I have been taking some time to look into LAD a little more since AN discussion and threads. They are currently in the top 200 on the Fortune 500 list and get relatively no volume or attention it seems

LAD consists of 270+ (That’s a lot) automotive dealers in the US new and used and some Canadian stores as well. With brands consisting of Bugatti and Rolls Royce to Kia and Chrysler. So all ends of auto spectrum.

Over last 12 months the price per share has dropped a remarkable 15-20 percent. Currently just about 10-15 percent over their 52 week low. When you look at similar segments such as AN who has shown growth over the last 52 weeks seems to me it’s been wrongly beaten down.

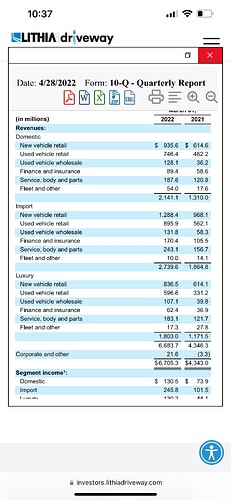

I took some time to look through their Earnings filings posted on March 31st of 22. Strong numbers across the board from my perspective in nearly every area want to highlight some below.

Note strong increases in revenue in new car used car and total revenue. Along with a big jump in EPS year over year.

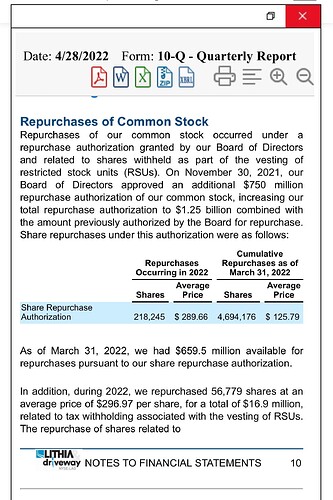

They have also been repurchasing shares. Which is always bullish going forward. Seperate from this filing there are several filings recently of execs buying additional shares as well.

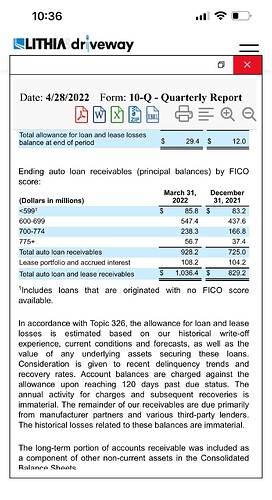

This was notable to me as it seems their prime loans have increased where their subprime has been relatively flat this would typically mean to tightening their subprime standards to avoid risk and offset loss which would lead to bigger profits when it comes to their lending side of their portfolio of business.

Their GPU doesn’t have the risk of losing steam as they primarily are new car franchises and new cars are still on a short supply. Along with the fact they have several high end brands which wheter we talk automotive or retail clothing has seemed to withstand the destruction of earnings high end consumers won’t be nearly as immediately affected to any kind of spending slowdown as lower to middle of road consumers. With months and months worth of new car sold orders continuing to trickle in at a snails pace. I’d expect a rebound here from LAD after their earnings print in a few weeks. They strictly have monthlies. I am going to be looking for an entry in the 300c range maybe 310. For August.

Final note here they do pay a dividend. Which has seemed to increase over the last year. I’d expect large profits for the recent quarter.

There is relatively little OI currently but I’d expect this to ramp up as gets closer to July 20th. This is an expensive trade and ticker. But wanted to put it on the radar if not simply for boomer picks.