s thoughts about it as well

"Here’s the greatest play you’re going to find this morning. HMHC management has made a shady deal and agreed to be acquired by Veritas for $21 a share via a tender offer.

This is where it gets interesting. The shareholders must decide if they will tender their shares or not on April 1st. They require 66%~ to tender for the merger to complete. Only 34% must not tender and they will not be acquired for $21.

Now here’s where it gets juicy and 100 bagger opportunity arises. Several of their larger institutional share holders have wrote letters saying they will not be tendering their shares as this is undervaluing the company. Several large shareholders believe the fair acquisition price is $28+… (see sources below)

Assuming only 1/3 shares aren’t tendered then that will force Veritas to either increase their cash offer to get a deal done or back out. However, either should boost the share price as this proves to the market $21 is undervalued.

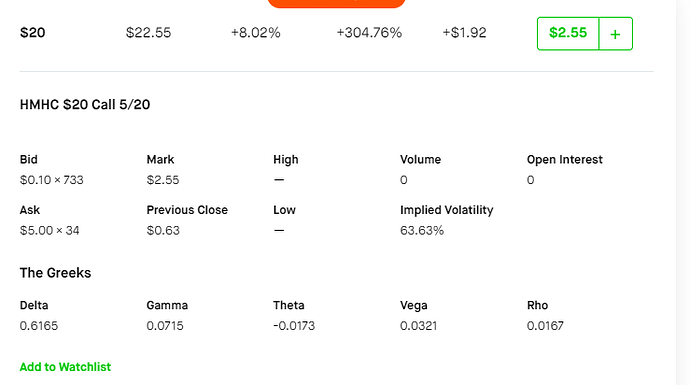

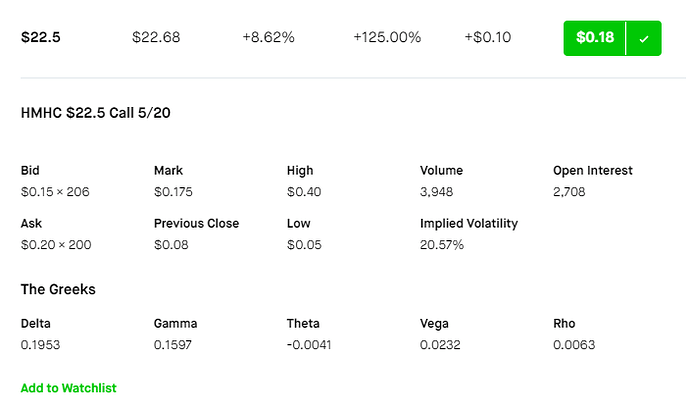

To make a great play I will be buying shares and will not tender. But if 66% are tendered then I make my $.10 a share in a month and go about my day. BUT the HUGEEEE upside is in the OTM call options. I am buying May calls with a strike at $22.50. These can be picked up for $.05-$.10… IF shares aren’t tendered and Veritas ups the offer to $24+ then you’re looking at massive returns. Retirement type returns within a month so strap in.

TLDR; buy shares and don’t tender and buy Short term OTM calls in hopes the offer gets bumped to get the deal done for massive returns."