to the downside for sure ill likely play the move the day of report as it was quite profitable last time. And premarket report so should have some continued move. May take a few CVNA puts for sympathy move

TLDR; KMX will mostly trend with the market until there are some catalysts that cause the used car market to fall and for investors to realize that it’s not worth it’s current valuation. CVNA and AN could have an effect on this in the next few weeks/months. Short term KMX is probably going to range trade between $60 and $70. There was a double top at $68 this past week. Good luck everyone, hope this gives some more insight.

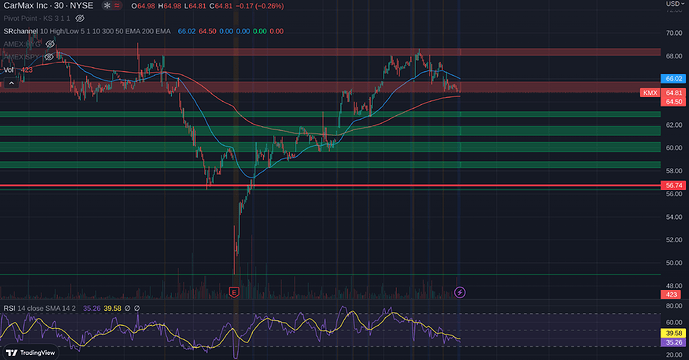

Looking at KMX right now it looks like it’s being oversold even though we know that it should be lower than it is now based on it’s earnings and the current state of the used car market. If you look at the 30 minute chart (you could look at any time from since they all look very similar) you can see we are at the bottom of the resistance range since it started dropping on Wednesday the 11th. The thing that continued the downtrend was JPM’s downgrade to $60 a share. So here is my hypothesis, if this week has good earnings then KMX will trend up with the rest of the market. This assumes there is no mention of slow downs in used car sales or CVNA issues. Since we all know CVNA is going to be in the headlines I think the real question is if this information is over powered by other market news and gets swept under the rug some what.

I think we will see a bounce of some sort since the RSI is already on the low side and we are approaching that $60 mark that JPM set. I think realistically this stock should be around $45 or less but investors are not convinced of that yet. Going to put this on the watchlist and track it this week. I know that @jjcox82 and I have talked about it before but I really think that if AN reports bad earnings then KMX will trend down as well.

Also, I do believe that if CVNA goes under or announces bankruptcy in the next few months (less than 6) then that will cause a flood of used cars to hit the market. I think the initial drop will be a little bit but then we will see consistent downtrends as there are too many cars available and not enough people purchasing cars. Classic too much supply and not enough demand which will cause these dealers to sell more cars for a loss.

If there are any holes in this thesis that anyone sees or points that I’m not thinking about let’s talk about them so we can make some money on this POS ticker.

Okay saw some new data this morning for KMX and CVNA which is interesting.

The TLDR; is KMX sold between 57% to 69% of its TSLA portfolio in 24hrs. It’s not in the article but my assumption is that they sold most of that inventory wholesale since I doubt they were able to convince that many people to purchase those cars that quickly. They did this cause they dropped the price of all the used TSLA’S by an average of 11k. This is very smart by KMX since they got that inventory off their books and created some more cash.

CVNA has started doing something similar but not as drastic and they still have roughly 700 TSLA’s in inventory.

The point is that the majority of used TSLA vehicles are now priced higher than if you went and bought one at a used dealership. We all knew this so it’s not much of a surprise here but it’s confirmation that the used car market has to fall more. Again we already knew this. I think with AN earnings and CVNA earnings next month we are in a for a wild ride. Buckle up!

Circling back here to the worst thread on the forums. Not because we were wrong but early. And because you replied to it and I got an email.

One thing to note here is AN sell’s new cars too. Which seperate a them from KMX and CVNA the strangle hold on supply hasn’t quite recovered on new cars yet like it has used. 3 years ago the average profit on a used car was 200 to 300 percent of that of a new one. Now the script is flipped. New car profits far out stretch used.

Secondly, AN is a well oiled machine and well ran company unlike KMX and CVNA. I do think ANs overall business will likely take a decline from last years previous quarters and you are likely correct that KMX and CVNA will follow if they break from meme stock mania currently. But I wouldn’t be overly surprised to see AN beat on their ER. Ultimately KMX will take time to decline and visit similar fate as CVNA as they both wander the same path and practiced the same business model for last few years. And they entered a space where mom and pop brick and mortars which AN now owns many of can provide the same service. But with deep pockets and a push to provide results may have ultimately been the lead to their fall from graces. Good luck here. I truly hope it plays out like it should.

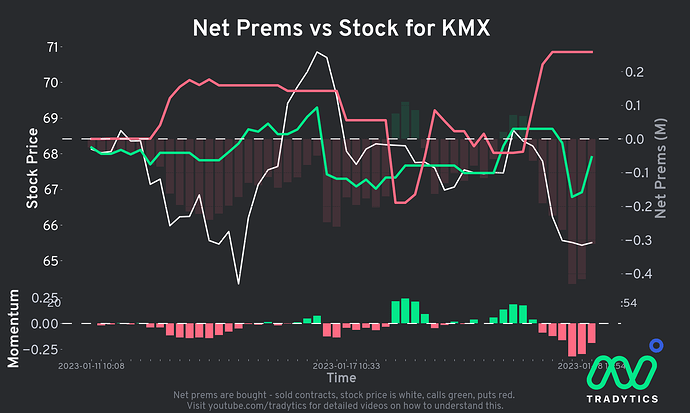

We are finally starting to see some put action on KMX which like @jjcox82 said should have happened but we were early like normal. I think he is right. It wouldn’t surprise me if $AN beat earnings but I think that the market would limit the upside to that if car sales stay flat. I think the unexpected thing for me today was seeing and increase in Mortgage Applications. This was surprising because interest rates are still high and housing prices have fallen but I think there is still some more room there. To me this says that people are willing to spend money at the higher rates and prices which could mean they start buying more cars again. Haven’t researched this enough but it seems plausible. Only other thing helping drive prices down is TSLA dropping the price on their cars. It’s still a wait and see type pattern right now. Still holding KMX puts.

This is interesting. Why people are still buying cars unless they absolutely need them is beyond confusing to me but that’s just me.

Also 10% interest on a car loan?!? Like damn that is crazy.