In this post im going to into the bear case regarding Home depot. I could be wrong but the upside gains are fat whenever, i try to fade the bullish consensus majority.

Home Depot has an Earnings ESP of +0.93% for third-quarter fiscal 2021. It has an

expected earnings growth rate of 20.6% for the current year

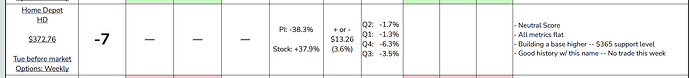

The stock is trading near an all time high of 372 and up 6% in the last 30 days leaving more downside risk.

Analysts have been bullish for Home Depots upcoming earnings which sets the table for

a nice financial opportunity betting against them. Supply chain struggles have pretty

much ravaged all specialty stores since earnings began starting with BBBY. I expect this

trend to continue in the home improvement sector this coming week.

The unique extreme Home depot has taken has been to contract out its very own freight ship at an undisclosed price.

Home Improvement is considered consumer discretionary meaning people choose optionally when and how much to spend in this sector to build upon their residence. One would draw the conclusion spending less time at home would create less upside for people to spend more money on home improvement items. During the height of the pandemic Home Depot got a surge of people deferring to DIY projects to not only keep themselves busy but avoid strangers entering their home.

In the last earnings call, home depot representatives said that DIY had been down significantly while contracting professionals to do home improvement was up to handle larger projects put on hold during the pandemic. From this I conclude those held up projects were likely knocked out last quarter leading to a further decline in DIY and also a significant decline in professional contracting. The focus of consumers during the full reopening was probably on spending on travel, dining, and group activities that were otherwise closed during the pandemic.

Inflation is a hot topic in the retail sector due to it being extremely difficult to pass those costs on to consumers. This is especially true for items “consumers can just wait and see” for a price change as the Fed and white house state that inflation is transitory. This compound effect would lead to lower margins on popular goods. Lumber for an example, has been a hot topic with rising prices over the last months and Home depot has taken the approach of “last to increase, and first to decrease” these prices in order to be competitive and attract more business. Volatility over lumber prices in the last quarter more than likely caused them to take a significant hit in lumber profits especially in the month of august.

As seen in the above chart home improvement search inquiries have declined to 2018-2019 levels. Supporting the thesis that consumer spending in this sector has shifted from home related goods largely.

Managing Earnings Expectations and How Im Playing This:

The stock is up 6% in a bullish trend in the run up to earnings, my base case for disappointment is a reversal of the 6% and an addition 4%. 11/19 335P and some 11/19 310p lottos

Playing Lowe’s in parallel to this is dangerous because they don’t trade largely together due to Lowe’s experiencing different growth patterns in sectors in relation to the past.