JELD engages in the manufacture and sale of doors, windows, and related products. It designs, produces, and distributes interior and exterior doors, wood, vinyl, aluminum windows, and related products for construction, repair, and remodeling of residential homes and non-residential buildings. It operates through the following geographical segments: North America, Europe and Australasia.

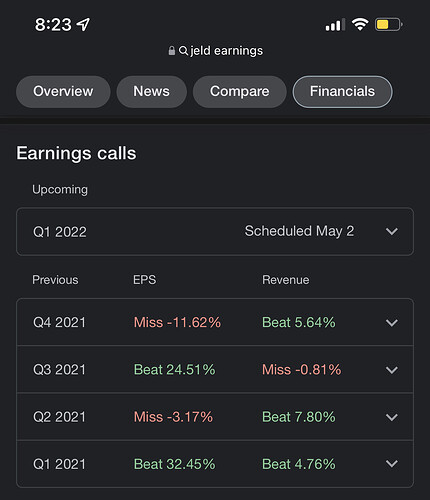

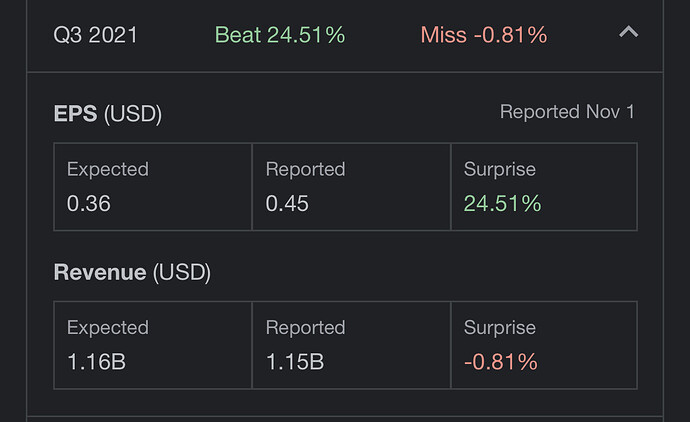

I came across this stock browsing the interwebs and thought about all the new homes or housing developments being built. Every, if not all, houses have windows and doors, can’t argue that. 2021 earnings seem pretty solid, and they beat expected revenue by 5.64% last quarter, but missed EPS by -11.62%.

JELD highlights of last quarter:

( JELD-WEN Holding, Inc. - JELD-WEN Reports Accelerated Revenue Growth with Fourth Quarter 2021 Results; Establishes 2022 Outlook with Strong Growth and Margin Expansion )

- Net revenue increased 11.8% for the fourth quarter driven by improvement in pricing and volume/mix

- Core revenue grew 10% in 2021, with growth in each segment

- Adjusted EBITDA increased 4.2% for the full year to $465.1 million

- Repurchased 11.6 million shares in 2021 or approximately 11.5% of total shares outstanding at year-end 2020

- Issued 2022 outlook including revenue growth between 7% and 10% and adjusted EBITDA of $520 million to $565 million

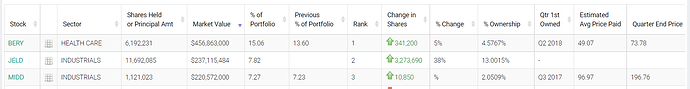

While browsing I found a company had recently purchased 11M shares between Q4 2021 and now.

The company purchasing is Turtle Creek Asset Management Inc. ( Home - Turtle Creek Asset Management ) They state ‘We were founded on a novel idea—a new way to invest in public equities over the long term—with a focus on seeking to lower risk.’ The purchase comes several weeks before their JELD earnings.

Earnings for JELD are May 2nd @ 8am ( JELD-WEN Holding, Inc. - JELD-WEN To Release First Quarter 2022 Earnings And Host Conference Call on May 2 )

I’m still looking up info, but found it interesting enough to possibly watch for Monday.