Sold mine for -6% or so at 1:30. Been watching ever since and so far that was the best move. Hope others are fairing better.

Big fail sauce for me.

I have a tiny position and I can tell you I’m down -$8…

im gonna wait till last minute to sell, the prices are slowly creeping up

Yeah… I’m now at -$1

I’m out for -$12 nothing burger loss. Well… that was fun…

Fail for me

Sold for pretty much break even. It could be that last week the market has such downward pressure overall that volatility in the market was high.

Looks like i’ll have to do a lot more research on this. IV pretty much did nothing on the last two plays, and I expected it to go up on AMD.

Got excited when every play hit last week, looks like this week might be a nothing burger on these. Sorry guys ![]()

Don’t apologize for trying to help people make money bro. You tried out a strategy, got good results, and wanted to share those results with others.

Even though these two didn’t do what we expected, thank you.

Yeah man. Worth a shot. Tested it with a small position

if someone held through earnings right now, would it even be up by tomorrow or be crushed by IV?

IV crush BIG time for the strikes people here were holding.

thats what I thought would happen. Hoping for a much better play on Shopify this thursday.

Yeah, i’m going to do a bunch more research on how IV affects these plays. They worked last week, and I know they can work again. I’m going to do another small position on SHOP as their earnings have been historically volatile. It is also the same day as FOMC.

At least with these strangles, if you took correct deltas and entered both calls and puts at the same time, the losses should be minimal from theta.

ABNB, AMD, and LYFT all had no IV increase.

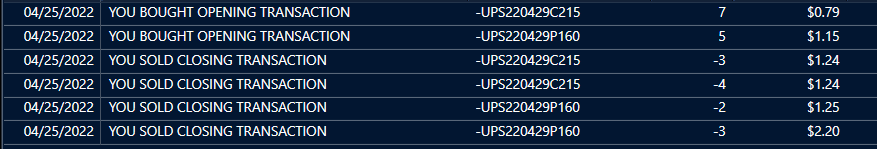

Looking back at last week. SNAP had highly volatile earnings last time, FB did as well, so did HOOD, UPS was just weird because IV launched in the morning and then slowly came back down.

Like I said im going to do a fuck ton of research this weekend and write a report on it.

As of now ill be taking 350P and 600C tomorrow on SHOP. Small position probably $500 on each side. Also, here is an example of UPS last week where the IV play worked perfectly. It was similar for FB, SNAP, HOOD, and MFST.

This week is a great week to take notes.

Maybe you can add this to your research: Ask other Valhalla traders of their prior experiences with spreads and ER plays.

I think going to far OTM can hurt your IV on smaller volatility swings. I didn’t look much at the PFE play. But do know that the ticker doesn’t move a ton. So far OTM strikes are more than likely not going to be anywhere close to paying.

I tried something a little different with Z today I took a 45c fd and a 35p May 13th. I feel like On the put side with ER being end of week the IV crush can offset the premium gains unless the underlying trends downward So far the call is up 94 dollars or 63% the put is down 24 dollars or 24%. I’ll still take a net 40% win any day. More than likely will exit the call tomorrow before FOMC gets the market wild and take my gains. Even if I chose to hold the put through ER and it goes to 0 I’d still be profitable on this by 20 dollars which I’d doubt I do. I’ll look for some sort of down turn to hopefully exit both sides in the green.

im actually dumb. SHOP isnt tmrw lmao

I wonder if it’s possible to isolate when these strangles are more likely to work. Some combos might involve:

- IV rank and/or percentile - maybe those with room to run are more likely to bloat up on premium

- Stock beta - the more volatile the better

- VIX levels - the market undercurrent, but like IV rank/percentile, may want to see some room to run still

So it’s possible that we see something like this - strangles work when:

(IV rank/percentile < 75%) AND (Beta > 1.25) AND (VIX < 30 AND Rising)

The 75%, 1.25 and 30 values are totally made up. Rigorous coding can probably tell us what the right values are, assuming this hypothesis has any merit. If you have the tools to do that, great! If not, we might still be able to see if this intuition is directionally correct by taking the handful of stocks that you did play, and track these metrics if possible. If getting historical data is hard though, we could also track a handful of stocks over the next two weeks and see how things go.

I like you’re thinking man! Definitely going to be looking into this more over the weekend.