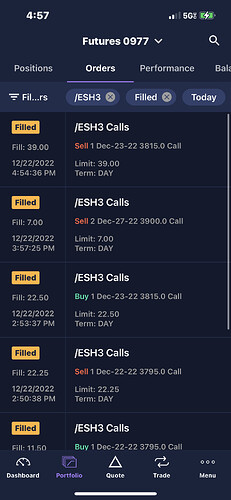

Well I shouldn’t trade and work I guess… everything’s blown up - closing it all at pennies. No christmas presents for anyone, bah humbug

After blowup #… 4?

I may just focus on my other es ninja scalping account but we’ll see if I have any extra money left after this Holiday season…

Good luck everyone - this is a reminder to never follow my trades(I don’t want to feel bad when you loose too), and to practice proper risk management unlike me.

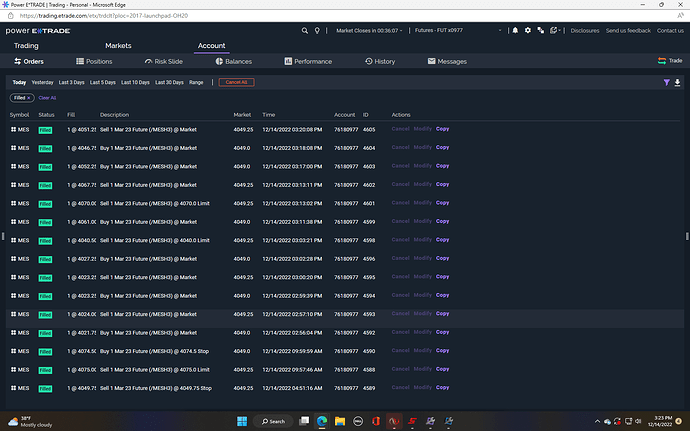

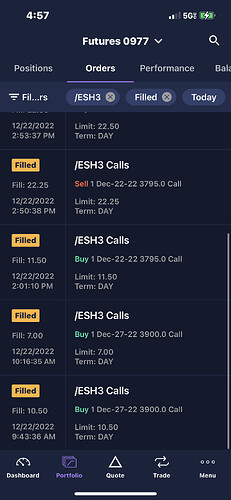

I have to refund it got bit yesterday, waiting on money to be deposited, but margin requirements too high today anyways($500/contract low volatility days vs etrade $11k or so). Practicing on SIM mode today. This is my preferred account to trade just need easier days for me to play es since I’m so poor and a quick 10 point move can wipe out $500 in a very short time.

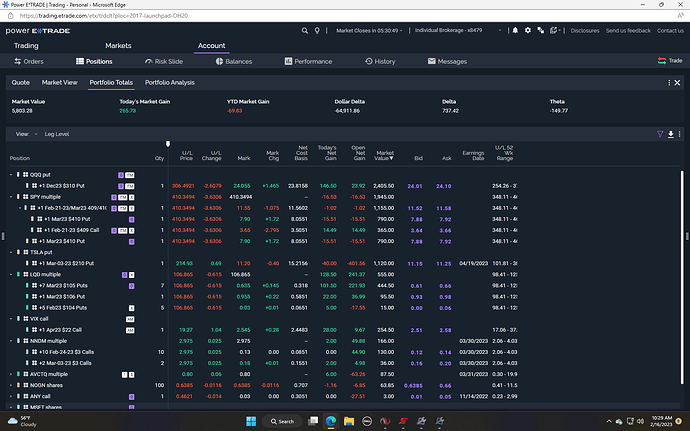

I feel like I’m posting too much but I’m using this to keep myself watching what I’m doing - I had the etrade account down to $500 and up to $18k this year and I need to drastically change my trading and avoid the massive drawdowns while maxing out leverage to grow - it’s a tricky balance I need to learn especially since I’m a horrible longer term trader and do best on intraday scalps typically.

I guess I’ll just focus on the futes scalping… scalped 1 mes contract this afternoon and made a little back. I’d probably be scared to scalp the es with these movements tbh, but I’ll get there eventually.

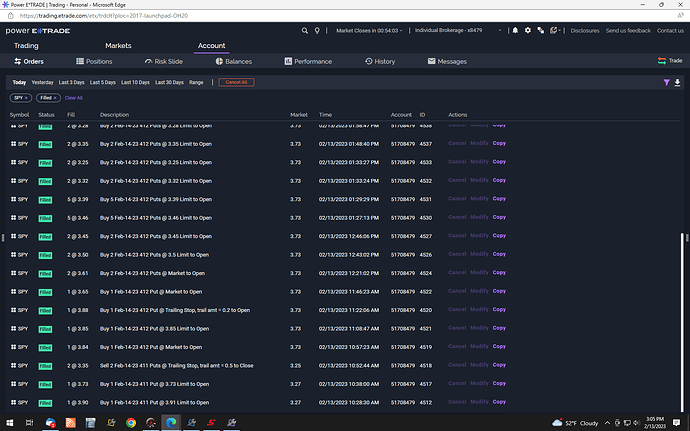

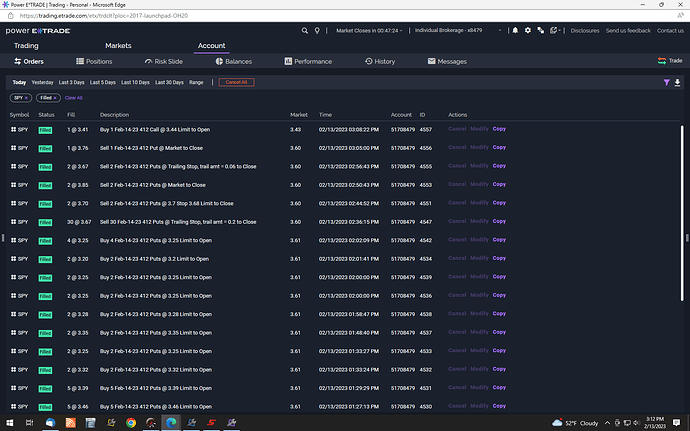

(set some overnight orders up and started the day off down a little…)

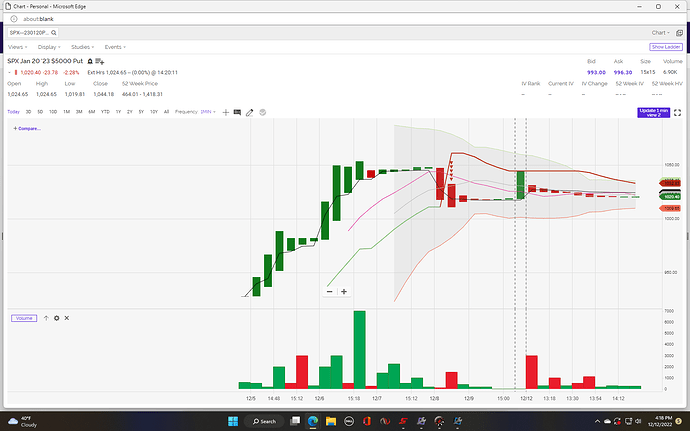

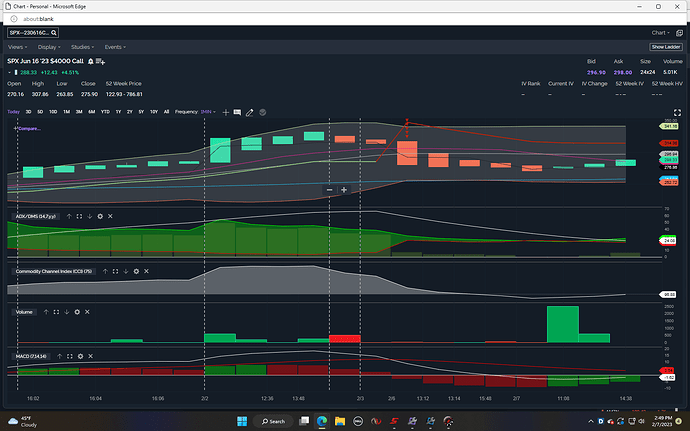

Entered way to early and got distracted but rode it up later in the day.

I really wish I could put any kind of stops on futes options but atm I’m just glad I finally rode the ma’s all the way up.

Home with flu so no es scalping today. I’ll get a home trading setup once I have some free cash again.

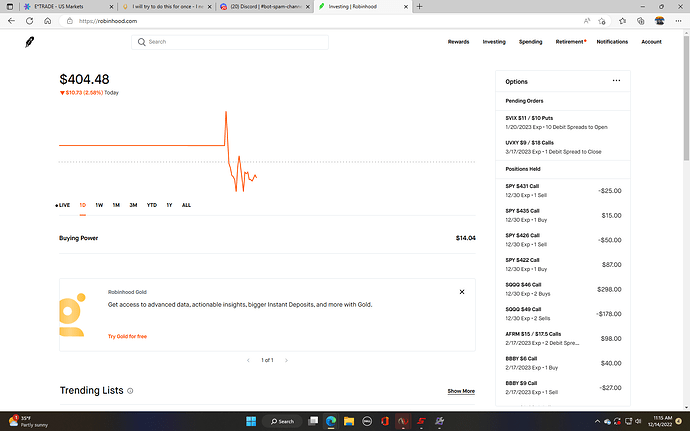

Rh account is blown… I’ll revisit that in the future, maybe I’ll get lucky and the uvxy spread will somehow pay out ![]()

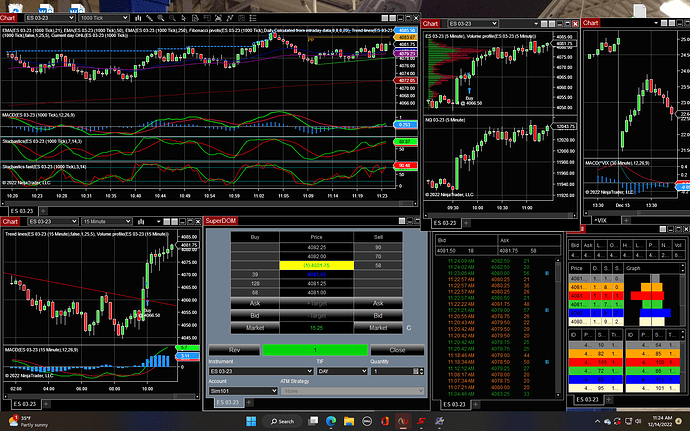

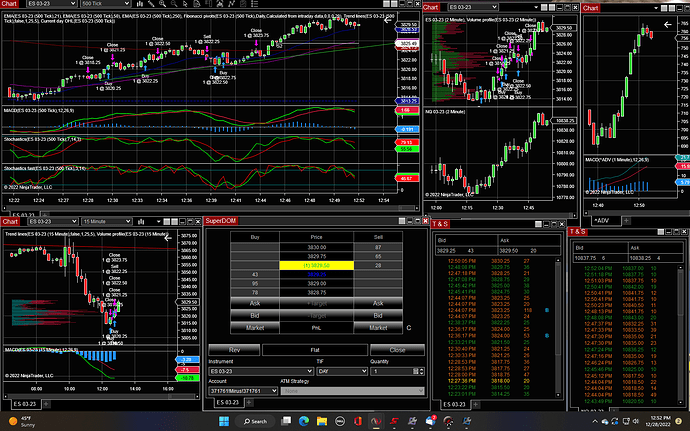

Dipped my toes into ES again. I’m not 100% so will stop playing here. Trades are easiest to see on the top left tick chart.

So I stopped posting - blew up account. Have my final reload in on the main account, but still working on my futures set up with 2k. Is much better with trailling stops so buying the platform soon ($1.1k - comes with Vol set ups I got access to for a little while as I was beta testing their new release)

I will try and post entries a little on the main account (probably less 0dte and fds as futures is dopamine inducing enough) but will not post futures trades because I do so many (es only now - mes got me killed with commisions even thought they are cheap vs etrade)

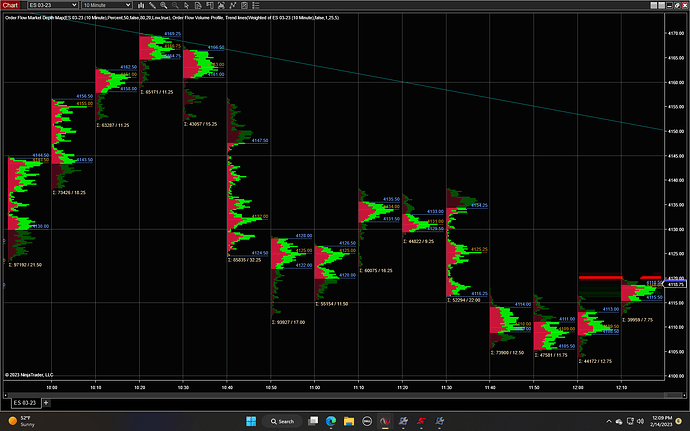

Just pics of what my futes platform has changed into (I have volume balls pop up to, but only larger orders)

Small buys into penny stocks - some high ctb some just had unusually high options activity. IONQ running a bit atm but light into all. Easing into sqqq in case of a spike after Powell tomorrow.

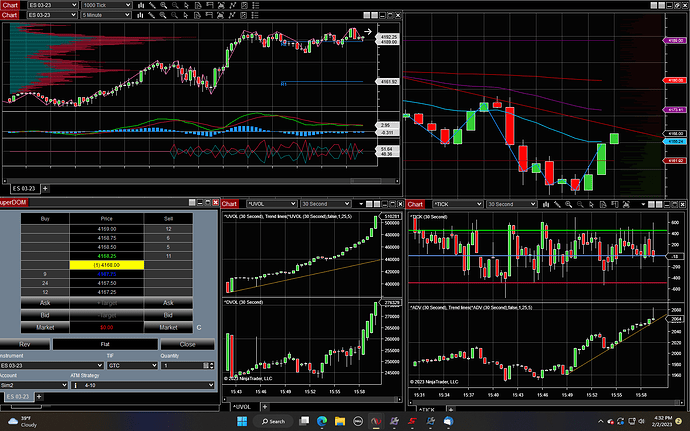

Scalping a little on ES, I have trailing stops now!! YAAAYYY, only cost $1100 to get the software lol…

Once I’m less scared and more confident on market direction I’ll start scalping options more but will probably stick with calendar spreads or weekly plus to limit my degeneracy which I can satisfy with the futures account.

Note to self - NEVER BUY ON MARKET ORDER - the a holes sold the cc on ionq below bid lol (.4/.45 spread, sold a .3247. (I bought 100 shares and sold a 7.5c with a market order - 5.47 av including cc)

Got busy with work, at least I ended green for the day.

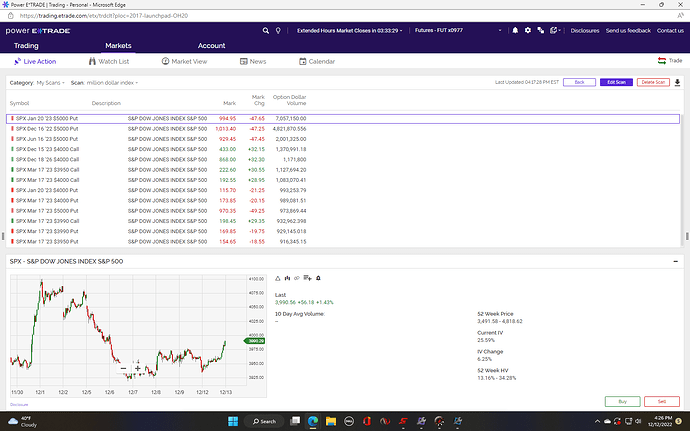

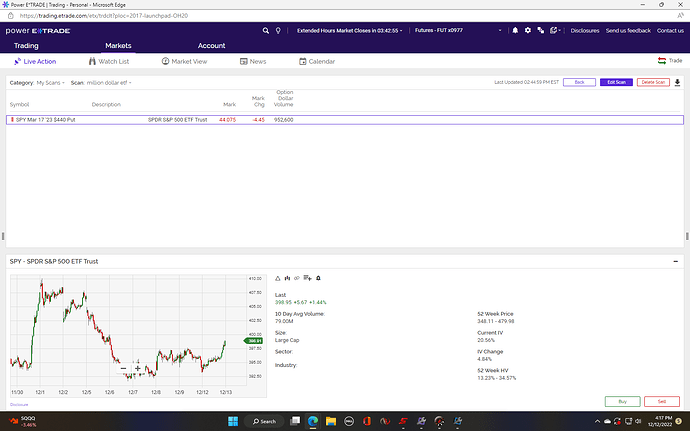

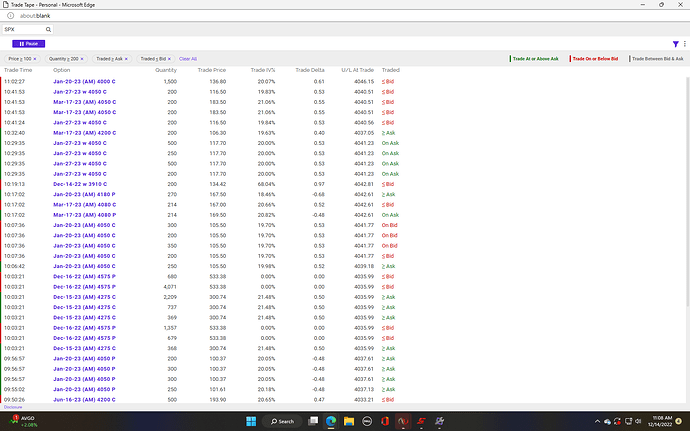

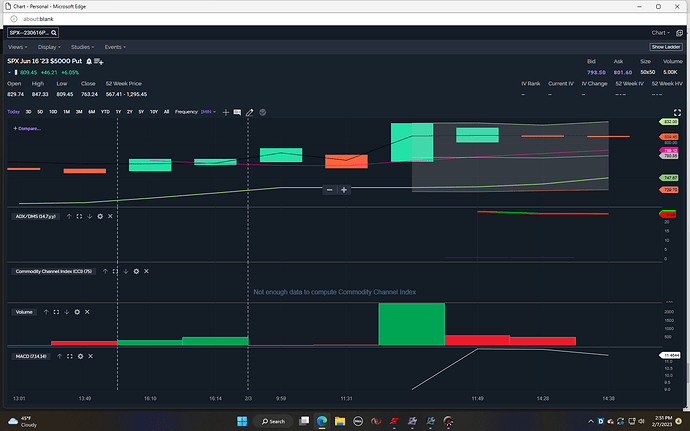

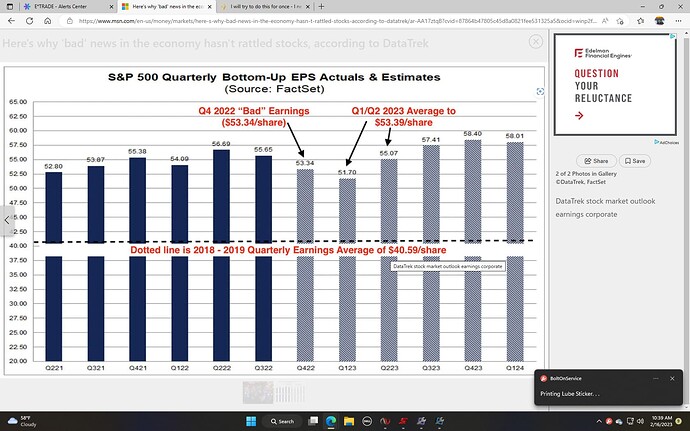

Saw this flow and thought it was interesting:

I have no idea what can be implied from this other than someone is bullish and the itm spx put buyers at 5k are still there for the next few opexs… opexi, opexes?

I just want some easy plays to lean into, days like today are too risky especially when I can get pulled away by my business(customers, problems, etc.).

I bought 1 more spy put for 3/17 a 415p, will cut tomorrow if it’s still red, hoping for an overnight de risking but who the hell knows how much cocaine these bulls took today.

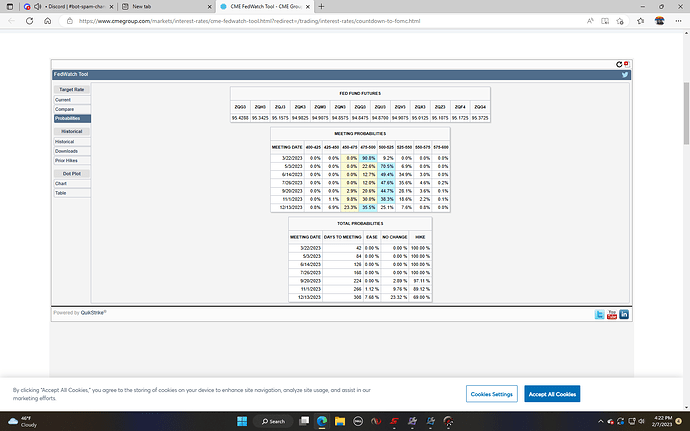

hmm… 100% probability of hikes each meeting until 9/20/23 and market on cocaine rocket. What could go wrong?

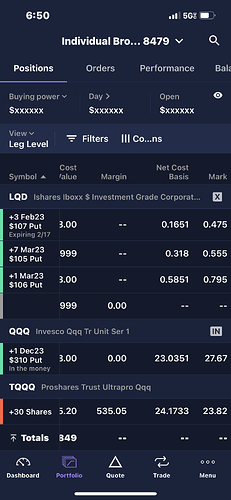

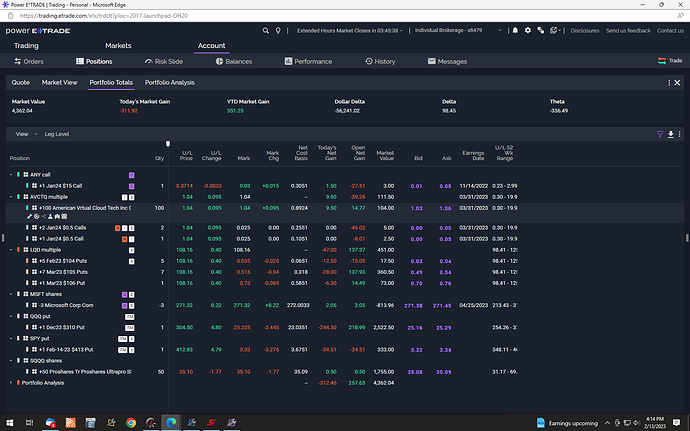

Swings atm that I haven’t paperhanded yet

I’m reworking my es strats, commission was still eating up profits - too many trades with too little profit per round trip. So I’m back to sim- expanding ranges and scales.

Took a few 0dte spx scalps today since futes under development again, and it’s surprising how more tolerant I am to swings and ready to wait for limit fills to enter.

Degenerate level averaging in but it worked. I tend to not average in on days it is running hard but today I was convinced it would pull back at some point. Also why I went spy not spx (plus busy today can’t scalp minutes/ticks)

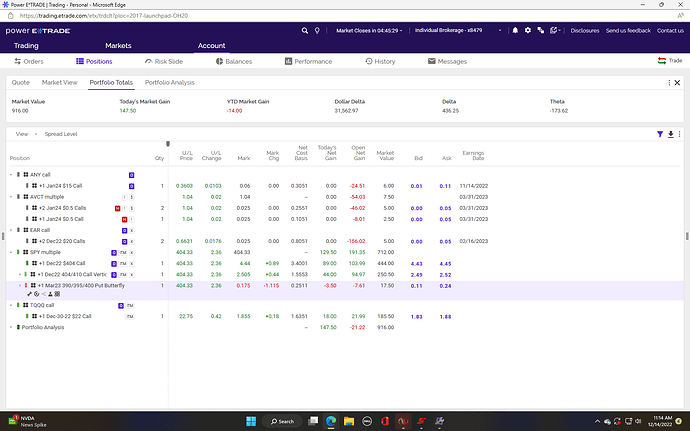

Everything I have open still - sold a few more lqd short term puts (any and avct options stuff is old)

I will probably open an es option position in the AM after CPI

Probably not doing anything heavy today - have trailing stops on everything. Monday should be a good day to start laying in a little heavy, today and tomorrow probably full of traps and premium draining.