ILMN had earnings after hours (8/11) and apparently they were pretty horrible and the stock knifed down. After some pullback it’s now sitting around -14%.

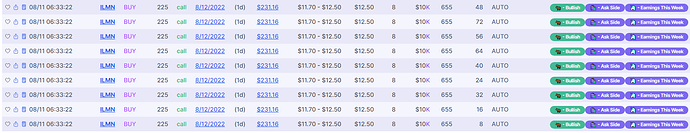

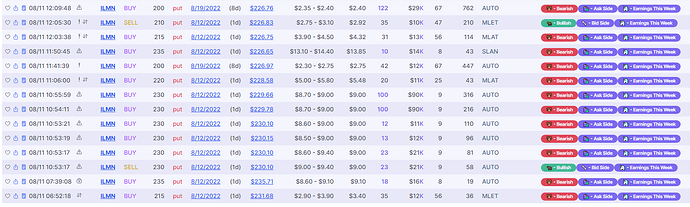

Only caveat I see is somehow it has high IV, but also not a lot of OI and thus has really wide spreads. We will just have to see how the stock is looking in pre-market tomorrow and also overall market conditions…

Some key bits that were mentioned were slashing growth estimates and EPS…

The management lowered the 2022 guidance for consolidated revenue growth and Core Illumina revenue growth to 4% - 5% and 3.5% to 4.5% from the previous estimates of 14% to 16% and 13% to 15%, respectively.

Illumina (ILMN) expects to record GAAP diluted loss per share $(2.93) to $(2.78) and non-GAAP diluted EPS of $2.75 to $2.90 for 2022 compared to previous forecast of $2.33 to $2.53 and $4.00 to $4.20, respectively. The company has lowered GRAIL revenue to $50M – $70M, down from the $70M – $90M estimated in May.

Relevant article: ILMN stock drops as company blames macro factors for Q2 miss (NASDAQ:ILMN) | Seeking Alpha