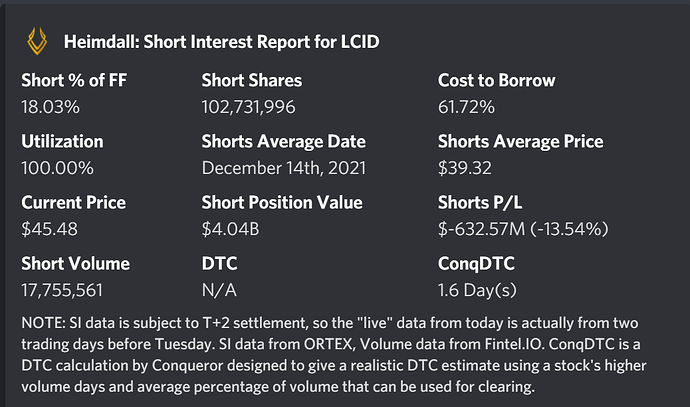

On the flip side, price action over the last couple of days does look pretty bullish and I note short interest seems to be pretty high. Not sure how accurate this data is but is this a cause for concern as well?

HOOD didn’t get slammed on the day of their share lockup period expiration back in the beginning of December. It didn’t really start falling until a day or two later. Same applied for another stock TASK that I played on a share unlock.

I sold my puts just now for about 20% profit. It seems to be continuing to drop a bit more, but I was comfortable with the gain. Now I’ll be chilling to see how next week plays out.

Just FYI, and this may not have an impact on whether the shares move tomorrow but the lockup only ends at 2359 on 19 Jan

The “ Lucid Shareholder Lock-Up Period ” means the period beginning on the Closing Date and ending at 11:59 pm Eastern Time on the date that is 180 days after the Closing Date.

Same thing happened on DASH that I was tracking as well. I think share unlocks on high volume stocks shouldn’t really be a play, there should be multiple catalysts that drive a decision for us.

This is true, but you can’t let that dissuade you from trying to play it. I wrote a DD for a put play on the DIDI share unlock here recently. It would have been great. But as you said, a catalyst occurred (the company blocked employees from selling shares). But that news also scared other investors I believe who were already on heels about the company delisting from the U.S. exchange, and the puts worked out anyway. Just have to try and be on top of news and those upcoming catalyst as best you can if you have real conviction in the play.

Heard duke talking about the share unlock being for Monday the 24th. Was just curious if there is any proof im not seeing for it, we were talking IN vc before but i had to go. If someone could help me find this that would be awesome

All im finding is that the lockup ended the 19th.

Thanks to mr Dooknukem for finding the article that shows the unlock is for jan 19th and the 23rd. After unlocks take place usually the price movements were looking for happens within 2 days after the unlock, im looking for the downward movement for monday-Wednesday next week. Heres the article

https://seekingalpha.com/article/4480553-lucid-what-you-should-know-about-the-lock-up-expiration

Article was released jan 20th

“ The recent volatility comes right before the lock-up expiry on early investors’ shares and Churchill Sponsor shares expected after January 19th and January 23rd, respectively. ”

Not sure what this Jan 23rd date is referring to, based on my understanding the sponsor shares are unlocked Jan 2023?

My understanding is that the Churchill sponsor shares unlock on the 23rd. Aproximately 50 million shares.

Yes that was my bad today in VC and trading floor. Yes 2023 not 2022

Yep unfortunately it seems to be that article wasnt very clear on the date. Sorry for assuming that it was for this year. Puts were still profitable today tho

ah shit looool

Yeah… like I was saying… calls on LCID /s

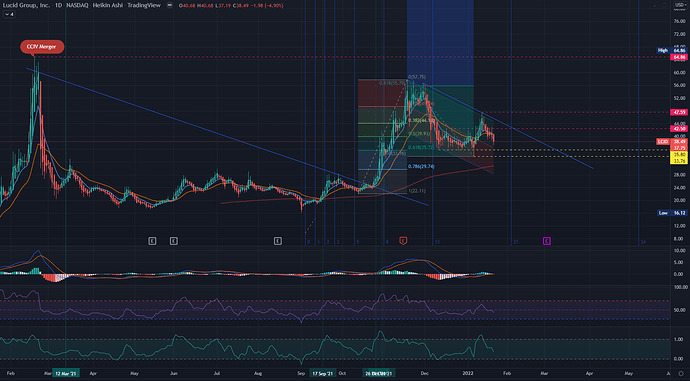

With the Market the way it is. I’m sure at the very least the puts will work out. I ended up holding EOD with the impression that if nothing else, the Market would still be down and likely push LCID down. Its ramp up to 47 bounced and has been continuing a trend down to the bottom bollinger, so it’s likely that it could touch $35 on TA alone.

Yep, sounds about right…

8 and 21 MA lines have touched, and it’s getting nearer to the 200 MA now.

What you want to see is what it will do near that bounce line of 33.76 (intraday movement).

I am of the opinion that it will break that support and then test the 28-30 channel–which should be in line with the 200MA then.

ER day will be interesting. Great for a straddle or butterfly spread.

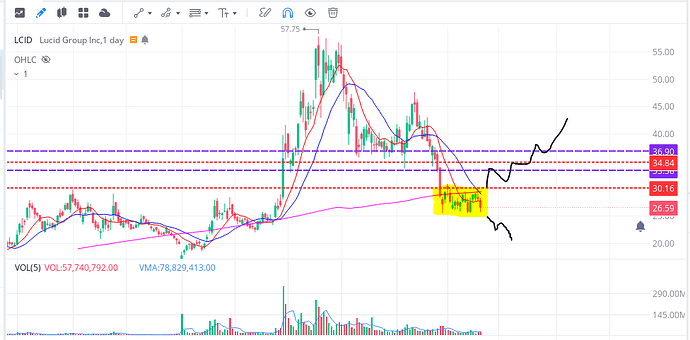

Reviving this thread with LCID being at a decent accumulation zone on low volume.

Long term I am rather bullish on LCID - mostly due to fundies: huge pollution problem in China, access to foreign EV technology, China’s ambitions to become a world leader in EV tech, communist gov passing a mandatory EV car ownership next 5-10years

Loading on LEAPS (1 and 2y DTE) at each dip