CLNE - Clean Energy Fuels

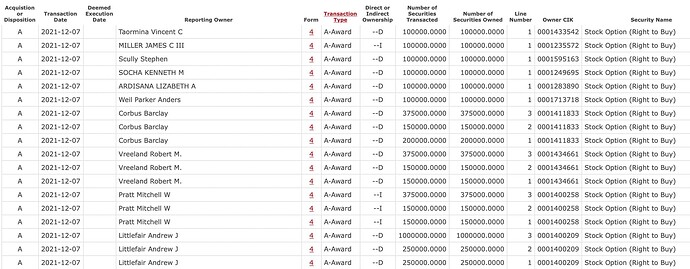

So I did some scraping on the SEC EDGAR forms and noticed this wonderful company which never before provided a FIRST EVER Price-Based Performance Grant for all of their executives.

I thought this was interesting and wanted all my fellow Lords and Valkyries to join my future adorned pleasure boat of Tendies.

Now you ask, Castle-kun (UwU), What is CLNE? What do they do?

Well here is what seeking alpha has on them:

Clean Energy Fuels Corp. provides natural gas as an alternative fuel for vehicle fleets and related fueling solutions, primarily in the United States and Canada. It supplies renewable natural gas (RNG), compressed natural gas (CNG), and liquefied natural gas (LNG) for light, medium, and heavy-duty vehicles; and offers operation and maintenance services for public and private vehicle fleet customer stations. The company also designs, builds, operates, and maintains fueling stations; sells and services compressors and other equipment that are used in fueling stations; and provides assessment, design, and modification solutions to offer operators with code-compliant service and maintenance facilities for natural gas vehicle fleets. In addition, it transports and sells CNG and LNG through virtual natural gas pipelines and interconnects; procures and sells RNG; sells tradable credits, such as RNG and conventional natural gas as a vehicle fuel comprising Renewable Identification Numbers and Low Carbon Fuel Standards credits; enables its customers to acquire and finance natural gas vehicles; and obtains federal, state and local credits, grants, and incentives. The company serves heavy-duty trucking, airports, refuse, public transit, industrial, and institutional energy users, as well as government fleets. As of December 31, 2020, it served approximately 1,000 fleet customers operating approximately 48,000 vehicles; and owned, operated, or supplied approximately 565 fueling stations in 39 states in the United States and 5 provinces in Canada.

Now the performance grant details:

- Form 4 → https://www.sec.gov/cgi-bin/own-disp?action=getissuer&CIK=1368265&type=&dateb=&owner=include&start=0

All the executives just received a first-ever price-based performance grant. The current price is $6.23 and the only price-based requirement is that it reach $14 (just over a 100% increase). The CEO will receive 100,000 shares if they hit this goal which is a pretty sizeable $1.4M grant. (my only gripe with this is no date requirement… F… I love grants that have target date thresholds).

now what I noticed is this sneaky sneaky SNEAKY (I’ll share more sneakyness later from CLNE) little statement.

If you look at the individual Form 4s, you will see they also have a separate smaller grant that is only received if reach a “specific volume hurdle related to securing certain levels of gasoline gallon equivalent”.

I have only found one other time they had a similar performance grant was on 2019-02-25 and the stock went up 44% over the next month.

- Holy Shit Balls - Stock Buy Back?!?! Count me in!

https://www.sec.gov/ix?doc=/Archives/edgar/data/1368265/000110465921147197/tm2134512d2_8k.htm

The board also agreed to increase the company’s share repurchase program from a cap of $30M to $50M

Now earlier I said about how sneaky these executives were:

Back in Jan 22nd 2021, They moved up a typical earnings grant forward by 1 month before earnings release. Prior to this fast forward grant, the stock was absolutely tearing it up (300% in 3 months). So moving the grant might be meaning they are bearish(?) about the firm?

Form 4 - https://www.sec.gov/cgi-bin/own-disp?action=getissuer&CIK=0001368265&type=&dateb=&owner=include&start=80

HELL NAH they werent. They signed a new deal, and had a FIRMLY GRASPED and BURSTING earnings report that saw that stock go from $10 - $18 in a very short period of time.

Soooooo… with that said, I am not good with charts (yet) and I am looking to enter into this Cleanest of Stonks the next couple of days. They have been gapping down to around $5.88 couple days ago and rebounded nicely. I’m going to buy maybe a 1k shares and fuggedaboutit.

Also, some bullish fucking news / Catalyst is they signed a new NG deal.

https://www.businesswire.com/news/home/20211216005364/en/

If anyone has any chart experience or have any other input, feel free to chime in! So come ride the tendie wave to my future pleasure boat.

This has been my Ted Talk.

Thanks,

Castle.

Edit 1.

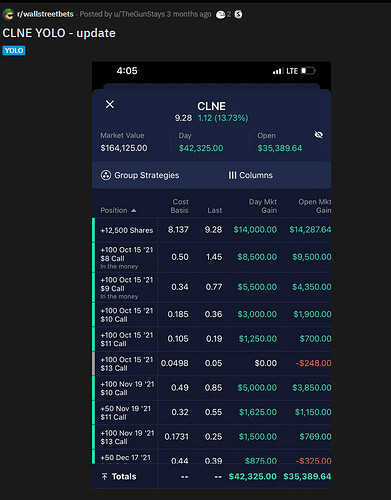

Forgot to mention, CLNE had several Reddit Sentiments in 2021 with one degenerate betting big 3 months ago and coming out wetter, stronger and sexier.