With the war in Ukraine right now Russian Equities have been either delisted or suspended for the time being, with that being said lukoil, LUKOY is going to be an incredible play once trading resumes. LUKOY is the 4th largest oil producer in Russia and 17th largest in the world.

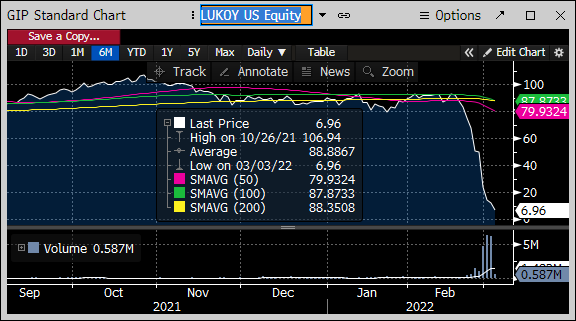

As of 3/3/22 trading has been halted on the security due to economic sanctions put in place. At the last close LUKOY was at $6.96, down from $92.64 on 2/15/22 representing a -92.487% decrease in just under 3 weeks.

The company while currently being boycotted in the US was the first to break its silence and call for Putin to end the war. Furthermore the company is in incredible financial health and will be an incredible play so long as nationalization or nuclear war does not take place.

starting with the balance sheet if we look at the first line item we see that they have $689.7B in cash and equivalents on hand, and while it is hard to get an accuracy ready with current spreads that roughly translates to $5.4B USD. Coupled with the fact that their operating expenses and debt obligations only amount to $64.62M USD.

Then moving onto holdings we must compare LUKOY and LUKD because Russian holders are not included in the US entity we see that not only is there large ownership by Russian oligarchs but we see “Big Money” also has skin in the game.

Looking at their segmented business we see that 84.7% of revenue comes from international business which can be further broken down by not only exports but also by refiners outside of Russia, The revenue from Russia only accounts for 15.3%. Which only gives more supporting evidence that as long as nationization does not take place the company will continue to be fine once sanctions are lifted.

As of now there are no exchanges that I am aware of that allow for the purchase of this security, and it is likely that when trading resumes the price will continue to drop until the sanctions are lifted, however, the company has enough cash and equivalents to whether to storm, especially if you buy the rumors that they are going to attempt to raise capital in the form of issuing bonds.

Here is the full calculations on the fair value of the stock with a 10 year forecast.

lukoy_valuation.xlsx (46.8 KB)

This is not an all in play by any means.

It is risky but, history has shown that fortune favors the bold.