Hey everyone,

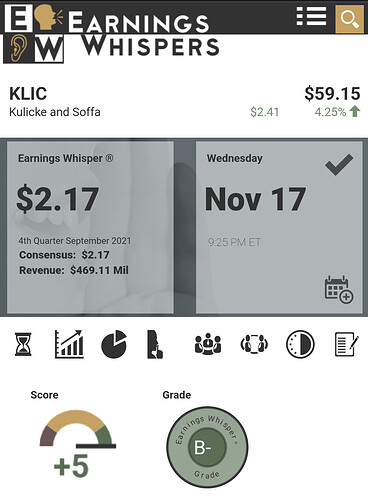

Want to start this DD off with disclosing I’m not too familiar with the semiconductor industry. The reason for the DD on KLIC is I’ve seen it mentioned quite a few times in trading-floor, and it happened to come across my ToS newsfeed the other day as well. Considering their ER is coming up, thought I’d break down what they do, the current competitive environment, and how we can possibly profit off it.

Who is KLIC?

Kulicke & Soffa Industries, Inc. engages in the design, manufacture, and sale of tools used to assemble semiconductor devices. It operates through the Capital Equipment and APS segments. The Capital Equipment segment consists of ball bonders, wedge bonders, advanced packaging, and electronic assembly solutions. The APS segment offers a variety of expandable tools for a broad range of semiconductor packaging applications.

Essentially, they make the machines that make semiconductors.

Before we dive into them as a company, it’s important to understand the global semiconductor shortage and what caused it.

Now if you ask anyone why we have a shortage in chips, they’ll respond with the typical “covid-19 delays, duh,” which only covers a part of the picture.

Yes, covid-19 did cripple the global supply chain, mainly due to a shortage of works and extra steps taken for precaution, but there were a few other big factors that also contributed to this current shortage.

1. USA - CHINA trade war.

In September 2020, during the trade war, the US Chamber of Commerce imposed restrictions on SMIC, a global chip-manufacturer. Till this day, they’re still restricted to US-businesses.

2. Taiwan Drought

When US-businesses looked for a new supplier, TSMC was the easiest supplier. They quickly rose as a leading provider for all businesses that needed semiconductors. In 2021, Taiwan experienced it’s worst drought in half a century.

“Well why the fuck does that matter?”

Because TSMC uses 63k tonnes of water a DAY to clean their factories. If they don’t have ultra-pure water to clean, they can’t create.

3. Renesas Electronics Corp Fire

Renesas is a Japanese chip manufcaturer that supplied around 30% of car chips to the world. In March, they had an electrical fault that destroyed a lot of space. It took them longer to recover and already hit a struggling car-chip market.

4. Increase in copper and other raw materials

Self-explanatory on this one.

As you can see, even without covid, chip manufacturers had a helluva year. You hear it on the news all the time, and for the foreseeable future, the supply will remain lower than the demand.

In the manufacturing world, this is a dream scenario, and while it won’t last long, the short to medium term bullishness remains.

I say short term because there is an obvious short term demand for chip-creating tools. I say medium term because this situation presents an extremely unique timeline for new, innovative companies to acquire more marketshare and continue to be long-term suppliers to chip-makers.

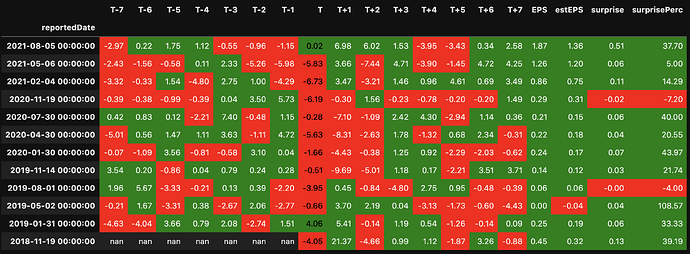

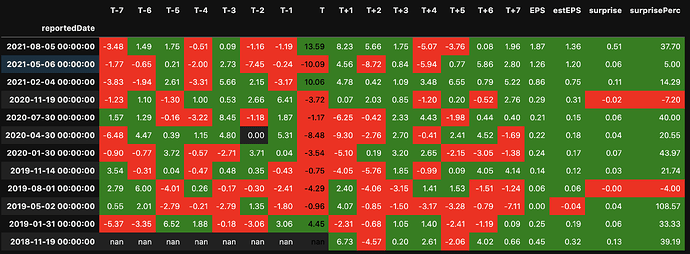

All of this is proven through their past ER and guidance they’ve provided in their ER.

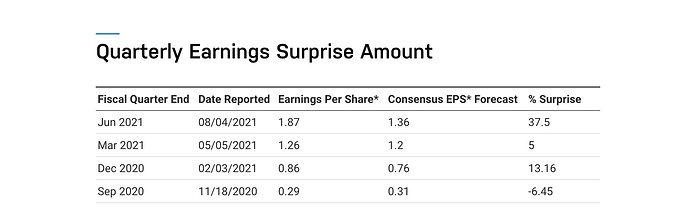

As you can see, they’ve beat on 3/4 of their last reports. Considering the start of the chip-shortage-dominos starting in September 2020, this makes sense.

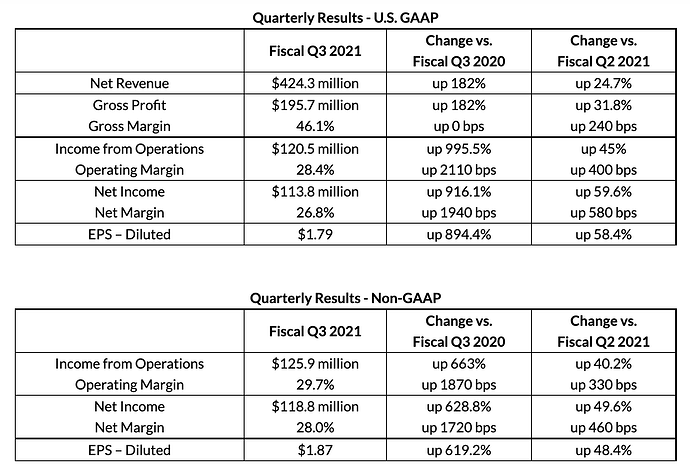

Q3 numbers:

Important to note, during the call, they reiterated they expect to see continued, future growth, citing:

*the past several years of our R&D investment and the market expansion ever have extended our competency and the solution to better support several significant, long-term and the structural market opportunities. These opportunities are also right in demand within our broad portfolio of solutions and provide access to new high growth opportunity in the semiconductor, automotive and the display market.

As we ask you on this long-term strategy, we are enhancing our ability to create a long-term value for customers and ultimately for shareholders*

So last quarter, not only did they crush, but they also reassured investors “hey, we know demand RIGHT NOW is really high for us, but we believe we’ve taken the right steps to insert ourselves into a position where we are huge market players and will continue to expand off these current opportunities.”

Other bullish indicators

So far we see the chip shortage is here to stay for the short to medium term, and KLIC has grown their business exponentially. What makes this upcoming ER bullish?

1. Dividend Raise

On October 18, they announced they’re raising their dividend by 21% to $.17. Yes, I know the dividend is a tiny amount, but dividend rates are one of the more bullish indicators a company is growing, considering 1. they don’t have an obligation to raise dividends and 2. they’re fiscally in a place to afford more payouts.

2. Stock repurchase history

KLIC has some sound leadership on board and they’re very aware of the opportunity given to them by investors. Before they really started to blow up, they extended their stock repurchase program through to August 2022 to $400MM.

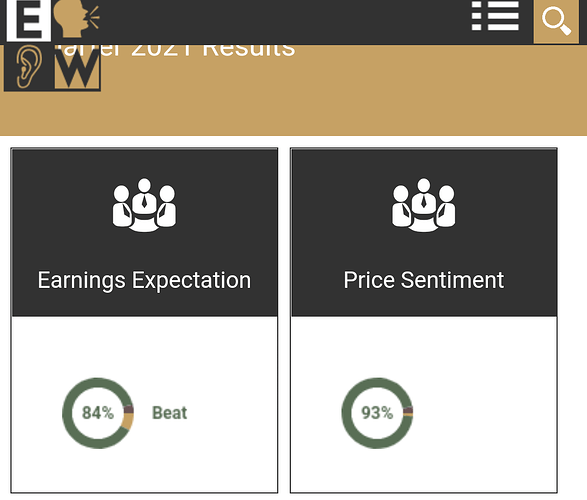

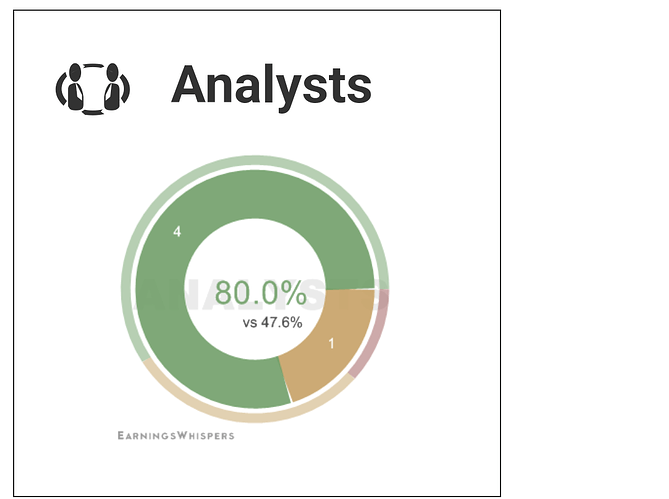

3. High as fuck analyst grade

While I don’t take analyst grades seriously, it’s something to be said when some of the most reputable ones are giving KLIC top marks all around for their upcoming ER.

Now let’s flip to the other side and make some bear cases.

1. It’s all fucking priced in

Ever since they announced the dividend increase, KLIC has gone up about 50%. It’s possible there are institutions and investors looking to ride this wave of bullishness just to dump it AH and leave a bunch of bagholders.

2. It’s grown too fast

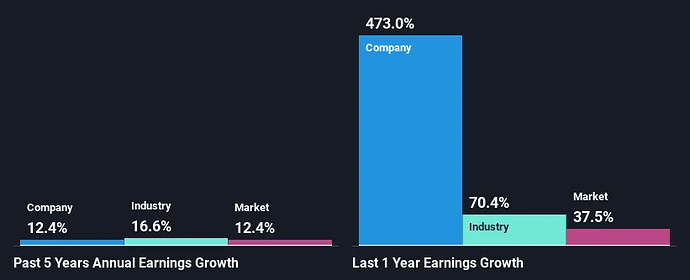

Here is a chart that shows how much other companies in the industry have grown in revenue vs KLIC:

Other companies in the industry have grown considerably less than KLIC. While this may seem bullish, there is a limit to how fast a company may grow. This may be the quarter where they announce their future guidance isn’t as high as people want it to be, thus investors might flee cause it’s no longer attractive as a “Growth” stock.

3. The chip shortage won’t last forever

This is a pretty obvious one, but the scariest part is timing when this will happen. Thankfully, through other ERs we have seen, the overall consensus seems to be the chip shortage will remain, for now. That being said, if KLIC were to come on call and say something that admits they know it’s going to start waning down, this could also trigger a sell-off.

CONCLUSION

Given the current state of our economy, as well as the other ERs we’ve observed, I’m short-term bullish on KLIC. They’re a perfect example of a business that’s in the right place at the right time, coupled with a leadership team that will pull out tricks to keep investors happy. I believe these goods heavily outweigh the bads, and they’ll both report great earnings as well as raise future quarter guidance. If they are to begin waning down, I expect it would be in a q or 2. They report tomorrow AH on Nov 17th. Good luck to all playing it.