What’s up everyone. Been quite busy for the past few months with work, but things are slowing down and I can finally get back to doing more trading/DD contributions. Today I want to talk about the current used car market, my predictions, how I plan on playing the market in the future, and just have a general discussion thread for anyone else that may be keeping their eyes on the industry.

So for months I’ve been awaiting for the bubble to burst on the used car market. Used car valuations accounted for a nice percentage of our outrageous CPI numbers in the past months. Valuations on used vehicles skyrocketed over the course of the pandemic due to limited supply of new vehicles being produced due to lock downs. This is something that auto makers are still suffering from to this very day due to multi-month wait times on new vehicle orders. And when those new cars actually can be produced, people are seeing outrageous price markups from dealers as adjustments to the valuations of the current market. And with this, the market has set it self up for a major downfall I believe.

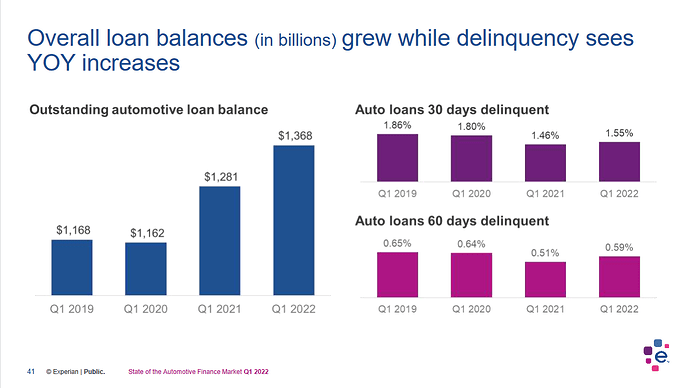

You know how student loans have been pushed back for now years due to this $1.7 trillion dollar problem lingering over people’s head because of fears of defaults? Well guess what: the current auto loan amount nationwide totals up to about $1.4 trillion. What’s really scary is that number apparently accounts for only 1/10th of the mortgage loan market.

I’ve felt that people buying used/new cars over the last few years have unfortunately put themselves in a situation of seeing a huge depreciation in the value of said vehicle in the next few months, and in turn being very upside down on their purchase.

Experian released their " State of the Automotive Finance Market - Q1 2022" around the beginning of June 2022, and it seems it has confirmed a lot of my fears.

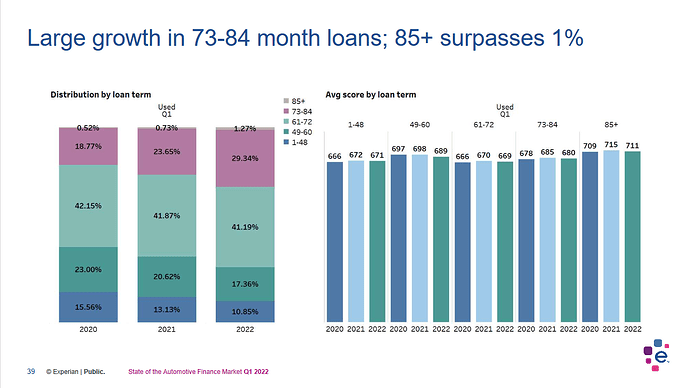

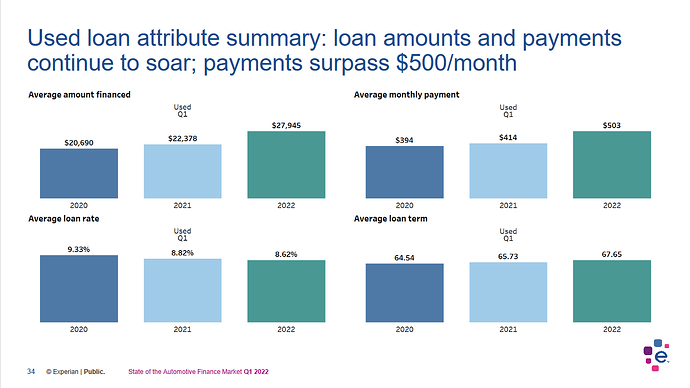

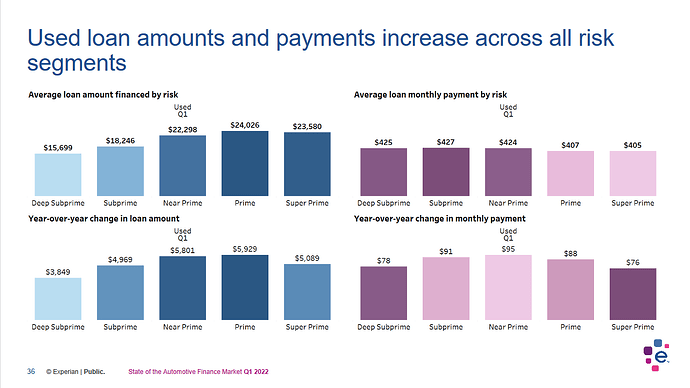

It seems that people not only have been borrowing larger amounts of a vehicle purchase, but it also appears that they have been taking out loans with insanely long payment periods. The interest collected on these amounts over that time period would be insane.

Because of these larger loans amounts being borrowed, the average payment has now reached over $500 for the national average. And that’s over a crazy long payment period also.

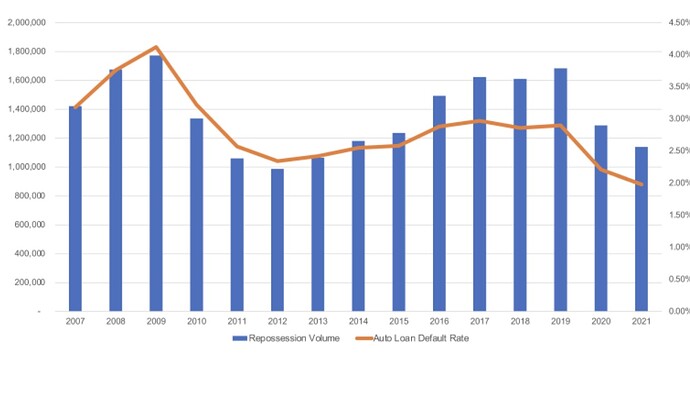

And because of this drastic increase in financing amounts combined with the current state of the economy, defaults are now on a steady rise.

With these kinds of numbers, I’m expecting the number of repossessions to start climbing. When that happens, auto dealers will be adding back into their inventories. But if the amount of repos start climbing, that could be a good indicator that used car purchase will also start to see a decline. Therefore, auto dealers will be sitting on that inventory, and slowly supply will start meeting (or even slightly exceeding) demand. And if this occurs, you can expect the increases in market prices to start falling. This in turn makes that dealer’s newly repo’d depreciating asset worth even less. And more than likely you’ll start seeing banks/finance companies selling these defaulted loans off like crazy because they prefer the liquidity for pennies on the dollar and don’t want to keep those types of assets on their books.

So with this information, I’m expecting in the next couple of months to see a hefty decline in earnings for CVNA, KMX, and VRM. I believe the used car market will begin slowing down drastically in the next month or two so will probably be setting myself up on a short/put position on some of these tickers. I only feel like worse news is yet to come.

I will say that I don’t believe the used car market will slow down due to deals people can get on new cars. Those markups over MSRP are still high as hell, and probably won’t see a major decline anytime soon. Not to mention all of the issues that major auto makers have been dealing with in the past year (Hyundai’s recall of 5 million cars for fire issues; Ford recalling Mach-E’s for losing power while driving, Broncos for roof and engine issues, etc; etc). So it’s not exactly like you are getting the best build quality out of new vehicles these days it seems. So put plays on Ford, GM, etc may not be out of the question in the near future also.

For the long term, I’ll probably be sticking some money into AAP (Advance Auto Parts) because I think parts stores will see a nice revenue increase from people attempting to keep their current vehicles on the road longer rather than replacing that they have done so easily in the past. The average age of used vehicles on the road increased over the pandemic from 5 years to 12 years, so there are a lot of older cars out on the roads now that will need to be maintained.

This is not financial advice and please do your own research.