Yup! You want the deltas to be the exact same. That being said if OI and volume is shitty on an equivalent delta, it’s okay to take one that is slightly off.

After your two entries what did you end up with for an average price?

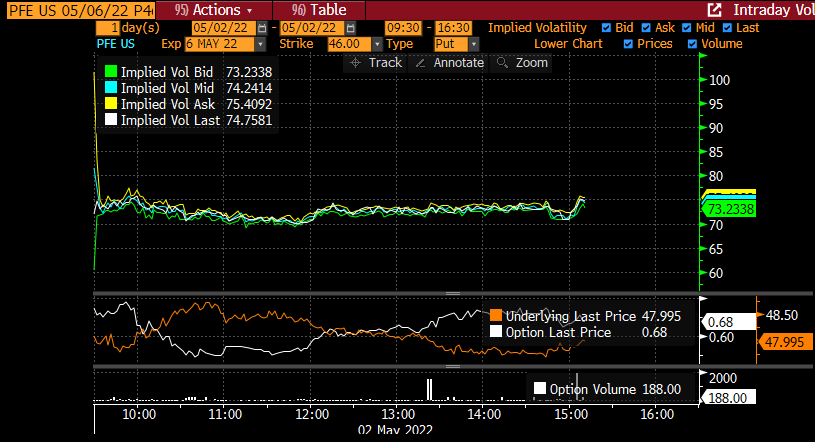

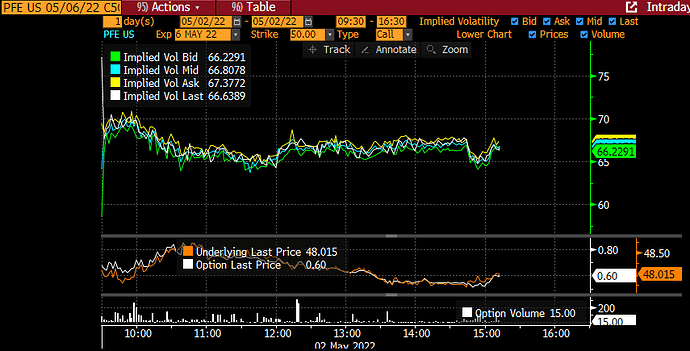

Just what I’m seeing for PFE today, hit the daily low on IV around 10:45, it jumped back up and it now trailing back down. Interested to see how it reacts after lunch.

IV looks to have bottomed out on PFE. Buying more contracts here. Could be a slower burner and not see the IV increase till EOD. This happened with MFST last week.

I didn’t play this today, but tomorrow looks promising with Lyft, SBUX, ABNB, and AMD after the bell.

Agreed. PFE is definitely a slow burner. MOS as well.

I expect IV to go up in throughout the day.

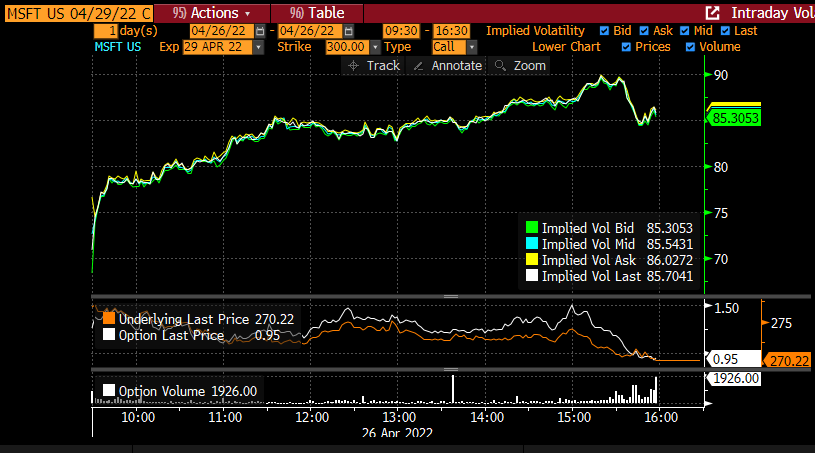

IV was low on MSFT last week and I was down 20%, ended up closing the trade up 35%.

Hoping it works out! Agreed on there being better plays with higher IV and interest later this week.

I want to point out that the initial spike you see on IV most likely isn’t real and is just a result of wide spreads on the ask side coming in. Your chart is likely showing IV mid and it’s also an aggregate of short and long dated options.

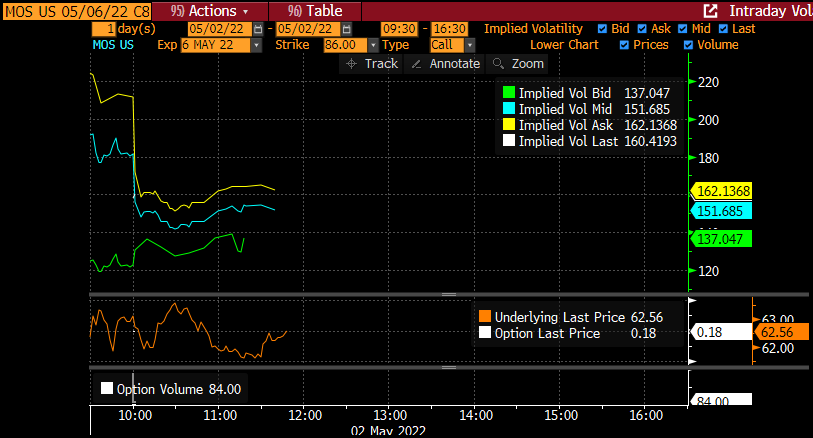

If you take a look at this MOS chart (for a front week near the money call) you can see the bid stays relatively flat, but the ask tightens up a lot which also makes the mid IV go down.

I would stay away from MOS btw, you don’t want to be rushing to dump something in the last 5 - 10 minutes of trading when it trades this wide.

This is a front week PFE near the money call. As you can see this trades liquid so there is no spike. The spike shown on the chart you posted is likely from illiquid long dated options’ spreads tightening. This looks to be sinking still. Like you said, this might be an opportunity to try an EOD play. Not convinced PFE is the right ticker for a volatility play though. At least the spreads are tight on this one.

Personally I like this play for tech stocks a lot more than stuff like PFE. MRNA’s a nice one though.

Also, MSFT was the opposite situation, I looked back at the charts for earnings day. It appears the vol climbed steadily throughout the day before dumping a bit in the last half hour. This chart is for an OTM call, an OTM put looks similar.

Good input, I appreciate it! And yeah MOS i’m unsure about. I took a very small position because the spreads were so wide. These plays are absolutely the best on tech stocks with tight spreads and lots of OI.

Let’s see how the EOD plays out but I definitely agree they’re better plays later this week.

IV is starting to tick up on PFE, we shall see if this continues. MOS spreads are still shit so but it’s a tiny position so i’m holding till EOD.

Take a note on what the bid-ask is and where you get filled on wide spread stuff like MOS, so we can get an idea of how much you’re getting burned by the spread. Helps to determine if the trade is worthwhile!

IV on PFE been trending up since ~1:10PM, we’re in the last 90min now.

I opened my PFE positions at around 10am and just closed them for about a 25% overall loss at 3:50pm. From what I can see IV never got back to what it was at open.

PFE did not go as expected. Swole was correct in that IV stayed low and never came back. All of the plays last week were tech stocks besides UPS. They all had generally high volatility intraday.

Tomorrow i’ll be playing AMD.

Yup MOS and PFE were both losses. I will give AMD a shot tomorrow

How bad of a bite was the spread on MOS?

PFE was pretty tight but you basically had to hit the bid/ask in both directions to get filled, which isn’t great.

Not great.

MOS puts sold for even at .31

MOS calls sold for loss .24 > .16

It was a last minute decision this morning and I ignored my rule of only playing tight spreads.

OI was pretty bad too.

AMD looks amazing tomorrow though.

What strikes are you looking into for AMD?

Based on the criteria, my guess is either the 80p/100-102c, or the 70p/110c.

The 80p/100c pair might be too affected by price movement for this strat, so I’ll wait for Ryndir to chime in.

ETA: 75p/106c might be an option too.

I’ll most likely be taking 75P and 108C tomorrow for AMD.

I’ll also do a much smaller position of 65P and 120C.

I’m bummed out that PFE didn’t play out, but looking back it was a completely different setup than all the tech stocks I played last week, where these far OTM strikes did extremely well.

PFE had no IV increase, and historically has not been volatile so lesson learned there.

I think sticking with the tech stocks that have high OI and high volatility will always be the move for these plays.