It is time …

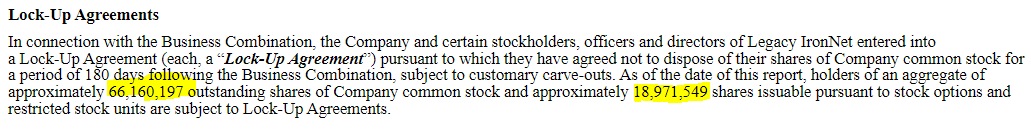

Six months ago, Aug 27, 2021 to be exact, IRNT completed its business combination with the SPAC LGL.

Well, its six months in a few days, and on Monday (2/27), all shares will be unlocked.

(Technically, there were some shenanigans around allowing one of the Directors to sell stock, and I think some more were issued, but it doesn’t change the general thrust of the story.)

I (and presumably everyone other than the diehard fans at https://www.reddit.com/r/irnt/) would expect the prices to face downward pressure as a result.

Unexpected self-fattening for the sacrifice

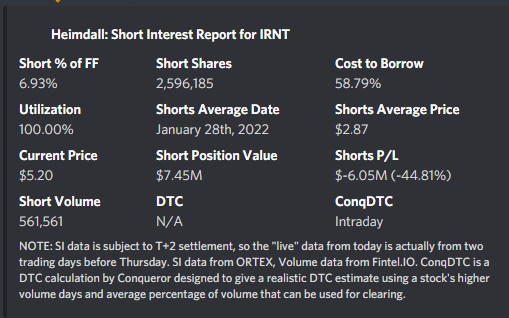

Interestingly, IRNT was up 40% at one point today, and has settled on a 27% gain to close at $5.20. Yet it spent a good chunk of the post-gamma-squeeze time in the $3-$4 band. It’s even gone up a few percentage points after hours. Cannot find an actual reason other than positive cybersecurity sentiment.

This feels like a gift asking to be shorted. (And perhaps a final rug-pull setup by the big boys before lock-up ends…)

Btw, short interest will help IRNT even less after tomorrow. SI is ~7% of (current) float, DTC is < 1 day and CTB is ~59%, so even though avg. short price is $2.87, shorts can either cover relatively quickly or just ride it out.

And neither will the option chain - no meat on the bone there for a gamma fart, even.

Wen tailspin, then?

If all goes as expected, prices should plummet early next week.

Looking to play this with 3/18 deep-ITM puts. Note that IRNT has earnings coming up on 3/16 AH. IV nearer to earnings should add a bit more to premiums, if someone wants to risk flying close to the sun.

Not planning on holding the puts through earnings, or get strikes farther out, because they could say things during the earnings that riles up the fans and prices rocket. If that does happen though, we can consider that as another shorting opportunity if there is nothing materially positive.

Thus, my plan is to get some 3/18 deep-ITM puts tomorrow, and liquidate as soon as prices start flirting with the $3 level again.

Seems suspiciously like free money though… what am I missing? Any better way to play this?