Let’s talk Lennar (LEN). Lennar is one of the nation’s largest homebuilders (#2 after D.R. Horton, as of 2020) when they had over 53,000 closings that year. They build a wide range of homes, affordable, move-up, active adult, multifamily and vacation properties for investors.

A bit of backstory: I’d been looking for an airbnb property to buy since pre-covid and finally bought one last year in the Orlando area. This particular Lennar development there is huge, with one section (currently) a mix of single-family homes, townhouses (connected to each other) and condos (4 or 5 story buildings) which are only sold to investors - you can’t live there, there are no mailboxes or schools assigned to this portion of the development. There are also normal parts of the development for people to live in, and they’re currently building another investor only section. Back in 2017, the investment townhouses were selling for ~$300k, today that same townhome (resale) is going for $560k-$600k. The new investor section is starting at $556k. Keep in mind that the resale places are sold with all furniture, forks, and future bookings.

From their most recent 10-Q “we expect to conclude our long-planned spin-off by year end. We have formed a company, named Quarterra Group, In. (“Quarterra”), which will have three asset management verticals - multifamily residential, single family for rent and land banking and similar land finance strategies. When it is spun off, Quarterra will remove $2.5 billion of assets from our balance sheet, without materially affecting our earnings.” Quarterra is currently a subsidiary of LEN and will spin off later this year under the ticker “Q” (also something to keep an eye on as it’s rental apartments).

The upcoming ER is for June, July, August which coincides with typical family moves (kids finish out their school year before picking up and changing houses) for folks that want to buy a move in ready home.

The prices drops being offered to buyers under contract (per a subreddit) are to get to lower appraised values so closings can happen, rather than outright discounts, though LEN are offering $10k incentives toward upgrades (which are crazy jacked up price wise to begin with.) Housing is cooling, but not yet crashing.

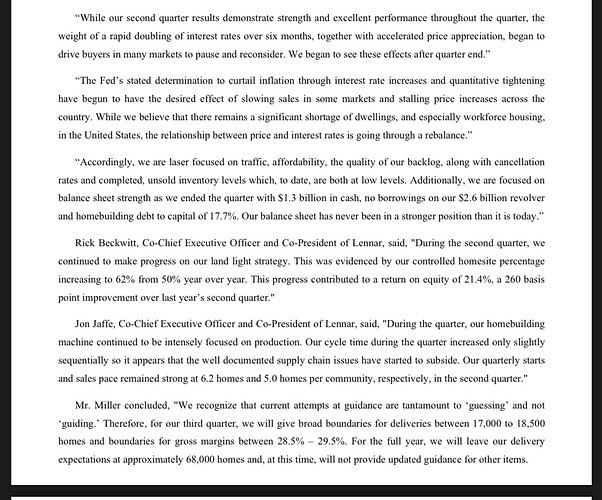

Guidance for this quarter from the last 10-Q “We recognize that current attempts at guidance are tantamount to ‘guessing’ and not ‘guiding.’ Therefore, for our third quarter, we will give broad boundaries for deliveries between 17,000 to 18,500 homes and boundaries for gross margins between 28.5% – 29.5%. For the full year, we will leave our delivery expectations at approximately 68,000 homes and, at this time, will not provide updated guidance for other items. Recognizing that the Fed’s actions are still quite fluid and responsive to inflation data, the housing market will rebalance supply and demand, and interest rates and purchase price as market conditions evolve. Nevertheless, at Lennar, we are operating from a position of strength, enabling us to continue to execute on our core strategies.”

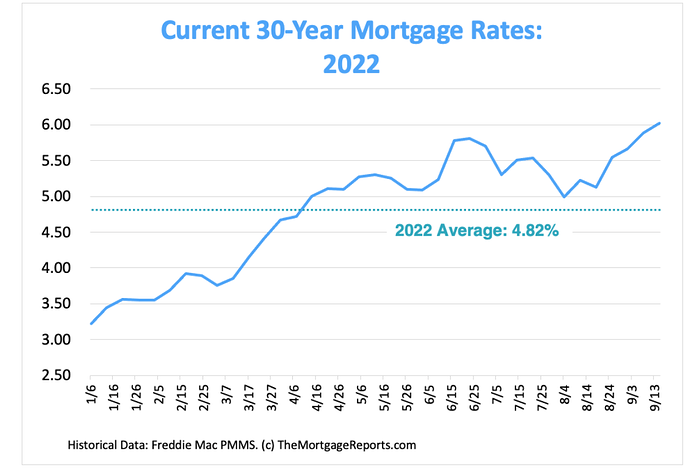

So, where am I going with this wall of text? I think this Q3 earnings will be good, avg 30 year rates didn’t hit 6% until September.

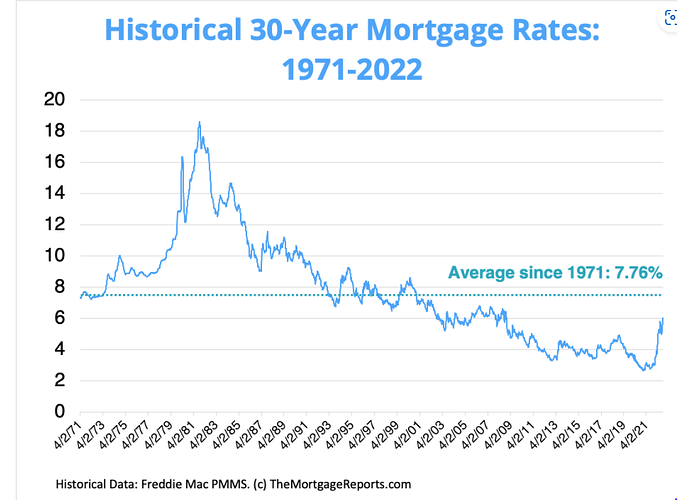

And it’s likely going to get worse as the Fed tries to tame inflation, with a goal of increased unemployment leading to demand destruction.

TLDR - buying calls on Monday likely ATM and puts for the following quarter.

Would like your thoughts on Lennar and to make this a discussion. Thanks for reading!