**Ticker: $HOOD

Fundamental Share Mechanics/corporate action(s)

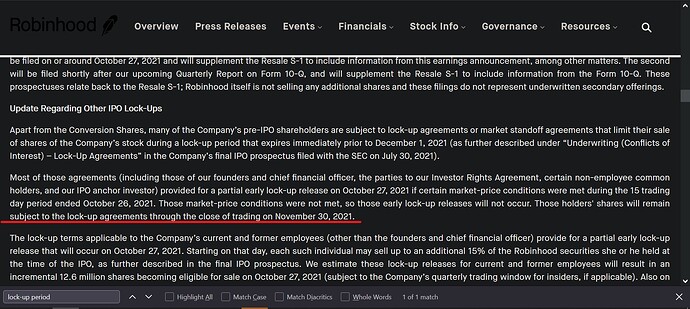

I found the ending of a Hood lockup period for shares that caused certain investors to be restricted from selling, and that date is NOV 30 after which they will be able to sell out. Will update post with image shortly.

Technicals:

The TA for HOOD puts it at a very critical support level under which there is a cliff of freefall & open air. I was initially using Heiken Ashi candles mostly, but when I flipped it back I realized there is little support current levels if it breaks down. *im currently learning the forum so I’m going to update with some charts when I figure out images just getting my initial thoughts down).

————————————————-

Additional Variables/Catalysts

The recent breach/cyber incident where many users’ private information and sensitive personal identifying information such as SSN’s, brokerage passwords, etc. were exfiltrated and for sale on the dark web - this incident is additional negative catalyst on top of the pile.

HOOD has been bleeding revenue from exodus of customers, lack of a crypto wallet still, and the negative sentiment from ‘January taking of the Buy Button’ + pending lawsuits, comprise a pile of negative catalysts that should put serious headwind.

If PFOF (payment for order flow) ends up being banned in whole or in part, then this will fundamentally put a brick wall in front of the business model for both RH & WeBull.

The Play: Puts/Short

Expiry: For puts, expiry’s After Nov 30 lockup period ending, currently assessing different options, but looking at Dec & Jan.

This is my first forum post so I’m learning the format and this first one is from mobile. Because of the shakiness in the market overnight and pre-market I’ve switched to my alter ego and gone full ManBearPig - half man, and full bear - I’ve been scanning for bear plays and HOOD along with ATVI are 2 I’m looking at. My contributions will get better as I learn the forums, thank you for having me in the community, and I look forward to becoming more active! I appreciate any input and countering thesis on the bull side.

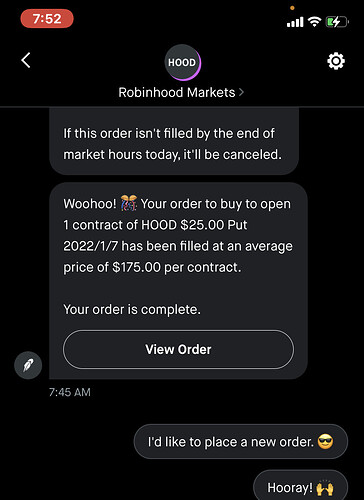

Update: I went with Hood puts at the $25c strike for JAN 21 2021. They are up pretty nice, I’m giving myself time until after NOV 30 lockup end date and looking to sell off of those shares being able to push into the market, but so far it did what I had hoped - it rode up over the 50MA then had a hard rejection and then started breaking down. If it does break support here I’m looking to add. I’m adjusting stops as I go, but so far I’m liking the play.

Update2: riden2lo linked his DD in a response to this one in the comments, and rexxar brought to my attention that ridn2lo was written before mine by about 5 days. Not intentional as I hadn’t seen other DD written in the past week. Can close or delete this one I’m not sure what the protocol is for that, as there isn’t a type of merge for posts-functionality.