Unfortunately there’s a lot of unknowns here with this merger as it hasnt gotten very far yet. This post is for me to continue gathering information on this SPAC and potentially make an investment into it at a later time.

HUGS is looking to bring Panera Breads back to the public market via a SPAC (Well not entirely as it sounds like its an investment into an IPO so slightly different from SPACs I’ve dealt with before). After reading SEC documents it doesnt look like this ticker will become Panera but instead will give you shares equal to $10/IPO price of Panera. You can find that info here. so unless the price of HUGS is under $10 it doesnt look like investing in HUGS shares is appropriate however I may be wrong and please do tell me if I am.

What does interest me here is the warrants. They are the standard 11.5 to execute and are around $1.50 right now. The problem at this moment is that we dont have the number of warrants needed to convert to 1 share.

In addition, at the Effective Time, each issued and outstanding warrant of HUGS will be assumed by Panera and will relate to Panera Common Stock (each, a “Warrant”) (with the number of shares of Panera Common Stock underlying each Warrant adjusted in accordance with the terms of the Investment Agreement).

The merger does have a deadline in its SEC filings of June 30, 2022. But as far as a date for the vote or anything thats still too far out to have dates on.

Brief History of Panera

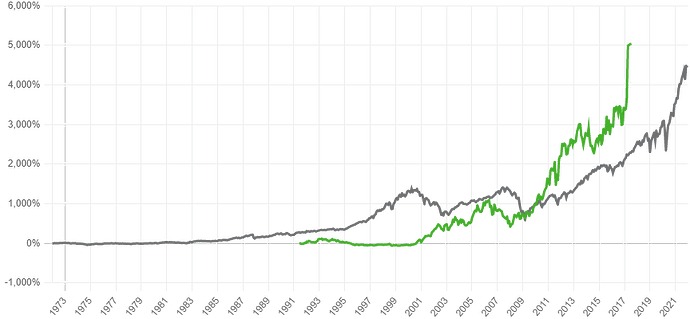

After its initial IPO the company performed well.

Food Business News quotes paneras website from 2017 stating:

According to Panera’s web site, the company was the best-performing restaurant stock when measured over the last 20 years, delivering a total shareholder return of 9,753% from April 18, 1997, to April 24, 2017, compared to 210% for the S&P 500 during the same time period

So why did they go private? CEO Ronald Shaich was quoted saying:

“The reality is if we really want to build value in companies we need to take a long-term view,” he explained. “The greatest competitive advantage of the FANG stocks — Facebook, Amazon, Netflix and Google — is they have the ability to be long term.

“The greatest competitive advantage Panera had, the reason we produced the results we did, is because we could think long term. And the reason I took our company private is I’m increasingly worried about our ability to do that in a public market.”

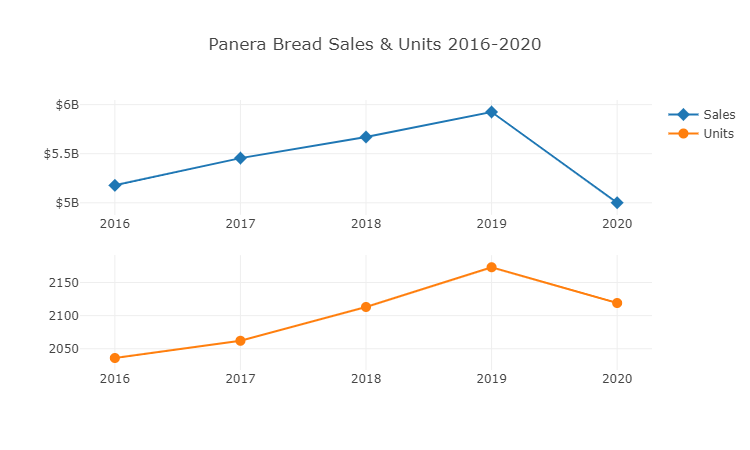

The Company Today

It looks like Panera has struggled during the pandemic as a private company. Depending on where you look YOY sales are down 10-15%. Considering Panera has had online ordering and to go pickup well before the pandemic began you would think they where already ahead of the game and that sales wouldnt decline as much as they did. So perhaps theres more to the picture than the declining happening the same time frame as the pandemic.

Things I Want to Know Before Investing

- Whats the IPO Price?

- Whats the warrant conversion?

I’ll be keeping an eye on this for future information. As it stands I’m not taking a position or really looking to get one right now until I have the IPO price and or warrant conversion. This may change if the SPAC price drops below $10 as that looks to essentially be free money at that point. If anyone has anything to add found something incorrect etc I’m all ears and would love to hear.

ANYTHING BELOW THIS LINE IS JUST TIDBITS I FIND THAT I WANT TO LOOK INTO MORE. INFO BELOW MAY BE INCORRECT, INCOMPLETE, WRONG, AND WHATEVER ELSE. ITS BEST ADVISED TO IGNORE ANYTHING HERE UNLESS YOURE GOING TO RESEARCH IT YOURSELF.

-Panera brands owns caribou coffee and einstein bagel bros. Will those brands be encomposed by the listed security?

-45% of sales are e-commerce