Decided to start this on a whim, will update when I can. RSX shot me down, but it is what it is. If I manage to play well enough, perhaps I’ll knock some stuff off of my wish list like a recording room. I’m here for Conq’s wild ride, with the occasional SPY scalps from Yong, AI Bot, and Forum + VC plays. Basically going to try to use the information given to me to make decisions. I lack a lot of fundamentals, so I don’t think I will be able to explain my reasoning for my choices. I’ll probably be messing around a lot, so this serves as a good review for me sometimes on the decisions that I decide to take. Appreciate all the knowledge being available and given to be able to make these plays. Without further ado:

3/22/2022

Currently at $4,311.72

Holding these overnight:

Today’s choices:

WFC: Heard Jekyll mention this one overnight, and saw it overall had positive results, except yesterday; held overnight and my calls exploded. Sold them at around 53$, could’ve held longer but it’s better to be safe here.

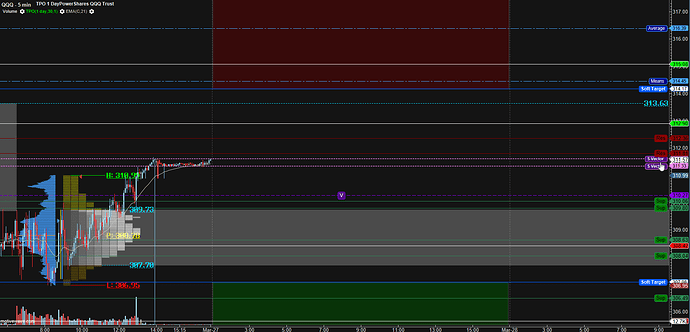

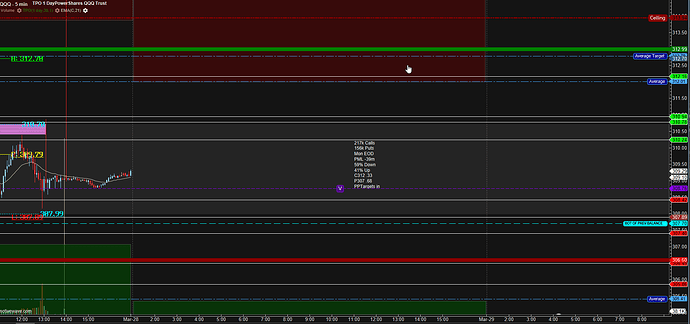

SPY: Read Yong’s sentiments on the forums regarding 440-450 support spy had, and I had confidence to make some quick scalps. Normally I don’t do scalping, but I decided to try to take JB’s advice and made some quick buy and sells throughout the day.

FB: Followed Crayon’s call and scalped for a quick bit on it.

CCJ: idk lol

MULN:

https://tradytics.com/bullseye-dashboard?alert=-z4TxY-sF9gB-QGDq6-nA41T-tCyK9

What’s wrong with this stock, fuck it I’m throwing money in. I bought it early, so I could’ve sold at a good 3.50 peak for 270, but decided to hold off and see what the morning brings. I might regret this.

That’s mostly all the notable ones for today.