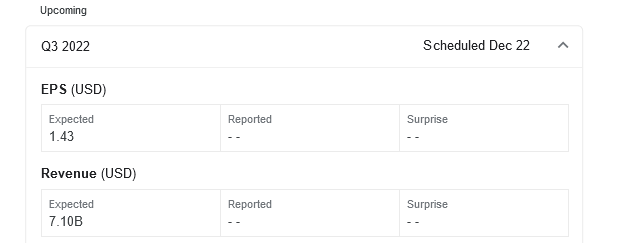

What’s up everyone. So on 12/22/2021, Carmax will be reporting their earnings for Q3 2022.

I’m a little on bearish on Carmax due to current economic events going on in the U.S., and think that they might suffer a nice drop after this upcoming earnings report.

CarMax is a used vehicle retailer based in the United States. It operates two business segments: CarMax Sales Operations and CarMax Auto Finance. The corporate entity behind the formation of CarMax was Circuit City Stores, Inc. The first CarMax retail location opened in September 1993. Carmax has a little over 220 stores across the country employing about 27,000 people.

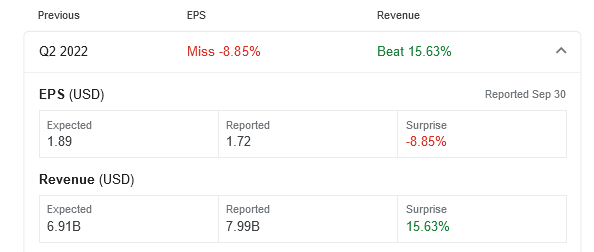

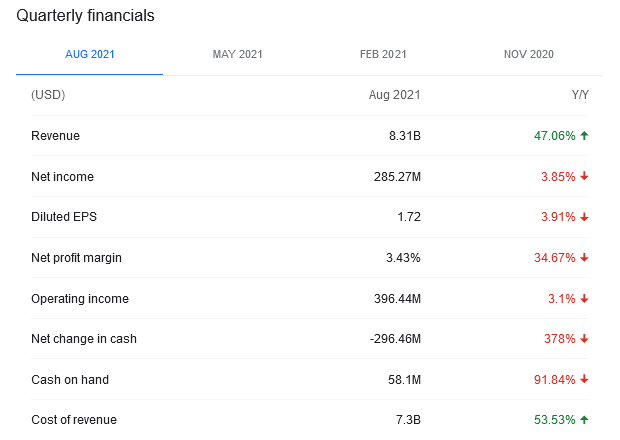

For Carmax’s Q2 2022 earnings reported 09/2021, they did not exactly knock it out of the park in comparison to the previous quarter.

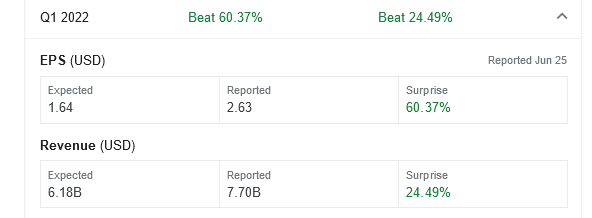

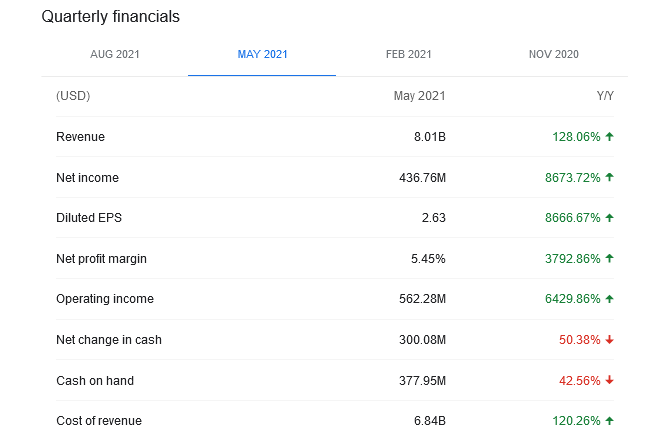

For their Q1 2022 report, they did great on earnings and saw a nice jump in stock price the days following.

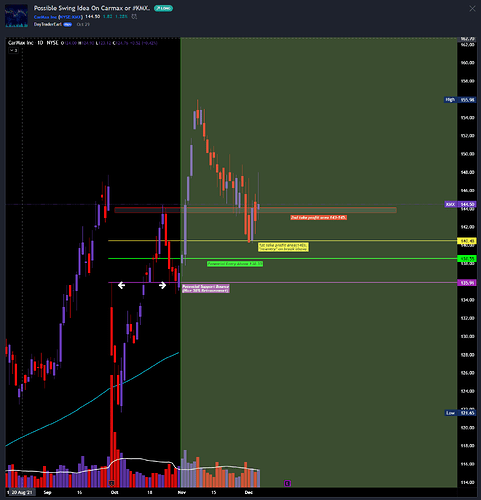

As you can see, Carmax saw a nice bump in their Q1 earnings. A lot of this growth though during the period was due to the Covid boom. Prior to pandemic March selloff in 2020, Carmax had a high of $103.18 in 02/2020 before dropping to a low of $37.59. Since 03/2020, it has been on a tear hitting as high as $155.98 this past month on 11/2021.

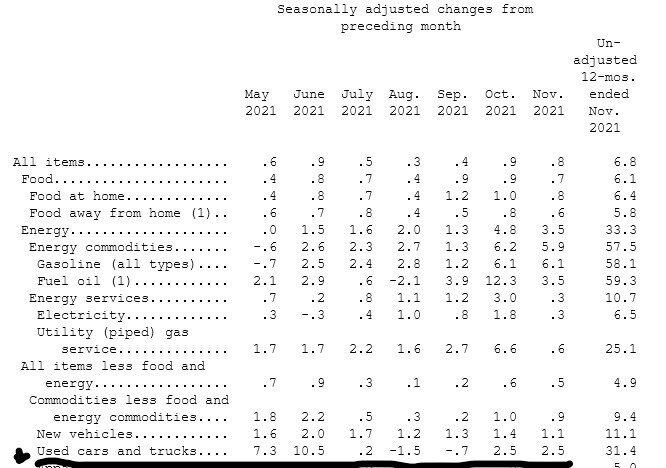

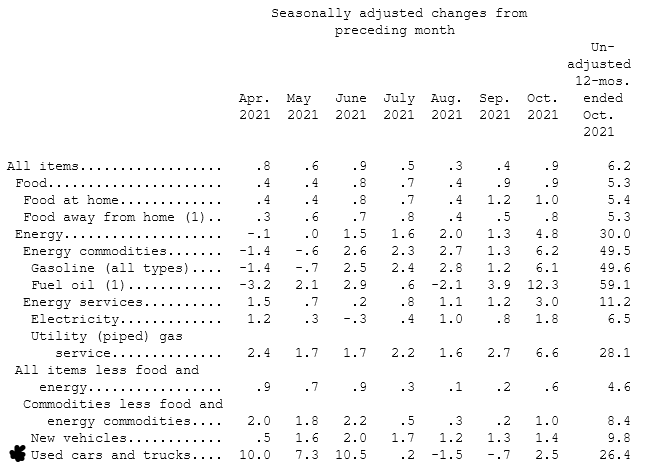

The auto industry has taken a beating during 2021 due to semiconductor shortages and supply chain issues with other materials thus causing the reduction in production of new vehicles. Because of this, the used car market has seen a massive boom over the year due to highly inflated pricing. Used car values saw up to a 10.5% increase on prices which in part led to some of the large inflation numbers that we have seen in the past CPI data reports. These are also the percentage rate increases that were occurring during Carmax’s Q1 period.

But over the last few months, CPI data has shown that those percentage increases in used car prices has been steadily declining. And I believe that was reflected in Carmax’s Q2 earnings report as you can see with their losses in net income, profit margins, etc.

Carmax also does their own in house financing with Carmax Auto Finance. From their Q2 report, CAF income increased 35.9% to $200.0 million, primarily offset by a $35.5 million loan loss provision compared to $26 million in the same period the previous year. That’s a pretty decent loss in loan revenue and I can only imagine that figure will continue to climb.

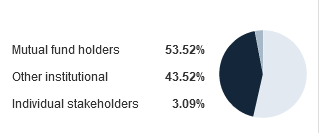

So due to the declining inflation percentages on used car prices, scaled down production of new vehicles by auto makers, and the remaining difficulty in acquiring reasonably priced used inventory I am feeling strongly that Carmax’s upcoming earnings report will be lackluster. Details from their last report stated that they had opened 3 additional stores so far in 2021 with a plan to open 10 more. They also announced they had repurchased 1.8 million shares for $220 million dollars. They also said they are still eligible to repurchase an additional $900 million worth of shares. So with increased operating costs also thrown on the table with the other factors at play, I expect to see a decent drop over time as the Covid pump wears off for them.

I had similar convictions for their last earnings report, and puts panned out well for me. I will also be looking at puts on this earnings report as well.

This is not financial advice and please do your own research.

[event start=“2021-12-22 13:00” status=“public” name=“Carmax (KMX) Earnings” url=“https://investors.carmax.com/ir-home/default.aspx” end=“2021-12-22 13:30” allowedGroups=“trust_level_0” reminders=“1.days”]

[/event]