What up everyone. Today we are going to be covering my dear friend Robinhood (HOOD). This piece of shit since their last earnings report has just been steadily on a slow ride downhill while being on fire for the entire trip.

HOOD will be reporting earnings this Thursday 04/28/2022 in AH . And once again, I don’t feel things are going to look great for them. Here are some of the catalysts I’ve been looking at that lead me more to the negative side.

Crypto Wallets: About 2 weeks ago, crypto wallets went live for 2 million users on a wait list that still use the Robinhood platform. Whereas HOOD believes the wallets will draw more intrest in their crypto platform. But there are two factors that lead me to believe this will hurt them more than help. For one, their wallets are only capable of holding crypto that is traded on their platform. And number two being that crypto trading on Robinhood used to be stuck in their brokerage, but now there are 2 million users that now have the ability for a mass exodus. It will be interesting to hear how their user count numbers differ from their last earnings report in which they informed everyone that they had lost 1 million users since their earnings prior to that one.

Shiba Inu: “Oh my God. Just wait until Robinhood list Shiba Inu. That shit is going to moon!”

How many times did this statement get thrown around for months? Too damn many. Well two weeks ago Robinhood listed Shiba Inu. Guess what? It totally didn’t moon. Yes it had a nice 20% run upon news of the listing, but very quickly lost all of that momentum only to fall back to it’s starting price before the boost. Very tough read on this to me. I don’t know whether to interpret this as the desire for the meme coin has fallen off, or has the amount of crypto trading on Robinhood just fallen off? My money is on the latter. Let’s not forget also that they still offer the least amount of crypto options as compared to many of their competitors.

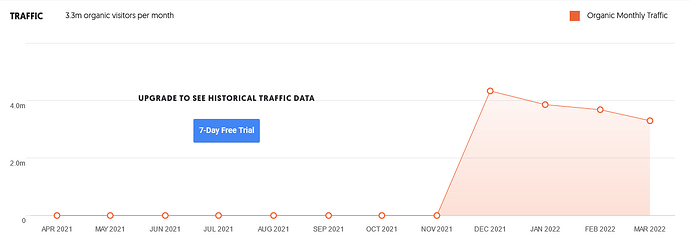

Website traffic: Visits to Robinhood.com have fallen drastically for months now. From Dec 2021 to March 2022 there was a total drop in visits to the site of 1 million users. That’s huge for a 4 month span. Just from Feb to March was a total loss of 400k visits to the site. It is not looking good for them indeed.

New All Time Lows: HOOD is now in similar territory to where it was at in their last earnings. Upon the announcement of their abysmal performance, HOOD dropped to it’s prior all time low of $9.93. It has bounced off of that low once since their last earnings and proceed to break it on 04/26/2022 with a new all time low of $9.85. It then proceeded to hit another new low of $9.21 in AH upon news of the company letting go of close to 10% of it’s staff.

And with this news, I will be doing as usual and playing against HOOD for earnings. New features that were announced since their last report such as extended hours trading being lengthened and ETF investing aren’t going to boost growth for this dumpster fire. It is a slow, slow sinking ship. I personally will be looking for HOOD to hit the $7 range after this earnings report on Thursday. I will probably gamble with a few puts for earnings, but honestly may just go short on some shares to play around during the algo drops in AH. Their last earnings drop was quickly recovered in AH and Theta gang fucked a lot of people on options.

This is not financial advice and please do your own research.