Bear did for Lqd the cooperate bond etf.

https://www.reuters.com/business/investors-brace-more-weakness-us-corporate-debt-2022-02-08/

Two quick articles worth a read if your interested but I will explain the highlights down below.

First is the appeal to buying cooperate bonds over treasury bonds is there higher yields. As I’m sure we’ve all seen treasury bonds have been rallying, this is due to the fact that interest rates are becoming more and more of a reality which causes bond value to drop, this is called interest rate risk. This occurs because new bonds are issued at a higher yield causing the value of old bonds to loose value (yields move inversely to price)

This is important because as treasury yields rise people are going to ditch their cooperate bonds for treasury bonds because they pay a higher yield. This same affect also occurs in the cooperate bonds them selves.

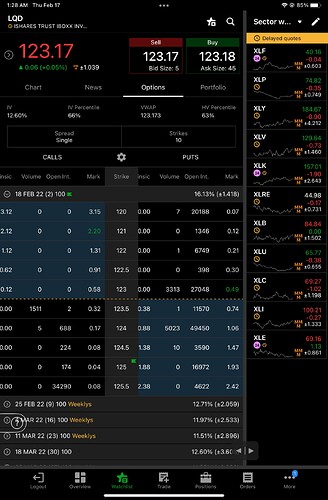

So has anybody caught on to this yet. The flow shows repeat floor buys from floor traders over 1 million dollars since Friday.

Put for call ration is around 3:1 for options expiring this Friday, I can’t seem to get the whole chain in one photo on my iPad but check it out 0 itm call oi compared to large itm put oi.

Fomc this afternoon bearish catalyst. The continuing of rate hikes as planned will see the continued down trend.