Hello all! This is my first forum post, i’m going to try to be as detailed as possible. Last week I made a signifcant chunk of money playing strangles pre earnings and selling before close. It worked on 5/5 plays last week, and now that i’m confident in it, I am wanting to share! IV always increases before earnings, so why not make money on that spike.

Things you will need to do this effectively:

Think Or Swim Mobile App, it has BY FAR the most accurate implied volatility indicator. It makes tradingviews look bad.

Access to option chains and being able to understand delta.

Picking FAR otm strikes with equal delta, HIGH volume and OI. These will not be affected by movements in the underlying.

I only play weeklies, even with 1DTE, IV will overpower theta. If any plays have only monthlies do not bother,

Easy peesy.

Pros: This trade has no directional bias, great for if you work an actual job and can’t constantly pay attention.

Cons: IV does not increase, you lose a small amount of the trade from theta. (I have yet to see IV not increase the day before earnings.)

Rule: Always close EOD.

My last earnings plays were:

SNAP- 70% Gain

MFST - 44% Gain

HOOD- 120% Gain

FB - 110% Gain

SPOT - 20% Gain

How I picked which tickers i’m going to play is based on the previous days OI and volume on whichever strikes I am interested in taking. Don’t play anything with low volume and low OI.

For example: Last week HOOD had a STACKED options chain. I bought 8.5P 5 mins after open for .16 a contract, and 12C for .12 a contract. I sold at the end of the day and the puts were STILL worth .16, and the calls were now worth .27.

How is this possible? IV and IV alone on OTM cheap strikes.

The beauty of this play is that because you are taking a strangle with calls and puts, the direction of the underlying dos not matter, if IV increases you will make money.

Before I dive into anything further, I want to show you exactly how I played HOOD.

First off, we NEED the think or swim mobile app, just make an account you dont need to deposit money.

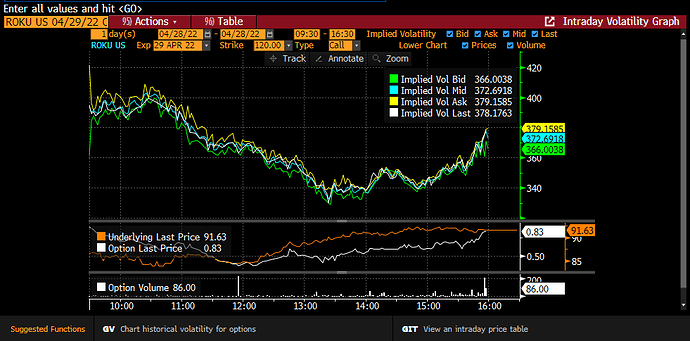

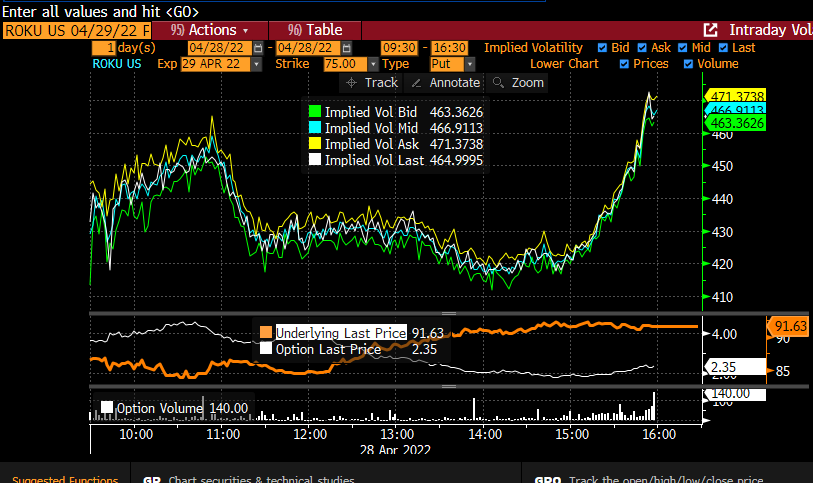

As you can see, IV spiked hard at open (this happens almost always.) You don’t want to buy here because youll overpay for premiums. Watch the IV indicator and look for a plateau, then get those contracts.

As you can see here, IV increased for the entire rest of the day. Even though the stock went up, those puts DID NOT change price at all.

Okay, so how do we pick strikes? Well, we need to stay delta neutral. We don’t care about what the underlying does, we just need strikes that are very similar in delta.

When I took my HOOD strikes, I went with 8.5p which had a delta of around -0.15, and 12C had a delta of about 0.16 If i recall. Also to note, these strikes had the highest OI and volume from the previous day.

Now that we are delta neutral, at the very least we will break even, although I have yet to see that happen. IV went up so much that it greatly overpowered theta, it didn’t even have an affect on the contracts.

Here is another example with MFST:

IV spike at open, so wait 5 minutes to buy in. Then pick your delta neutral contacts.

Last example, sorry no pictures lol. But for playing FB I took 100P (highest volume and OI with a delta of -0.002 and 250C with delta of 0.0022.

OTM strikes generally seem scary, and it makes sense. But the reality is with these IV plays, the OTM strikes do not move much from change of the underlying, BUT they heavily benefit from IV increase. Sell that shit before close and make your money.

One more thing, I typically sell half my position during the mid morning IV peak. It falls off for awhile and then in the last 90 minutes it greatly picks up again. This week I might look to add more in the last 90 minutes.

Here are my plays for next week list in order of favorite.

Monday-

1.Pfizer

2. Avis Budget Group

Tuesday-

- AMD (biggest play of the week imo)

- Lyft

- Sbux

- Airbnb

- Moderna

Wedesnday

- Shopify (maybe actually the biggest play)

- Wayfair

Thursday

- LUCID

- FUBO

- DKNG

Once again, the day before earnings I will carefully review the option chain and decide whether or not im playing these. I’ll also be posting the strikes i am taking before earnings in this thread.

Hope this helps anyone and please ask questions or clarifications on anything ![]()