Why short sell shares

I don’t understand options so no puts for me. Thus short selling shares the way to go.

Short selling is addictive because it can be profitable yet risky at the same time if you do not have strict stop loss control.

I have issue with strict stop loss so I can have many green days of hundreds in profit per day but my loss will be in the thousands effectively cancelling all my profit. Still working on improving myself.

My style

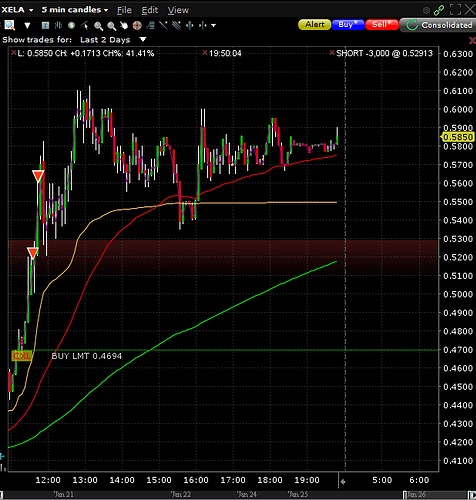

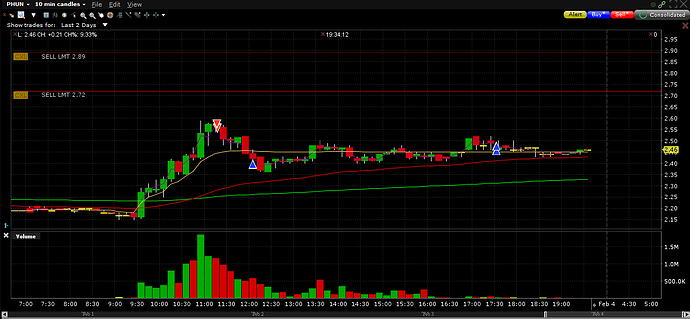

I go in and out quick and sometimes I hold / average up. Occasionally holding short positions overnight .

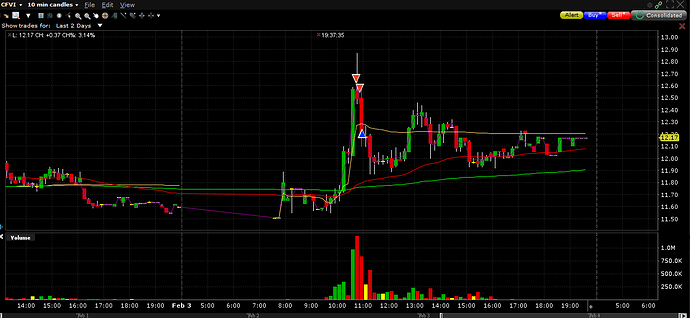

Short selling signals I used :

-

Look left on the chart for previous resistance.

-

News catalyst . Sometimes even with mediocre news, a stock can get pumped because of MOMO plays and that is when I get fucked.

-

Float, small float bad, big float still ok. Then look at float rotation for the day if the volume is over 3-5 times the float at PM or even during market open, then there is a chance that previous resistance don’t matter anymore which means a ticker can go higher if it gets enough attention from retail traders.

-

Is it being pumped anywhere, shortsqeeze/squeezeplays

Lastly

I still consider myself a newbie (I started sept/oct 2021) as I can’t read a short setup as well as the peeps from Atlas.

I’m active in the short chart in the other discord because Valhalla do not have a separate room for these purpose.

I will show the good and bad of shorting (mainly bad) i’m red this week but hope I can get in form after ESSC plays from next week onwards.