I like it. Holding two 75p at $1.54; I’ll cut though if we gap down in the morning.

You mfers. I’m now up to 9. However I also will at very least cut part of it if we get any kind of drop. To at very least cover part of my exposure. Hope it works out. Got some more data coming shortly. After I play some catch with my kid and maybe a little batting practice.

As promised, some more real time data. This really should have been included in my original post however fuck y’all. It wasn’t. So those of you that haven’t seen F thread or AN or CVNA I manage one rooftop of a moderately large auto group we have been in business for 60 years and I’d put money on the fact we are one of the most successful cutting edge dealers in the country privately owned that is.

Since everyone decide to make this play at least people way smarter then me I spent few hours to dissect why GPU (gross per unit) is important now keep in mind volume is low because of supply now and since about April 2021. Below I will attach our used car only GPU for the first 5 months of this year and last will be our used car GPU from June of last year. At a glance most may see it as a slight drop however if you take that to the context of KMX and the amount of retail units they deliver coupled with the fact that they over pay for units. I think the math explains simply why I think they miss. Secondly they have missed EPS in 2 of last 3 quarters as you will see that would have been the prime time to beat your expected revenue.

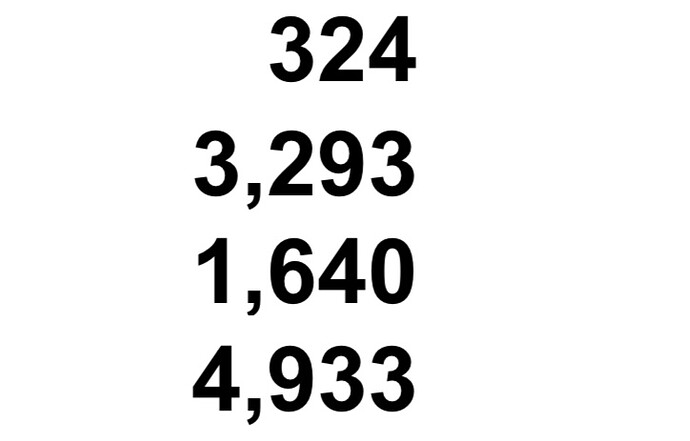

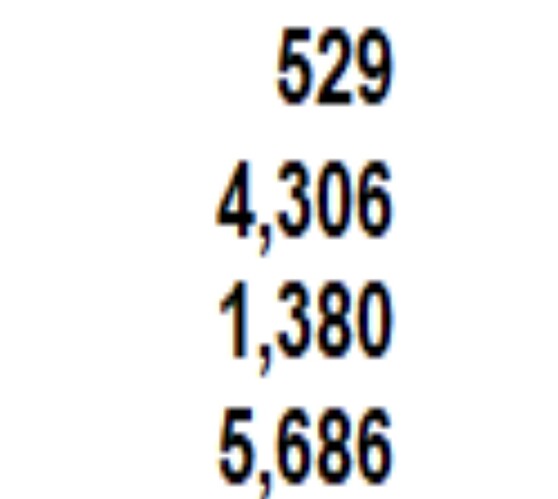

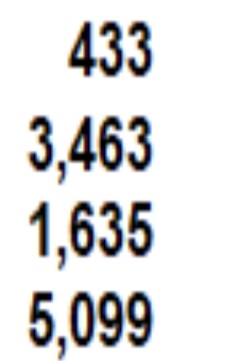

So let’s start with this year so far now keep in mind geography I’m in the Midwest automotive retail sucks when it’s 2 degrees and wind blowing sideways

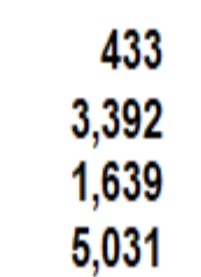

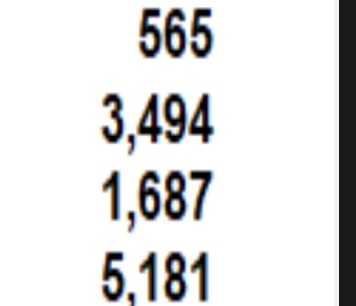

These are last several months GPU again at very successful 9 store group mix of brands but solely used numbers.

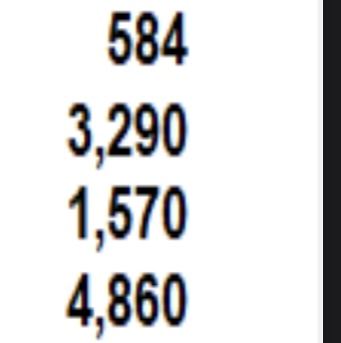

Now here the final is last years June numbers.

I think if you look at these you will see the significant down trend in used car profits maybe it’s dealers selling scared. Maybe it’s just looking at overall gross.

New car GPU however since this time last year is up almost 300 percent. That’s in turn why I am bullish on the likes of AN but bearish on strictly used car dealers like CVNA and KMX. Sorry this was long winded as always. But I hope everyone makes some money.

See some messages on TF about what these numbers mean so I will break down. My apologies as I had to cut some info out. Top number is total units delivered. Second number is Front gross profit so basically the difference between what dealer owns car for to what you pay. Third number is finance profit so what store makes based on marking up the rate extended warranties etc. the bottom number is the total gross before anything comes out expenses payroll cleanup etc. Hope this helps.

Took a 2nd put here at 1.10

I cut one at 1.65 today, only to turn add two more at 1.15; let’s ride!

Up to 12 now had to average down from 1.80 originals picked up. Sitting at 1.62. Hope this works out like we’d think. And hopefully they don’t post terrible EPS then say something earth shattering. I’d expect their guidance for Q3 and Q4 to be pretty pessimistic with current economic climate

After reading through this fully they did beat their EPS however there was a lot of decline in there total sales decline their GPU was up 134 dollars per unit compared to Q1 last year. If we look back and think though Q1 last year the auto market was still running along as it had prior. The semi conductor shortage didn’t start til April/May time frames. Q1 this year should have produced substantially more per unit.

Other thing in my opinion worth noting is an increase in their losses from the finance arm. This is only going to continue to rise with inflation.

Their increase in units purchased is also dangerous. When you buy a car from a consumer or another dealer it’s because you were willing to pay the most for it. Especially when not generating any revenue by selling a current piece of inventory. Numbers largely look what I’d have expected to the down side. Not much bullish here to me.

We will find out how the market reacts in coming days.

I appreciate the time and effort you put into the research here.

Looking back to the lessons we learned with RH: Analyzing our earnings plays

It does happen that when a company reports “good earnings” and gets pumped that you end up seeing a selloff in the days to weeks afterwards as longer investors look to exit positions because “the writing is on the wall”.

As a community we really do need to stick to that blueprint considering it fell in line with the lessons we learned back then, we didn’t expect KMX to report bad earnings and for that reason holding through this earnings was probably the wrong move and simply waiting until after earnings to take a position would’ve been better.

So all this is to say that if the thesis is correct, average down your puts and see where it goes from here. (for those that are wondering what to do)

Again, I appreciate this research and I’m looking to provide tools that will better aide us in capitalizing on opportunities like this in the near future.

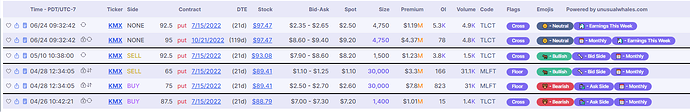

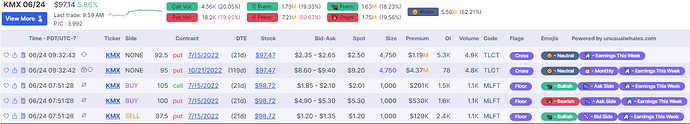

This is interesting. Perhaps the whales agree.

Today is the first day since May and April where 1M+ flow showed up, and it was for puts. Seems somewhat telling considering today is post-earnings. Unless these are closing of puts or STO puts ![]()

And 100K filter here, leaning bearish

By the way, just as a PSA:

I would ignore the first two trades as cross trades are iffy to interpret. From the unusualwhales blog:

“A cross trade is when separate clients within the same broker execute buy/sell orders for the same security at a fair market price, and happen fairly frequently within options trading.”

Appreciate that. I am as remorseful as anyone that it didn’t drop like it should have and what I expectedly thought. A put entry would have been much better today as it never gained any premiums in run up to earnings.

I truly hope that as I had mentioned above that most only played this with money they could afford to lose have felt bad all day about the thought of anyone losing money on this. However I intend on getting out of this trade green or at least pinkish haha. I do however recall CVNA last earnings and it shot up on ER that they missed badly. And then proceeded to fall from roughly 90 to where it sits today in a few short months. I still think we were all mostly right our entry’s could have been mistimed and expires.

I hope those that are still holding end up getting out okay and I apologize that this didn’t work as expected. I am still sitting on mine and will average down til I get out at some point or they go to zero because I was fully prepared for that to me the possibility.

No apologies needed my friend. Most of us have been through plenty of earnings plays and we know and understand the risk.

Great DD and who knows, next week it might play out!

Oh and I also just took 1 July 15 90p gonna get out green overall

In my opinion GM announcement this morning in regards to still having major supply chain issues and production. This is bullish for the likes of KMX CVNA and any of the dealer group tickers AN LAD. If new car supply stays down it means that all of the used cars that have been over paid for in the last two quarters the values will most likely stay up until demand retraction occurs.

My stores month finished June as the second best used car month in our history. Including last years free for all. The inevitable drop in used car market and pricing is coming however I think we may have been a quarter too early. Once the OEMs catch up on new car production and they start hitting dealer lots over priced inventory will still be no problem.

Looking at the chart on the monthly it looks like KMX has formed / is still forming a bear flag. Since KMX tends to follow SPY for the most part it might not do anything until SPY decides it’s direction.

Appreciate the optimism however unless the market as a whole dies As you mentioned SPY the only bear flag we are getting here is shoved up our ass. There is relatively no bad news on the horizon for KMX and this week will be no news in general for economics so I’d highly be doubtful this trends anywhere below 90 range. Seemed to have strong support at the 89ish level as well. Need something catastrophic to push it further south and don’t expect that til Auto numbers start to come out.

Well it’s that time again. Going to sit this ER out from the sidelines at least for the pre game. I’d expect a decline in GPU and decline in overall volume coming here. But rising rates with in house financing leads to less revenue and bigger losses.

Will definitely be playing this post ER though once the tree shakes.

It’s earnings season again. @jjcox82 any thoughts on how to play this? ![]()

What with all the consternation in the used car market, this could move significantly, eh.