Note: This involves Risk

You Could Lose Money

I discussions on related to iron condors on TF and I thought I try and make a guide which is mostly copy and pasted.

Please consider discussing any complex options trades on the forum or with @TheHouse , @The_Ni , @Kryptek, @thots_and_prayers or the other gods before jumping in. - In the past I have seen these break and destroy ports and traders. Always utilize the knowledge and resources we have here, before going in blind. - I am sure some others a bit more familiar could add quite a bit here.

Iron Condors are were not featured in the film Iron Eagle, for those who saw it.

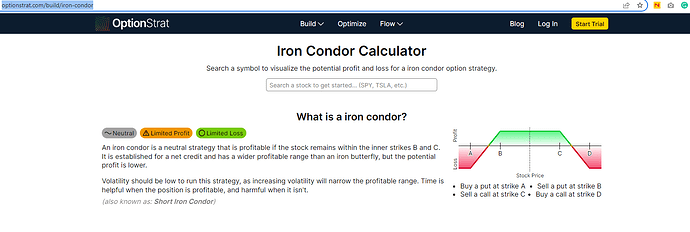

Short Iron Condor

This one is simple because it’s a combination of two strategies: the put credit spread and call credit spread. Search the Forum -

So, a short iron condor is a neutral position. Your position is net bullish from the puts and net bearish from the calls. This type of neutral strategy profits the most when a stock stays flat, not closing too much higher or lower than your strike prices depending on where you set them.

You can make this strategy as complicated and calculated as you want, and so your profit potentials will vary depending on where you buy and sell your 2 calls and 2 puts.

If you really want to use the short iron condor heavily I’d recommend really studying up on your profit/ loss potential for the various strike prices you set, and how current prices for those options are lining up and how that compares to where you think the stock price will go (and its volatility or where it has been).

Before going in and spending money - post the idea in the forums get some feedback. Lots of amazing people here with a wealth of knowledge.

To Visualize this it is very simple @ Iron Condor | OptionStrat Options Profit Calculator