Russia may go pew pew and LMT might moon. It’s a wiki, add to it should you choose to.

I’ve played LMT twice this week on Russia news. You have to be quick, and you can’t be greedy. Both times, the pop came right after news signaling an invasion - however - those pops don’t hold, so sell when you’re green!

This is a wartime fomo call scalp play. Russia news that tanks spy is usually good for a couple dollar pop on LMT because they do war stuff. Treat playing it like you would a pump and dump, small position in and out don’t be greedy.

This is not the time to “go long” on defense stocks in general as that time has passed and this shit is priced in for the most part on the major popular defense sector stocks.

Thots has been killing the entry and exit on LMT for call scalps.

Also opened a March 390c position (I WAS DONE FOR THE DAY)

I’m interested to see what happens end of day on LMT. I haven’t really seen a situation where war was imminent but then not imminent but still kinda imminent.

As of writing this, it is 2:30pm EST. It is currently 10:30 PM in Moscow. Twitter says Russia is planning to attack around 3:00am, so approximately 5 hours from now.

Oh… its imminent alright

nice gain porn

good god

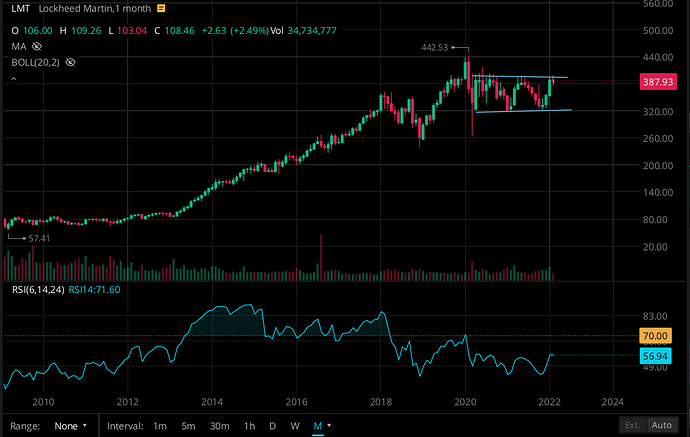

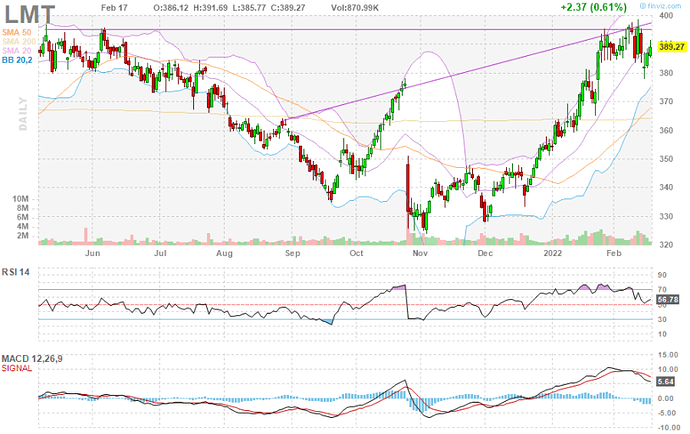

Lockheed is at the top of a range on the monthly. Could be something to consider for anyone planning to swing.

From trading floor conversation today:

LMT is a wonderful company and a long hold of mine. They do a ton of different things in the sector. It gets retail fomo when theres events like this, good for pops, but the conflicts as a whole get priced in early. Smart money hops in at the slightest rumor of military involvement anywhere. They ride it up until triggers get publicly pulled and they start selling off.

It’s not far fetched to say they are expecting something to happen soon. But regardless, this is how this usually cycles during conflict.

Indeed, LMT has met resistance around the $395 level it has not been able to get past.

To the extent that the Russia-Ukraine conflict should not be expected to have a material impact on LMT’s financials unless there is major spillover, this is probably setting itself up for a pullback nicely.

This part of it, where are you getting this from?

Going to remove that, we disproved that just forgot to update it. It came from trading floor. Tweets that were misleading that showed more spread out transaction times than originally thought.

@Conqueror edited to correct.

This is what I was concerned with. Its higher than Afghanistan prices right now. And it was no stranger to rug pulls during that conflict.

It’s a great scalp for current if folks are careful I just don’t want anyone getting caught because the calls are not cheap.

I did see this in Unusual Whales yesterday that supports this idea that folks in govt are selling. Did we feel that it was too little to mean anything? For what it is worth, it’s probably profit taking on a position that spiked nicely, and is not expected to hold these prices. And not sales of entire positions?

https://twitter.com/unusual_whales/status/1494045961273888775

Some absolutely sold, but after we dug into it, some of the transactions were spread farther apart than it made it appear initially. Appreciate your work on it man

Not sure if this should be posted here, but I found out that LMT will be partnering with Terran Orbital to increase satellite capabilities.

If you read the article you will see that Terran Orbital is about to merge with a SPAC (TWNT). This will happen this quarter as seen in the next article from last summer: Terran Orbital Announces Lockheed Martin Contract: What Investors Should Know - Benzinga

I have no prior knowledge in playing SPAC mergers or how exactly this works, but could this be a play that is profitable? According to the article 100% equity will be rolled into the resulting stock.

All of these sales occurred in late January.

Adding on to my previous comment: https://static1.squarespace.com/static/6022a91e9dbc57670b6ceecb/t/620d201488b7ed6e784e9e0a/1645027357495/Terran+Orbital+Analyst+and+Investor+Day+Presentation.pdf

This shows strategic partnership with LMT and possible eventual catalyst. Hope to get input from higher ups🙏🏾