After blowing up a few accounts, I’ve decided to start trading again with a robinhood account that I started with $4,000. I figure keeping a public journal will give yall the opportunity to learn from the mistakes I’ll inevitably make lol.

Plus, I think that forcing myself to write down and explain my trades might make me think through them more thoroughly. Making knee-jerk decisions off emotion has usually been my downfall lmao.

Anyway, I’ll be looking for setups where the risk/reward ratio seems skewed in my favor. Mostly I’ll be playing shares but potentially some options as well. I’m planning on doing mostly swing-trades, but may also daytrade if I think an opportunity is there or if I get stopped out of a position. I’ll mostly be getting my trade ideas from reddit, this forum, and a few trading discords.

Currently the account is actually at $4,700 (got lucky on ISIG lol) and I’m holding 600 shares of IINN (avg. 3.92) and 360 shares of RELI (avg. 6.61). My current goal is $5,000 by the end of the week

2 Likes

12/30/21

When I checked my robinhood account this morning, I was actually a bit above 5K (thanks to RELI). Since that’s my goal for this week, you’d think I would sell right?

Nope! I let RELI hit my stop loss at 7.30 before I sell (still making me about $250 profit though). Now, you might ask:

“How about IINN? That went up 27% today! You made bank huh?”

Nope! I sold this morning for $3.66, and actually lost money on that trade. I wish I was kidding you lmfao.

But that’s nothing compared to what happened next. See, I thought I had a daytrade today, since my last daytrades were on Thursday last week. Of course, I forget that Friday last week wasn’t a business day…

So I buy EFOI looking for a quick daytrade (500 shares @ 5.62) and when I go to sell I realize my mistake. Welp, looks like we’re hodling! Of course, it slowly bleeds over the course of the day and I’m now staring at a $575 loss on it.

With the other half of my portfolio I bought 830 shares of BVXV @ $2.44. I’ve seen it being talked about in some trading discords, seems to have good short numbers, and I think it might run.

Anyway, current account value is currently sitting at about $4,300. Tomorrow I might play some ESSC calls since we seem primed for another go-around.

1 Like

12/31/21

Sold BVXV and EFOI here at a loss. Started entering a position in ESSC calls at around 10:00 AM. Currently hold 20 of the 12.5c (Jan) and 11 of the 10c. I have a good feeling with this play, and will hold until I feel comfortable selling.

1 Like

So. ESSC. Once I was up about 50% on the trade I will admit I “paperhanded” my position and sold out. I refrained from updating the trading journal though, since Conq had called out a gamma squeeze and I think part of that was he didn’t want people talking about their exits.

Originally I felt bad about selling so quick, as I soon realized that I could be up 200%, 300%, if I had just held for a bit longer. And then, when the knife hit, I was suddenly glad to be able to get out green. Funny how just a few seconds of price action can make you go from kicking yourself to breathing a sigh of relief (and vice versa). Just goes to show how silly it can be to judge yourself based on hindsight.

Anyway, after selling out my robinhood account was sitting at about $5,800 or an almost 50% gain over my original amount of $4000. I decided to take a break for a week or two, and also move the money to my TDA account, since collectively I would be able to break 25K and unlock more daytrades.

I’m now invested in calls on oil (USO) and natural gas (UNG) since I think there’s a good chance that Russia will invade Ukraine in the coming weeks. I even wrote a brief DD about it on reddit if any of yall are interested: Reddit - Dive into anything

I’m also watching ABNB for a potential put play, and I read a post here talking about playing ESSC puts, so I’ll be watching those tickers for a potential entry.

Wow. Was up 4K on my oil and nat gas calls before I sold on Thursday to lock-in my profits. Sitting at about 10K total in my play account now. Total returns of about 150% since I started a bit more than a month ago. Of course, I’d be up a whole lot more if I had held until Friday, but oh well, you can’t let yourself think like that lmao.

Even without Russia invading Ukraine, we saw a confluence of factors in the energy market this week, leading to surging prices. I think this article gives a good overview of what happened: Bloomberg - Are you a robot?

I’m still bullish on oil and nat gas, and still believe that Russia is planning on invading Ukraine. However, I think I might sit on cash for a little bit, just because the overall market seems so jittery right now. It’s possible (IMO) that we could see the beginning of a new bear maket…

Also, I’ll be following Conqueror’s 1K to 1M trading challenge closely. Could definitely be some major opportunities there to make big returns.

1 Like

Pissed away about $500 in random FDs these past few days lol. I know I shouldn’t play VXX calls, I always lose money on them, and yet I can’t help myself. Ah well, could be worse.

ESSC attracted my attention today. It ran twice before, and with the extension coming up I think it could definitely run again (although maybe not as far as before). It looks like volume and OI on the 10cs and 12.5cs (for february) are really ramping back up, indicators which preceeded the past two spikes. As a result, I took a position on 10cs today, accumulating 25 contracts throughout the day at an average cost of about $1 each.

Of course, I could be completely wrong and it could knife back down, but I think that the current risk/reward ratio (with ESSC trading around ~10% above NAV) is in our favor. Even if ESSC only makes it back to $12, that would translate to a roughly 100% gain in my calls, which is generally my goal for riskier plays like this.

Accumulated 15 more ESSC call contracts today at an average cost of $0.78 each.

Current position: 40 contracts (10c 2/18) @ $0.95 average (cost basis of $3,800)

Current unrealized P/L: -$900

Pretty ugly P/L right now - guess it just goes to show how important proper positioning is lmao.

Funny story: yesterday around the time of market close I thought “hey I should get a FB call”. I filled out the order for it, but I was late and so it was queued up for the next day (today). Now any rational person would cancel the order, but not me. I proceed to forget all about it until I wake up today at noon today and see I bought a 240c on FB that was now worthless. $250 down the drain, though I guess it could’ve been worse lmao.

Cut my ESSC losses, lost around $1K on them (just goes to show how a bad entry can fuck you up). I bought 20 call contracts for the $3 strike (2/18) on SENS, since I think the risk/reward is looking good. I also bought 10 call contracts for the $15 strike (2/18) on UNG , since I think there’s a good chance putin invades soon given all the preparation Russia is doing, and UNG has dipped nicely.

Also, withdrew some money from my play account to pay some bills (also just bought an oculus!).

New play account value: $6,416

2 Likes

Too bad about that FB call. Assuming you are talking about the 240 Feb 4 expiry, it went to 3.65 today, probably could have at least broken even on it.

Yeah, but of course I sold when it was worthless haha.

Trading. It seems so simple in theory: buy stuff before it goes up and then sell for a profit. But of course, in practice it can be messy.

Barely staying above 25K right now. Play account currently at $5,163. I’ve been trying to follow the 1k to 1m challenge, but I think a lack of discipline has been causing me my losses.

Most of my losses since my last post were due to my UNG calls. I thought that it would have rebounded by now, and bought more when the position went deeply red. Of course it was a falling knife though, and I got screwed.

Also have been giving in to the temptation to revenge trade, lol, especially on VXX calls. Did make a little off of them today though. Also, I should’ve followed Conq in cutting ASTR before the launch instead of selling on the big red candle afterward.

Going forward, I want to be more disciplined in how I enter and exit positions. Instead of doing it all at once, I want to start incorporating Conq’s idea of slowing averaging in on supports. I also want to actually wake up earlier so I don’t miss better entries like I have been recently. I think I’ve been doing far too much gambling so far, and although it’s been somewhat successful I’m going to need to change how I trade if I want to be able to consistently turn a profit.

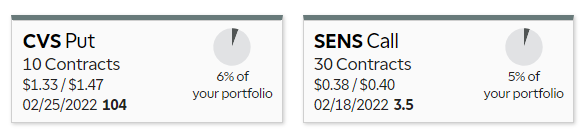

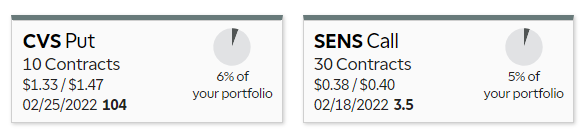

Current positions:

Got crushed on SENS today, oof. Also sold CVS puts for a loss. Taking out a position in UNG calls right now in anticipation of a Ukraine invasion, which has so far recouped some losses.

I think natural gas could return to $5 within the next week.

Damn I really want to get better at daily updates. Oh well.

Fortunately UNG calls took me back above 25k last week. Will need to be more careful going forward of not falling below that threshold again. I think I’ll mostly stick to Conq’s plays in the 1k to 1m challenge going forward.

Anyway, today was bloody for me. I was on the plane when the market opened and the internet was so slow I could barely exit my XOM and LMT positions green. Still, I held some XOM calls that went deep red. All told I was down $611 today, leaving my play account with a value of $7,178.

P/L Today: +$524.75

Good day today. Most of my gains today from UNG, USO, and RSX puts. Cool to see Conq also talking about UNG now. It seems like the invasion really could come any hour now. Tomorrow will be wild.

Also, put in the request today to have TDA switch my account from Margin to Cash. This way, even though I have a good cash cushion above 25K, I won’t have to worry about falling below it.

The big question now is how far will Russia go? I think the capture of the rest of the Donetsk and Luhansk regions are a given at this point, and feel like going for Kyiv would be extremely risky. Still, this is an unprecedented troop buildup, so I don’t think anyone can know for sure.

P/L Today: +$6,119.02

Made bank off of UNG and USO calls, along with RSX puts. Re-entered RSX puts and OZON puts along with the 1M challenge. Looks like it will be another very rough night for Ukraine, and in particular Kiev.

This morning the TDA website was being laggy so I sold a bit later than I would have liked. My plan is to start learning how to use TOS and stop using TDA’s web app. I’m hoping this will help me get better entries and exits. Still waiting to make the switch from margin to cash account.

Damn, I’ve really forgotten about this lol. Conq plays have been too good to me recently, and I’m happy that I’ve been able to take profits off plays like RSX and GME/AMC without getting too boned on the downside.

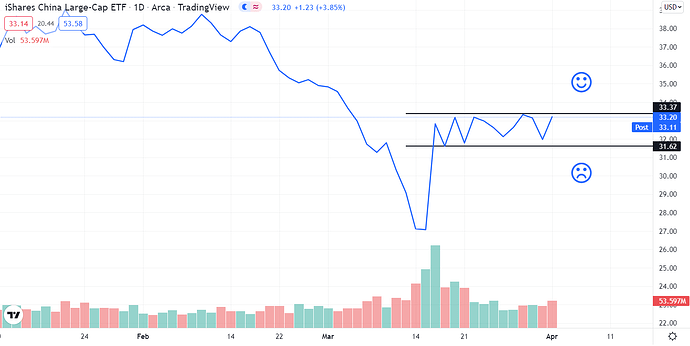

I’m going to start using this thread to post my non-conq plays, which currently includes FXI. I’ve been watching it for a while, and my thinking is that it could be winding up for a big move upward, as the CCP (hopefully) takes more measures to support their tech companies. I think we’ve already starting seeing this, especially with the news today: Alibaba, Chinese tech stocks jump as Beijing considers giving US full access: report | Seeking Alpha

Additionally, for the past two weeks I’ve noticed FXI has been trading in a sideways channel, with support at about 31.6 and resistance at 33.3:

Ideally of course you would buy closer to the support level, but in this case I think there’s a good chance we see a breakout soon. Thus, I picked up a small starter position today:

If FXI declines again and revisits the bottom of the channel, I will probably average down, with a stop-loss for the play at around 31.6 and a PT of about 36.

Damn it’s been a long time since I posted here. While the past few months haven’t been great for me, I wouldn’t say that they’ve been bad. Mostly I’ve just been flat, winning and losing in roughly equal amounts on average.

And yet, I’ve started to notice more acutely how my trading (maybe “gambling” is more accurate) has been affecting my emotions negatively. I can be glued to my screen watching the markets, which definitely messes up my productivity in other areas. Though making money feels good, losing the same amount somehow feels much worse, I guess its probably related to this: Risk aversion (psychology) - Wikipedia. Anyway, I think I’m ready to get off the financial and emotional rollercoaster of options buying, and am willing to try out less volatile strategies.

So, I’ve decided to try the wheel. This morning I sold to open 30 contracts of the SOFI 8/5 6P contract for a total premium of $900, just to get my feet wet. They’re a stock I’ve been looking at for a long time, and their earnings tomorrow gives these options a nice premium. If I get assigned I have no problem at all with owning 3000 shares at a $6 cost basis.

They’ve been seeing strong membership growth which I expect to continue, alongside growth in deposits driven by their currently 1.8% APY. And these deposits help drive their loan originations business, which benefits from rising rates. They are also aiming to implement options trading in their invest accounts by year end, which I think would be big for retail traders.

Honestly, given how many free banking options there are now (with SoFi being just one of many) I’m surprised how many people keep using traditional brick and mortar banks. I used to bank with BoFa and oh god, the fees. Monthly fees, minimum balances, overdraft fees, etc - are these really worth it for a physical branch?