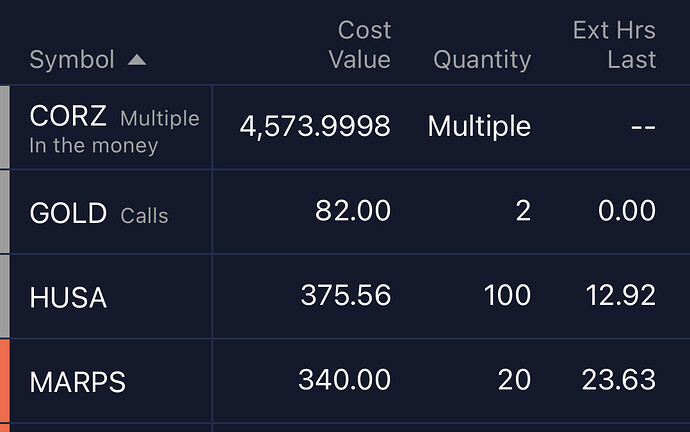

Alright, I don’t have much to say, but I entered HUSA earlier this morning with 200 shares at a cost basis of $3.56 because of its low float of approximately 9M, which is almost all of the shares outstanding thus ruling out possible near future dilution. Moreover, this is in the energy sector with oil drilling in Houston and makes sense as a play during these times. I was hoping it would hold off for today so I have time to write this after market close, but ahem…seems the stock is at $8.18 now.

I would be locking in profit

As JB said - take the profit

I set a stop limit as I have a reason to believe there is more upside. Thank you both.

Sold half of my positions for 140%, letting the rest ride risk free. Let’s see where a combination of sentiment and oil demand can take us.

Here are my top 2 American oil drilling companies (MARPS and HUSA). They are purely low float pumps that seem to be outperforming other stocks in terms of Biden’s news regarding ban on Russian oil. They can come down as fast as they come up and I was fortunate to have decent entries with some pocket money while their market cap was extremely low. .

I started to notice MARPS bounce up every time around $13 so I made a decision to take 70% gain off my last 100 shares of HUSA and bring my MARPS average to around $13.46. This is more attractive as it has a float under 2M with 2M shares outstanding.

Completely out of MARPS @13.5 was expecting a rebound, but decided to sell as soon as crude dropped to $108

Back in MARPS due to oil movement

Cut this off for $200 loss while my portfolio is big green. Was really rooting for this so I could average down on other plays with more capital. Unfortunately, the retail sentiment that drove this low floater up during the first oil surge was not there this time. That being said, I have no thesis here anymore. @tedro this is ready to be archived.