What up everyone. Hopefully you enjoyed the Coming to America reference for the title. Today we are going to be covering my dear friend Robinhood. If you’ve been here the past couple of months, then you probably know that I’ve set out to make HOOD my bitch since the beginning of December when the last of their IPO shares became unlocked. If not, here is a link to my previous DD: What is good in the HOOD? (Answer: Not much) - #22

HOOD will be reporting earnings this month around 01/27. And personally, I don’t feel things are going to look great for them.

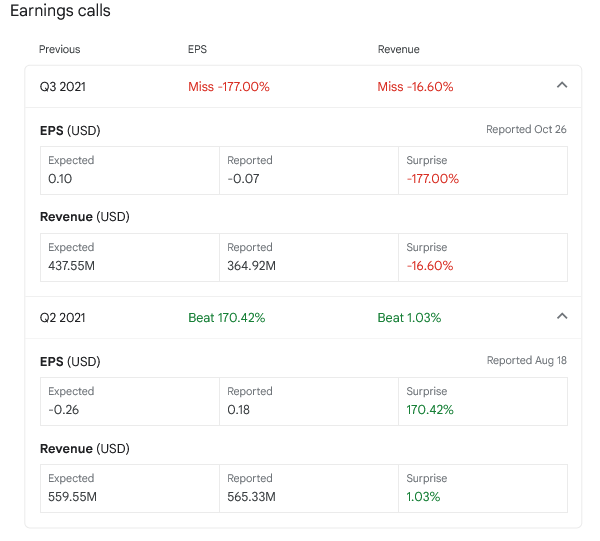

As we can see from HOOD’s last earnings, one report was good followed by a report that was not so good.

HOOD themselves have even stated in their last earnings report to not expect great things for their next report. Maybe it was a way for them to attempt some damage control?

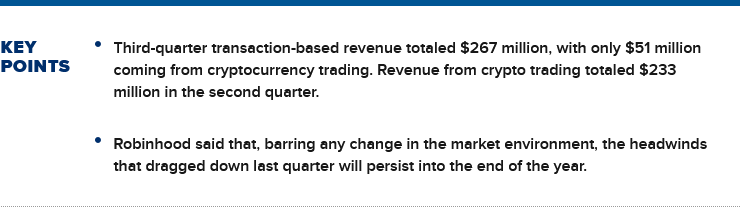

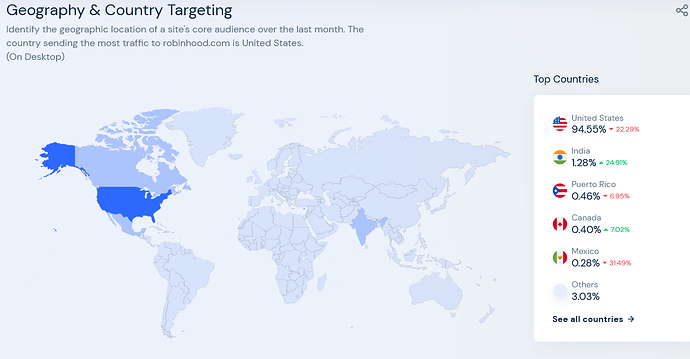

So let’s take a look at website traffic for Robinhood to see how well their predictions are coming into fruition. It appears that site visits for Robinhood have fallen drastically over the last few months. Like over 20% drastic.

Robinhood appears to still primarily have the bulk of their user base in the U.S. versus other countries.

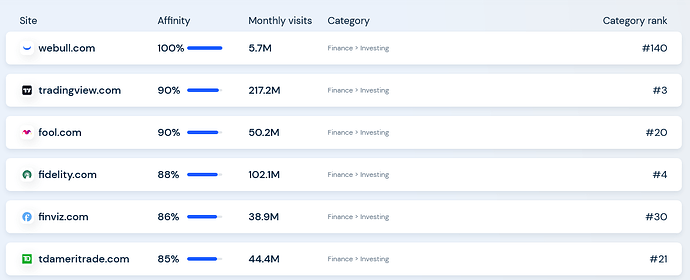

Here is a comparison of site traffic to some of their brokerage competition.

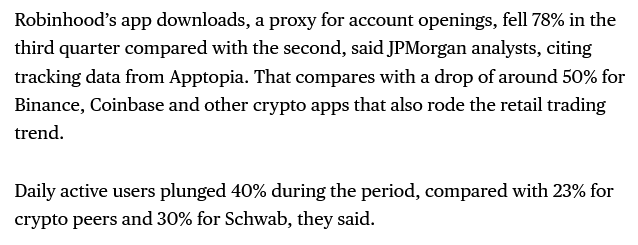

So it seems that popularity for Robinhood has waned a little over the course of 2021. In fact, they reported last September that active users and app downloads had fallen drastically.

So now that we know HOOD has a pretty strong bear case against it already, maybe some of their future guidance can help turn them around. Let’s take a look at that shall we.

Being an old user of Robinhood, although my account is deactivated I still receive regular email updates from the company. The most recent one I received was about updates to their options platform over the course of 2021. Let me tell you, these updates seem like an absolute joke.

So 24/7 phone support was a big upgrade to your options trading? Slow down there big guy. Don’t know if we can handle that much excitement.

Another key element that HOOD themselves appear to be bullish on for 2022 are crypto wallets. From the company’s last report, they had 1.6 million crypto users on a waiting list for their crypto wallet. My question though is how many of those 1.6 million users are awaiting wallets so they can finally transfer their crypto to another exchange? My guess: a fucking fair amount of them probably. Robinhood still to this day only offers a choice of 7 cryptos whereas another competitor Public offers 23 different cryptos, is a free brokerage, and doesn’t not take part in PFOF (payment for order flow).

Let’s not forget that PFOF and crypto trading were two of Robinhood’s biggest streams of revenue. With current talk of regulation to PFOF and Robinhood saying themselves they want to venture way from PFOF, their revenue stream has now become quesionable. Add the fact that so many other broker’s are now topping them in crypto selections, it’s not sounding to hot for HOOD’s future growth.

But one of the biggest updates HOOD has planned has me laughing the most. In a plan to give themselves more legitimacy, they recently announced they will be providing access to users of what essentially sounds like an ETF made up other ETFs. According to a recent Barron’s article, HOOD has made some new hires to the company, like a new Chief Brokerage Officer, to help push them in a new direction.

To me personally, there isn’t much that sounds that positive for HOOD and their upcoming earnings. Another factor is that the current market seems to be transitioning away from tech stocks a little more so that in itself could be a negative catalyst.

Like other earnings plays, I’m expecting to see some upwards movements on HOOD over the next two weeks going into their report. But given the circumstances, I’m expecting this thing to drop right back down afterwards. It has already lost 50% of it’s value from $30 down to $15 in just the month of December. Honestly I don’t really know how much lower it could go. Last time I thought I knew it’s bottom, it continued to set new all time lows. Surprisingly, the general consensus for analysts PT for HOOD is around $40.

This may be a decent play on some calls going into earnings, and then transition into puts afterwards. I have been steadily playing HOOD for the past month, and will probably continue to do so until after this earnings report.

This is not financial advice. Please do your own research.