The warrants are trading at under 50 cents right now, which is incredibly low considering that this is a despac that has zero risk of liquidation that would render the warrants worthless,

Stock is trading at $7.xx, even if it tanks to $5 after the PIPE unlocks, the warrant should be worth around 80 cents - $1.

If you look at other despacs, the typical despac warrant is worth roughly 20% of the share price. The typical warrant price for a post S-1 despac trading around $5 is trading around the 80 cents - $1 quoted above. So, even assuming the stock price will continue to tank, the warrant price should still come up to be in line with the average. If the stock doesn’t tank, or has a recovery/gets pumped or what have you, the upside could be as much as $2 / warrant. The downside if this goes to a $2 stock is the warrants might go down to 20 - 30 cents. Seems like a decent risk/reward to me.

1 Like

You will need to look through the filings to see what the warrant-to-share conversion is. Don’t assume it’s 1:1 because often it is not.

1 Like

I would say it’s rarely not 1:1.

Usually it’s a fraction of a warrant per unit, but each whole warrant is exercisable for 1 whole share. I have seen exceptions where the warrants are exercisable for 1/2 or 3/4 of a share.

But anyway, in this case, I did do the DD already to confirm this and the warrants are for 1 whole share.

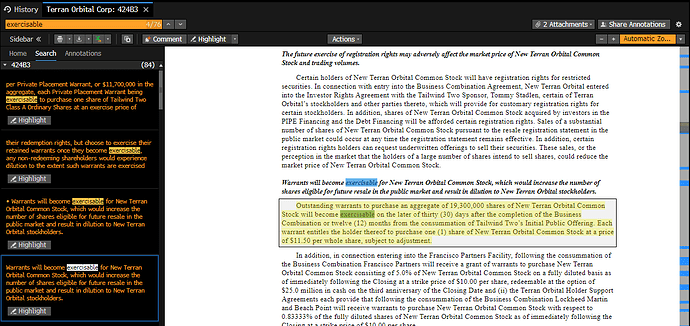

Here is the excerpt from the 424B3 released on 2/14/22 (which is the prospectus for the de-spac)