Founded in 2002, Wayfair is an e-commerce platform that offers some 22 million products under a wide range of brands, including Wayfair, Joss & Main, AllModern, Birch Lane, and Perigold for the home sector. The company’s products include furniture, kitchen appliances, home decors, and other home improvement products.

Prior to the fall of the market in 03/2020 due to COVID, Wayfair had seen a high of $173.72 just one year prior in 03/2019. It then hit a low of $21.70 in 03/2020. Since that time, Wayfair has seen an explosion of growth in their stock price reaching as high as $369 in 01/2021.

Wayfair has been the top-performing stock in the Russell 1000 over the past year. They have benefited greatly from being an e-commerce platform and specializing in home decor. That’s the perfect business model for when people are stuck at home during a pandemic.

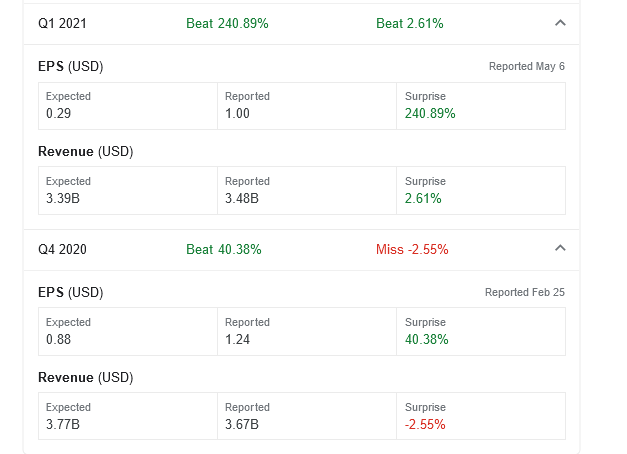

So far, Wayfair has missed on their projected revenue for both Q2 and Q3 2021 reports, but has beat on their EPS for the last 4 quarters. During the third quarter, ended September 30, 2021, W’s net revenue decreased 18.7% year-over-year to $3.12 billion. The company’s gross profit declined 23.1% from its year-ago value to $882.73 million. Its loss from operations came in at $69.8 million, compared to $221.85 million in income from operations in the prior-year quarter. Also, the company’s net loss amounted to $78.02 million, compared to $173.17 million in net income in the third quarter of 2020.

Analysts expect Wayfair’s revenue to decrease 2.5% year-over-year to $13.79 billion in its fiscal year 2021. Its EPS is expected to decrease 150.8% in the current quarter and 131% next quarter. It’s stock has declined 23.2% in price over the past six months and 27.3% over the past nine months.

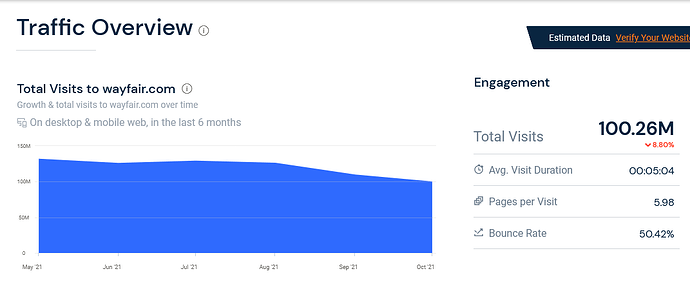

Website traffic has also been steadily declining over time.

A fair amount of analysts have changed their rating of Wayfair from “buy” to “hold”. This may be one to keep on your radar as it may have some room to continue downward since it’s share price is still relatively high compared to pre-pandemic levels. I believe their next earnings report for Q4 2021 won’t be reported until 02/2022 so there is still some time to get in on some potential put plays before we see a potentially nice drop.

I currently do not hold any positions and this is not financial advice.